VRA Update: Record Equity Inflows. Supply and Demand Highly Bullish. Investor Sentiment, Still A Major Positive.

Friday, March 16, 2018 at 10:25AM by

Friday, March 16, 2018 at 10:25AM by  Kip Herriage -VRAInsider.com

Kip Herriage -VRAInsider.com Good Friday morning all. Another mixed day in US markets yesterday, but this time it was the Dow Jones that rose more than 100 points while the rest of the market was mixed. Still, the markets did not decline into the close…and thats a positive…breaking the 2 day streak of weak closes.

If you’ve been with us for a while, you know that I’ve been bullish on the stock market for years…with intermittent periods of profit taking…using short term (ST) tops to take profits and then using deeply oversold levels to get aggressively positioned on the long side.

We’re not day traders…but we’re certainly “opportunity traders”…this is how the VRA System was constructed and how we’ll continue to crush the markets.

Check out the news from this morning. As reported in these pages more than 2 weeks ago, my Wall Street sources were telling me that they were preparing for record levels of fund inflows…investors aggressively re-entering the stock market. We’re now seeing proof that this is absolutely the case, with record inflows of $43 billion last week and estimates for more than $700 billion for 2018 (another all time high).

If you took Economics 101 you know the basic principle of “supply and demand”. More than anything, supply and demand controls the movement and behavior of all investment classes….be it equity, debt, currencies, housing…you name it. Today, demand for equities is surging. I see no evidence that this will reverse anytime soon.

Combine this with the estimate of more than $800 billion in corporate share repurchases in 2018 and you have a powerful combination of bullish forces that will continue to propel stock prices higher this year.

The fundamentals….for both the US economy and US equity markets…are overwhelmingly positive. And yes, at some point, this will cease to be the case. At some point, the markets will reverse. The US economy will go into recession. At some point. But that point is not now. I continue to miss the perma bears view that stock prices have topped and a vicious crash awaits. But they remain…and thats just fine by me…that’s what makes a market. We need someone to keep shorting and selling us their cheap shares.

Technically, as long as we remain above the most important moving averages…the 50/100/200 dma…we must remain bullish. Even for ST traders, when the major indexes are above their 8/21 dma, there is simply no good reason to be bearish.

My views remain unchanged; DJ 30,000 this year. DJ 40,000 by end of 2020.

INVESTOR SENTIMENT

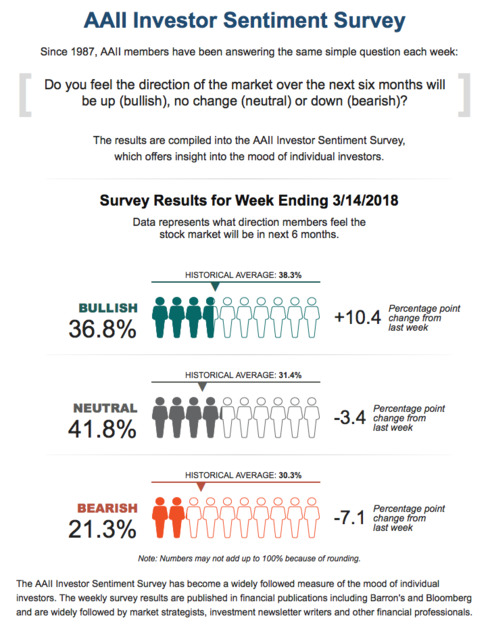

Below are the readings from yesterdays AAII Investor Sentiment Survey, my go-to sentiment survey for 30 years. Today, bulls have picked up some steam, with bulls at 36.8%, bears down to 21.3% and neutral investors remaining at a still high 41.8%. Remember, at the January highs, bulls hit 60%, so todays 36.8% tells us that investors remain skeptical of the bull market…exactly the kind of negative sentiment we want to see, as contrarians. I’ll repeat; once bulls reach 60–70%…for weeks on end…yours truly will begin to take some money off the table. When this happens, we will have reduced our holdings by a significant amount.

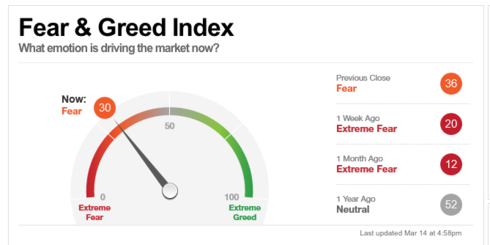

Below is yesterdays reading from the CNN/Money Fear and Greed Index. Today, it sits at 30%….a “fear” reading. In January, it hit 80%. At the 2/9 lows, it dropped all the way down to 8%.

We have no position changes…no reasons to take new actions…as the market sits today. I expect the market rally to pick up speed, once again. But I’ll also add that, from a current news perspective, that Trumps position on trade/tariffs…along with his changes in administration (rumors abound that more are to come soon), have the markets a bit on edge.

Finally for this morning, consider the following…from a macroeconomic point of view. Just two years ago…just prior to Trumps election…the number of countries with GDP growth above their two year average sat at 24. Today…again just two years later…the number of countries with GDP growth above their 2 year average sits at 34.

As we’ve covered here often, the global reflation/growth theme is very much alive. We see it in global range expansion breakouts and we see it in GDP growth. We also see it in the growth of oil demand, which may well produce our next VRA Buy rec. Energy stocks have pulled back of late, along with the price of oil, which could be setting up another great buying opportunity.

I encourage everyone to login to your VRA Members Site regularly. As a rule, we keep our position sizes to no more than 10–12. My goal is to be diversified…but not overly so. We want positions that are concentrated enough so that when we book our big gains, our portfolio actually feels the gains (rather than holding 50+ stocks, where even 100% gains barely move the needle).

Until next time, thanks again for reading…

Kip

To receive updates like this Daily sign up to receive two free weeks from the VRA at www.vrainsider.com/14day

Reader Comments