I WANT TO LOAD UP

I'm talking about precious metals and the miners...of which we already own (Gold/Silver, miners and ETF's). So, I guess I'm saying I want to load up even more.

I'll walk you through my thinking next, but this is also a good time for a "portfolio mindset check".

These are most valuable exercises...for all of us...whether veterans or newbies.

Now, your first thought about the miners might be "yuck...the last 3.5 years have been brutal...next subject, please". Believe me, I get it...but that mindset would also be a mistake...a huge one in my view.

Let's revisit the past...admittedly, this applies more to longer term VRA Subscribers, but everyone can benefit from it. Over the years, VRA Subscribers have made a fortune in the precious metals and mining space. In my second-ever VRA Update, I recommended gold and silver ($350/oz, $5/oz)...back in 2003...with gains of roughly 380%. Not too bad...but it gets MUCH better.

We also bought/sold a large number of mining stocks over the last 12 years, with over 2500% in gains to show for it. We made more than 1350% in Ivanhoe Mines, in two trades (now Turqoise). We used the same approach with Vista Gold (NYSEMKT:VGZ), Newmont Mines (NYSE:NEM) and Silver Standard (NASDAQ:SSRI), etc.

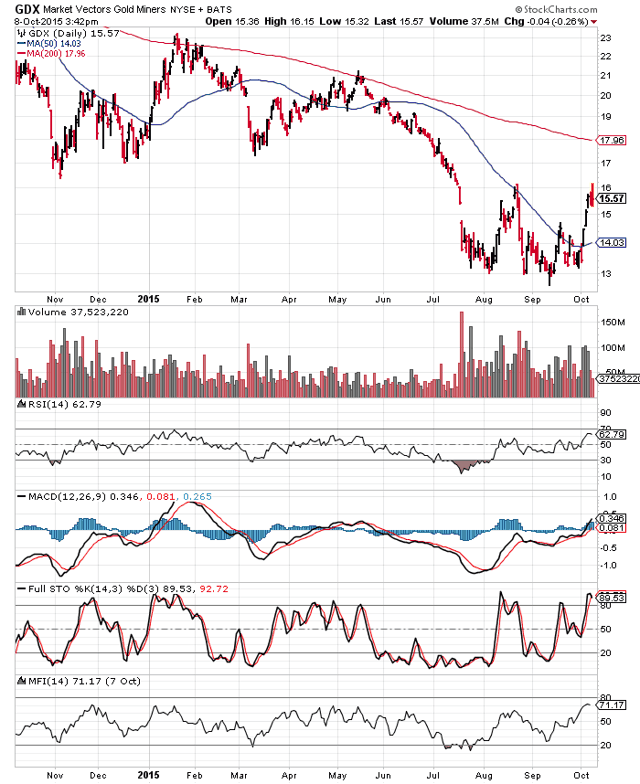

My educated guess is that your default mindset on the miners is less than positive...that's your call...but my job is to position you for major gains. Take a look at this 1 year chart on GDX (mining ETF):

First...yes, GDX is highly overbought...buying the miners at current prices could result in short term buyers remorse. However, it's also clear (to me) that this brutal bear market in the miners is over (which will only be confirmed once we are well above the 200 dma, and headed higher still). Let me also make this point; gold/silver could drop another 25% in price, yet the miners would STILL be cheap...just based on long term historical trading correlations.

I'll have more when the timing is right...but you can bet your bottom dollar that we will be adding to mining positions. Just in case you haven't noticed, the world is awash in debt, far more QE is on the way, and our politicians have little will-power for fiscal constraint. The only true currencies on the planet WILL win out...that's been the case for thousands of years...and as gold/silver begin to ramp higher, the leverage from the miners will result in stunning moves.

MARKET UPDATE

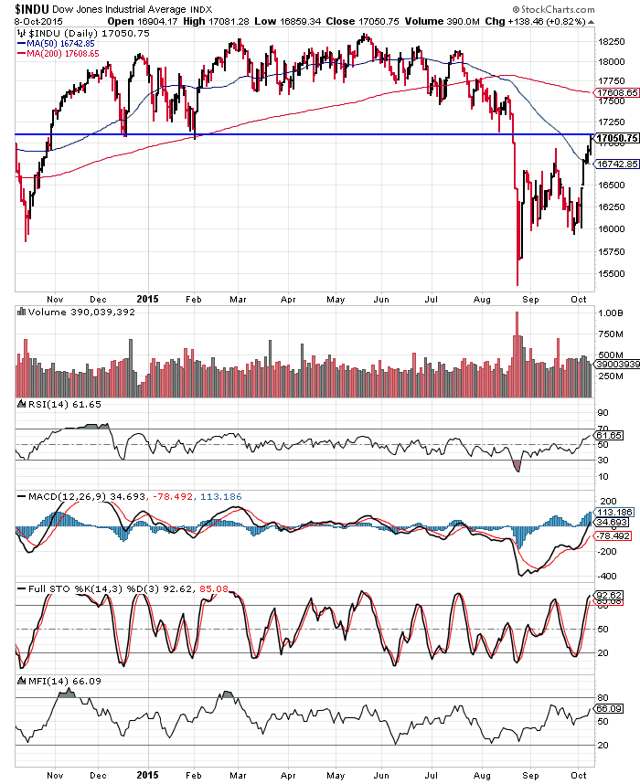

Here's the short term, macro picture on the broad market...in this case, the Dow Jones:

Notice the horizontal blue line that I have drawn above...the Dow has reached significant overhead resistance, which has also come with every indicator that I follow reaching overbought levels. Yes, the worst of this bear market is over...sure looks that way to me...but we are still well below the 200 dma, and new buyers at these levels are taking a much higher risk than they likely have any idea.

Overbought markets can certainly become even more overbought...but again, the reversal risks at these levels are high.

Until next time, thanks again for reading...

Kip