Good Thursday morning all. While US markets gave up more than half of their gains yesterday, with the DJ closing +157 (from 450 pt highs), we did see a pattern change. Maybe an important one.

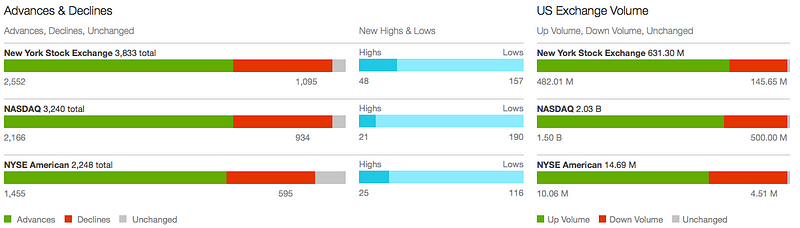

Check out the internals from yesterday. Better than 2–1 advance/decline and a big 3–1 up/down volume. For our markets to find solid footing and have an opportunity to regain their 200 dma, its important that we have multiple days of positive readings, at least somewhat as good as these.

Bottoms are messy but the internals continue to improve (by just a bit). Our pattern of higher lows for the years is still intact but some work to do to get back over 200 dma.

Which is my one primary concern about this market. The longer we remain below the 200 dma in our broad market indexes, the more emboldened short sellers will become. Watching closely.

Emerging Markets

We’ve also said consistently that the US-China trade war is not actually a trade war. It’s always been about China opening their markets, legitimately, to the entire world. Long term, both the Chinese people and the entire world will thank Trump. One man…with guts apparently made of steel…all American, through and through. Thank you Mr President.

Asian and emerging markets continue to recover. We saw solid, 1% + gains across the board earlier this week. Below is the updated chart we’ve been focusing on; FXI (China ETF) vs SPY (S&P 500). The outperformance of FXI since mid-October is striking. BTW, FXI is now just 5% below its 200 dma.

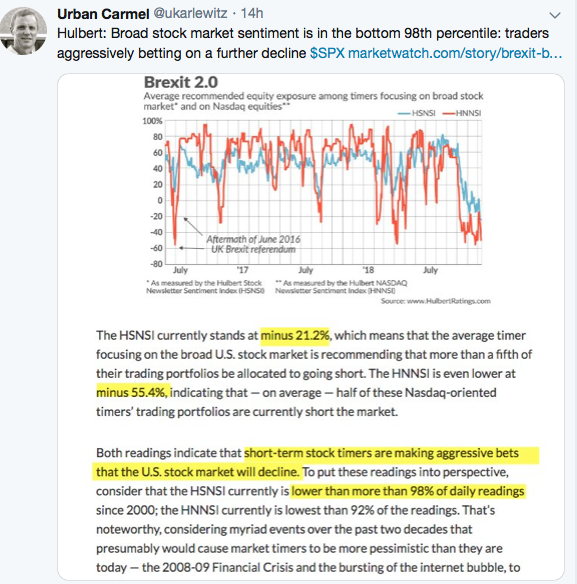

Investor Sentiment

An important component of the VRA Investing System is sentiment, and man is it ever bearish today. This post from the fat pitch blog makes the point well. Market timers are as bearish right now as at any point in history.

Our tried and true sentiment indicators hit deep into “fear” mode…another sign that the sell-off was coming to a close. The lowest reading I can remember seeing (ever) was 5. But todays reading of 9 tells us that theres “blood in the streets”. We know what that means…

If you’ve been here for a while, you know that we warn you when the markets are hitting extreme overbought/oversold and when investor sentiment reaches exuberance/fear. We took a combined 135% in net profits in the first quarter of this year for just that reason (AAII hit 60 and our momentum oscillators hit extreme overbought). We are contrarians. When everyone is going right, we want to go left. Lemmings, we are not.

If you’re bearish, you’re in the big majority. We do not want to be part of this majority.

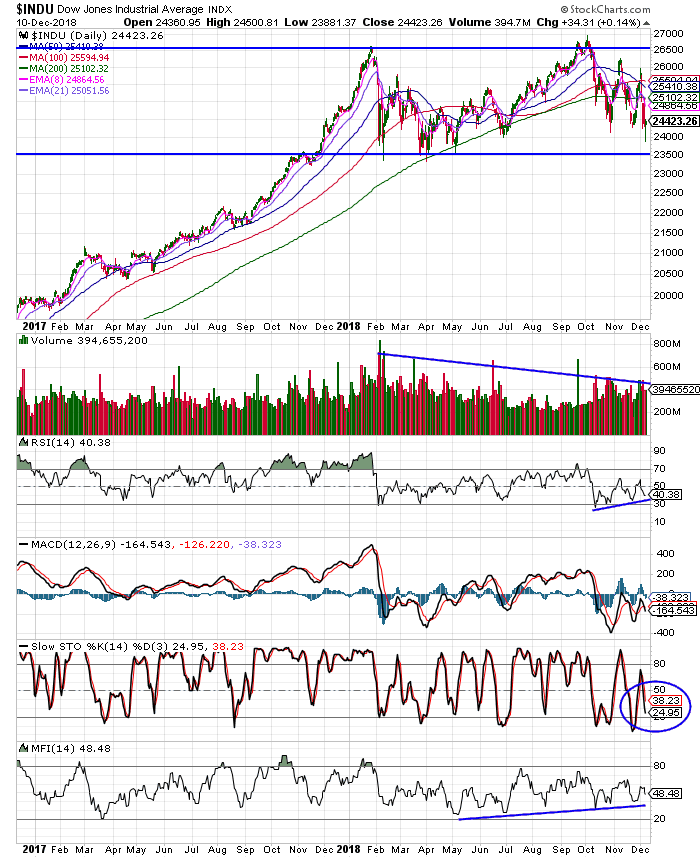

Below is a 2 year chart of the DJ, but its this years trading we want to look at today. For ’18 we’ve been stuck in one big trading range, from 23,500 to 26,500. Like a ping pong ball, we’ve bounced back and forth all year.

Lets take a closer look…I continue to believe the technical positives outweigh the negatives.

1) Sell side volume pressures have declined.

2) Both RSI and MFI have continued to improve, even as the market declined.

3) While stochastics never reached heavily/extreme oversold on this last decline, I’m good with that. The Santa Claus rally was due to kick in…I believe the move higher extends.

As we’ve been discussing here, over the last 3 weeks (even as the markets have taken a hit) relative strength in important areas began to improve. One chart we focused on last week was the semiconductors. With the DJ down earlier in the week, the semis went green. What led the way down is now leading the way higher. We want to see tech lead the way out of this correction.

Speaking of relative strength, gold has been trading exceptionally well and is now approaching its 200 dma for the first time since June. Short term, its reaching overbought levels, but with the FED about to cease rate hikes and the US dollar topping and reversing, this bodes very well for gold and the miners.

At the heart of the global bull market to come will be the worlds transformation from globalism to populism. Its occurring everywhere we look…massive long term positive. And we’re getting good news again on the US-China trade war (it’s not), as China continues to bend to the will of one man…DJT.

Until next time, thanks again for reading…

Kip

Experience the Vertical Research Advisory free for 2 weeks!! For a limited time we are offering a 2 week free trial to the Vertical Research Advisory, visit vrainsider.com for more details.

Since 2014 the VRA Portfolio has net profits of more than 2300% and we have beaten the S&P 500 in 14/15 years.

For our latest free updates tune in to our daily VRA Investing Podcast at VRAInsider.com or subscribe to our free blog at kipherriage.com