Good Friday morning all. Over the years, we’ve seen this movie before. We’ve seen it many times.

Remember the global market hysteria surrounding Greece potentially leaving the EU, where the Euro and European banks would crash, taking the worlds economies with it. Or the untold fears surrounding Brexit (Greece part 2). Or Trump winning the election, which would pretty much be the end of the world as we knew it, according to the superior breeding/intellects of our East Coast/West Coast liberal elites.

In just the last few years, each was a looming catastrophe. The downside was so massive that hedge funds (run here in in states by those same East Coast/West Coast hyper-pompous elites) liquidated their holdings and then went aggressively short stocks, where they would book massive profits as the markets collapsed…while the rest of us saw our investment holdings steamrolled by their vastly superior intelligence and stock market expertise.

But something funny happened along the way…each movie ended just a bit differently than the elites had predicted. Greece remained in the EU and the markets rallied sharply higher. Brexit took UK stocks to record highs, in back to back years. And the Trump victory has, to date, equated to more than $6.5 trillion in US stock market gains and the strongest US economy in decades.

Folks, there’s a reason that hedge funds lose to the equity indexes, year after year. Instead of being the smart money, 90% of hedge funds are routinely beaten by index funds, supported by data going back 3 decades. Here at the VRA, we like to take the flip side of the hedge fund coin. If hedge funds are overwhelmingly bearish (as they have been since the election and as they remain today), then we’re going to be overwhelmingly bullish. If this logic sounds too simple, it’s because it is. The KISS principle absolutely applies to a) the majority of investors (which is why I am a contrarian) and b) to hedge funds.

What’s the movie today?? It’s “trade war hysteria” of course. The “dumb money elites” are positioned for a global economic and stock market collapse. But we know better. At worst, its a trade hiccup (certainly at this point), as evidenced by new all time highs this week in Nasdaq and Russell 2000. Each trade war sell-off is smaller and smaller…meaning that the move higher directly ahead should rock and roll.

We’ll “keep it simple, stupid”, and continue to use their investment mistakes to crush Mr. Market, year after year.

Consider the following, most excellent piece from market pro Joe Fahmy. The VRA is a big believer in following investor sentiment, which we discuss here regularly. Fahmy gets into a number of important sentiment readings, each which continue to point to “extreme fear” in the markets. It’s this exact “wall of worry” that will send US/global stock prices sharply higher.

Trade War

Wednesday’s trade war related hysteria (its not a war…don’t believe the fake news) resulted in DJ losses of just over 200 points, breaking up a 4 day rally that took the broad markets higher by 3% and sent the Russell 2000 to another fresh all time high. We believed that Wednesday’s decline was a buying opportunity.

The key point above is that (in addition to Q2 earnings reports kicking off) share buybacks will be allowed to resume, following SEC imposed blackout period of 4 weeks. The importance of share buybacks cannot be overstated. While impossible to quantify, I’ve heard it said from numerous sources that I trust that in just the last 8 years (this decade), at least half of all stock market gains have resulted from share repurchase programs. Granted, companies would not be buying back their own shares if they were not also making truck loads of money…but the fact remains; buybacks have absolutely helped to send US equity markets higher. A lot higher.

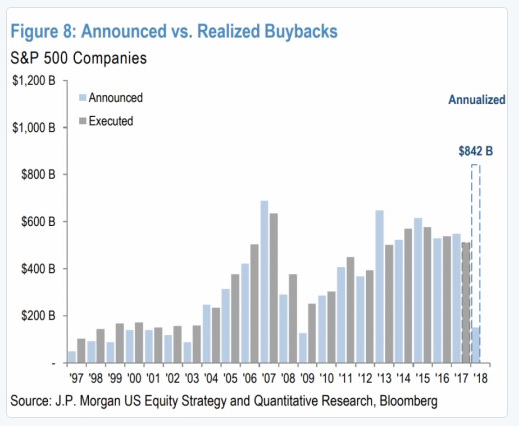

We’ve discussed the following chart a couple of times this year. With buybacks about to resume in earnest, its a good time to focus on it once again. This year, US share buybacks are projected to top $840 billion, or more than 20% greater that at any point in history (2006).

Remember, as shares are repurchased by the parent company, the number of outstanding shares is reduced, which has a direct affect of increasing earnings per share (while decreasing the price/earning multiple). In addition, the economic laws of supply/demand tell us that when increasing levels of demand (new share purchases) meet a decreased level of supply (outstanding shares reduced via share buybacks and M&A activity), share prices “must” rise. As you can see below, through share buybacks alone, stocks prices are set to soar for at least the remainder of 2018 (and most likely into 2020). Supply and demand, hard at work. How the perma bears continue to miss this most important macro point I have no clue.

Weekly AAII Investor Sentiment Survey

Last week, as bears outnumbered bulls by some 11 points (how remarkable was this!), we talked about the move higher that was almost certain to take place. How amazing that the broad markets have created more than $6.5 trillion in new wealth since the election, with US indexes near all time highs, yet just last week bears greatly outnumbered the bulls. Again, as contrarians, we knew exactly what this meant…”if you’re not long, you’re almost certainly very, very wrong”.

This weeks survey is out and we see a BIG reversal in the readings (no surprise there), with bulls now at 43%, bears at 29% and neutral investors at a still large 27%. My thoughts today? As the second half rally picks up speed, look for bullish readings to get back to the 55–60% levels…likely surpassing 60% as the markets finish off the year with a bang.

Until next time, thanks again for reading…have a great weekend.

Kip

2400% in net profits since 2014 while beating the S&P 500 14 of 15 years since our formation in 2003

To receive VRA Updates like this daily, which include all VRA Buy/Sell Recommendations, VRA Portfolio, VRA Special Reports and Archived VRA Updates, sign up to receive two free weeks from the VRA at www.vrainsider.com/14day