VRA Update: FED Minutes, Nervous Nellies. Strong Dollar is the Real Story. More Proof that Markets Love a Divided Congress. Oil Hitting Extreme Oversold.

Friday, November 9, 2018 at 9:51AM by

Friday, November 9, 2018 at 9:51AM by  Kip Herriage -VRAInsider.com

Kip Herriage -VRAInsider.com Good Friday morning all. Yesterdays FED minutes spooked the markets…just a bit…as they confirmed their hawkish interest rate policy into year end of into ’19. Here’s the bottom line; the FED will hike again in December. Thats a certainty, making it 9 straight rate hikes.

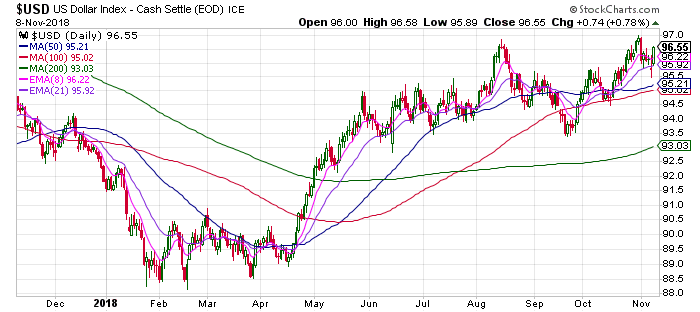

A quick look at this chart of the US dollar tells us most everything we need to know, as it pertains to the strong dollar and action in emerging markets and commodities. A strong dollar puts significant pressure on emerging market currencies and dollar based commodities, which explains much of the weakness these markets have seen in the past year.

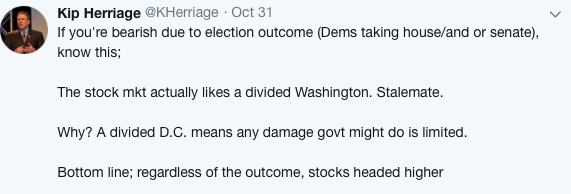

More Proof that Markets Love a Divided Congress.

As we’ve been discussing, the markets actually like a divided congress, as evidenced by the 2% moves higher across the board Wednesday, featuring a huge 545 point move higher in the Dow Jones and an even larger 194 point move higher in Nasdaq (2.6%).

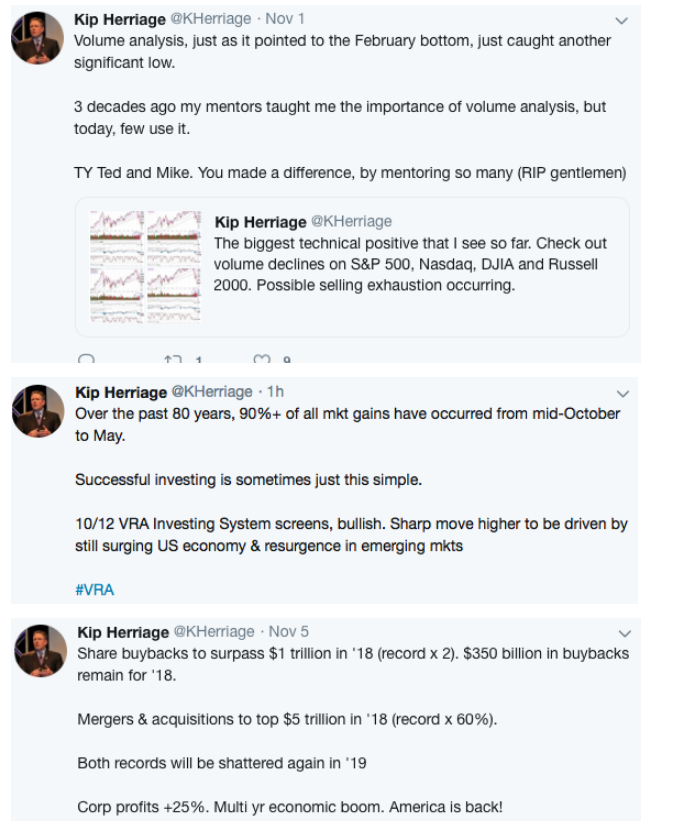

Our work in technical analysis (specifically volume analysis and VRA System Internals), combined with ongoing US economic fundamentals told us that the lows were in place, from 10/29 on.

Wednesday’s move confirms for us that the train is (once again) leaving the station. Could we have another retest of the 10/29 lows? Sure…anything is possible…but at this point it looks very much to me like we will not have a retest. Analytics and seasonality tells us that it is highly likely that future pullbacks will be light.

VRA Bottom Line: US and global equity markets are almost perfectly positioned for a 10–20% move higher, from now til end of Q1. This is how we’ve been playing it…nothing has changed.

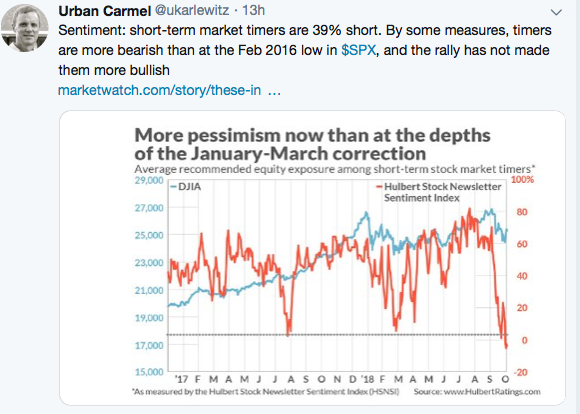

INVESTOR SENTIMENT HIGHLY BULLISH

Here at the VRA we truly love being a contrarian. When everyone is bearish, we tend to be bullish. When everyone is bullish, we become cautious. But today, sentiment tells us that investors are far too negative. This negativity is fuel for the move higher in stocks.

Urban Camel is another of our favorite follows on Twitter. Below we see that market timers are as bearish today as they were at the 2/16 lows. This is also exactly when the VRA became ultra bullish. Today, wrong-way market timers tell us that, once again, they’ve likely got it wrong.

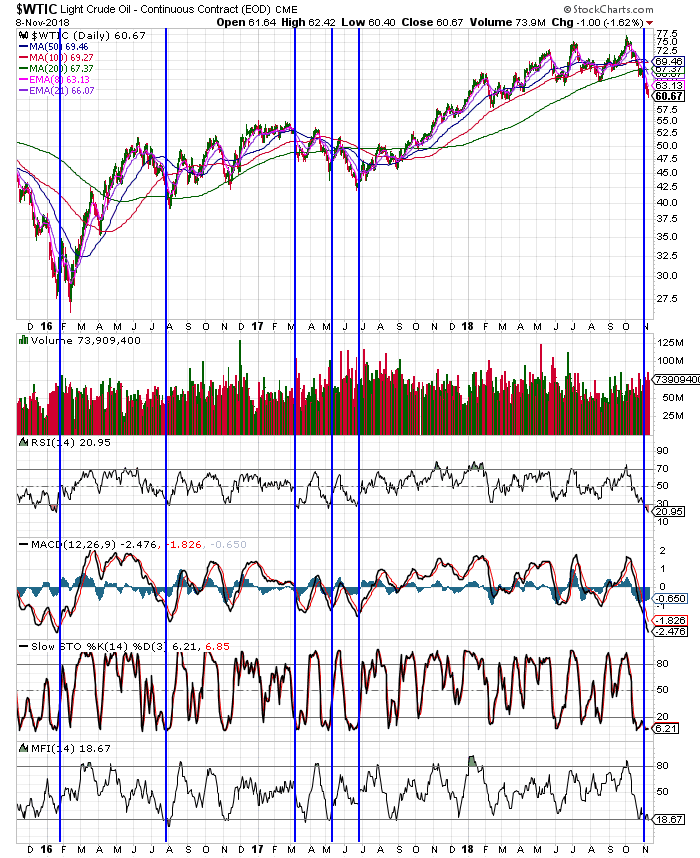

Oil Hitting Extreme Oversold.

The commodity chart I’m most interested in today is that of oil. Below is a 3 year chart. The vertical blue lines indicate each instance that oil has reached “extreme oversold” levels…which is exactly where oil sits today. In fact, as of this morning, oil is now as oversold on our key technical/momentum oscillators has it has been since the Jan/Feb 2016 lows, when oil was hitting cycle lows of $26/barrels. The VRA used these exact signals to go long oil/energy stocks once oil traded back up and through $32.

Note: over the last couple of months we have been in deep due diligence on a potential new buy rec in the oil patch. The timing of our new buy rec (which will come in the next week or so) looks to coincide with a significant buying opportunity in the underlying commodity as well. Stay frosty.

While no one can predict short term moves with precision (only charlatans claim to), US equity markets are poised for major gains over the rest of ’18 and into ’19. Markets love climbing the wall of worry.

Next up; as global trade tensions get resolved, emerging markets/Europe will start playing catch-up to US equity markets, further fueling higher stock prices. This is the minority view today…it also happens to be the correct view.

One caveat; while the VRA System sits at 10/12 screens bullish, we still must see continued improvement from the internals and each major US index trade back above their 200 dma, right now only the Russell 2000 is the only one still below it 200 dma. I look for this to happen in the coming days.

Until next time, thanks again for reading…

Kip

For our latest updates tune in to our daily VRA Investing Podcast atVRAInsider.com

Since 2014 the VRA Portfolio has net profits of more than 2300% and we have beaten the S&P 500 in 14/15 years.

Reader Comments