Good Friday morning all. I’ll be on the Wayne Root Show tonight at 8:30 EST, listen watch via NewsMaxtv.com or USARadio.com

Market update

Yesterday brought mixed/negative VRA System Internals for the 3rd consecutive day, as end of quarter window dressing by institutions results in portfolio rebalancing. Both the DJ and S&P 500 continue to work off their extreme overbought conditions, as we leave September (historically the worst month of the year) and head into the seasonally bullish October-May time frame.

We see no structurally negative issues in this market. We see a market that’s building energy, with powerful fund flows into US equities that continue to overwhelm would be sellers. The most pressing negative could be share buybacks, which are halted for companies soon to announce Q3 earnings (4–6 week blackout period).

9/12 VRA System Screens remain bullish. The rising tide of a strong US economy should result in broad based moves higher. My views have not changed. We are in the early stages of a broad based market melt-up. Dow Jones 28,000 by mid terms and 30,000 by year end/early Q1.

I do have one note of caution. As Q3 ends, we will increasingly see co’s that are forced to suspend their share buy back programs, as the 4–6 week SEC imposed “Blackout Period” goes into place. Co’s that will soon report earnings must suspend their share buybacks for 30–45 days (there are exceptions and each co’s blackout period is different). Still, with buybacks on track to top $1 trillion this year (for the first time in history), its a macro data point that we must be aware of.

Bottom line: if we’re going to get a sell-off prior to the seasonally bullish October/November to May time frame, right about now could be that time.

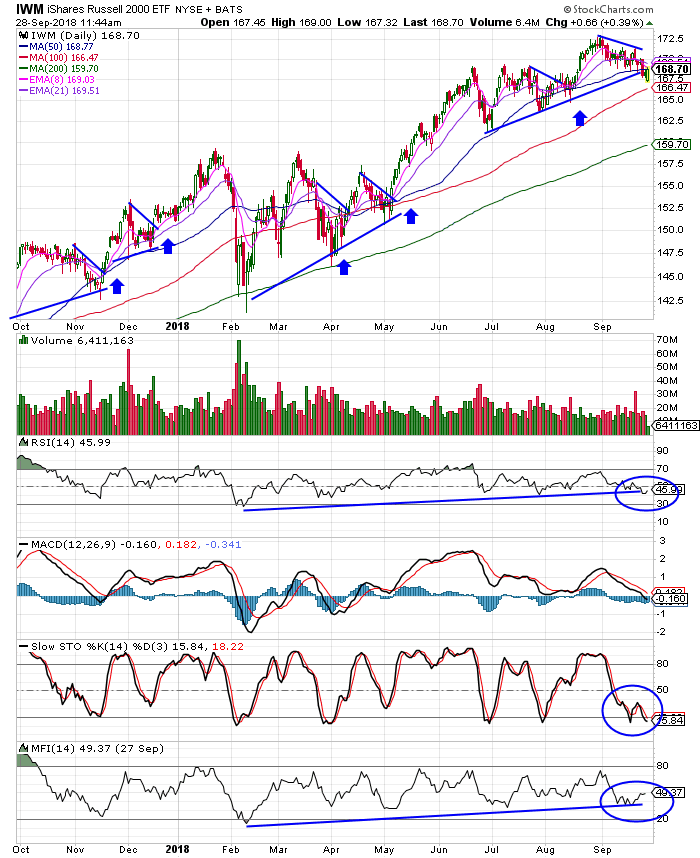

Russell 2000 (IWM)

While big cap indices have hit extreme overbought readings, take a look at this 1 year chart of IWM (Russell 2000 ETF). Small caps have traced out a repeating stair step pattern over the last 12 months, with each pause creating the next important buying opportunity. While not yet at extreme oversold levels, small caps have performed so powerfully this year that its likely they will not hit extreme oversold. The VRA Portfolio holds a number of small caps. I continue to look for a melt-up move higher into year end.

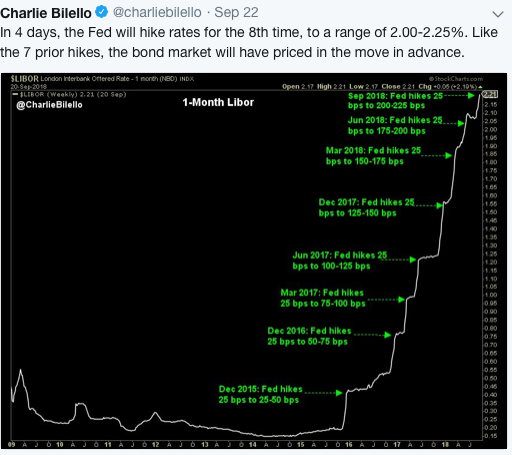

FED Rate Hike

The Fed raised rates for the 3rd time in 2018, as we have discussed here, the markets do not fear rate hikes…rising interest rates have been ultra bullish for US economy and equity markets. Next up, as European and Asian bond markets begin to normalize…as interest rates move higher there as well…we can expect international GDP growth to pick up, with a catch-up move higher in many European/Asian equity markets.

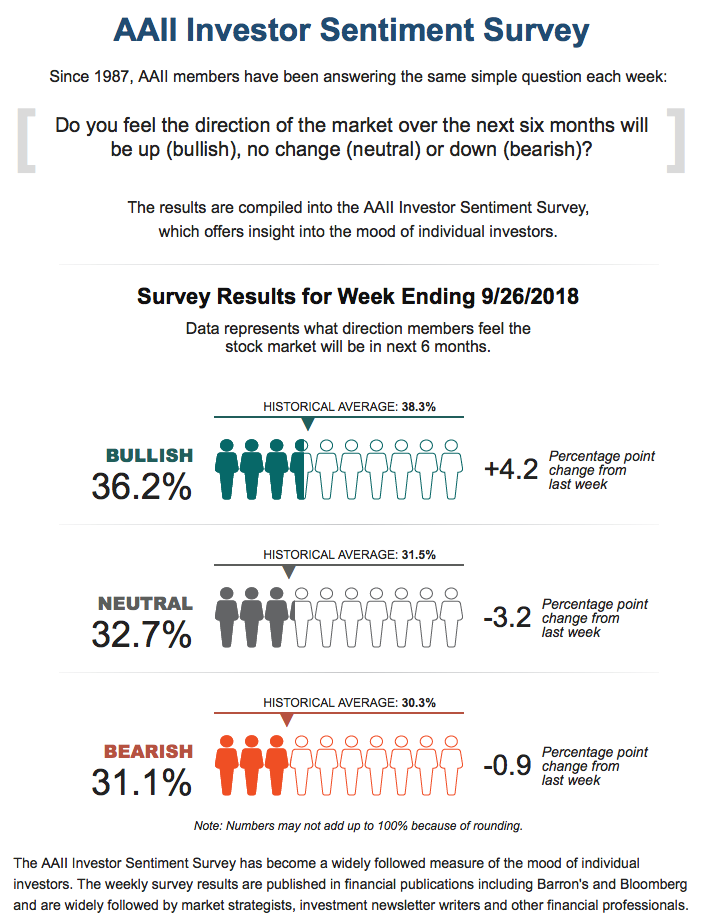

Finally for this morning, here is this weeks AAII Investor Sentiment Survey. 36% bulls with 31% bears…not even close to sniffing investor euphoria. Remember, I see no significant market top (meaning that dips must continue to be bought) until bulls hit 70%, for weeks on end.

Until next time, thanks again for reading….have a great weekend.

Kip