What Recession? Our Minimum Move Higher Has Been Met. Dow Jones Technicals and Market Update.

Thursday, January 17, 2019 at 10:23AM by

Thursday, January 17, 2019 at 10:23AM by  Kip Herriage -VRAInsider.com

Kip Herriage -VRAInsider.com Good Thursday morning all. Bit of a quiet morning so far. Morgan Stanley (MS) reported earnings and it was a big miss, with the shares down 5% as I write. But folks, have you seen what the financials have done this week? Big, 8–10% moves higher, post earnings reports from Citi and Goldman Sachs (the vampire squid) with regional banks seeming to beat estimates across the board.

Again, we simply are seeing no real signs of a recession. But out of respect to the bears, I’ll add this; no one on the planet knows exactly what will happen next. Stocks “are” a leading indicator of economic growth, so we must pay attention to what the markets are telling us. But the markets aren’t a perfect indicator of recessions either, which we’ve seen time and again as bear markets occur “without” a recession taking place.

This is why I created the VRA Investing System. It’s steered us right for many years. The VRA System told us that something very wrong was taking place in early 2007. I must have written 100 updates that went like this “with the FED hiking rates 17 straight times from 2004–2006, and with mortgage co’s closing their doors left and right, real estate is sending us warning signs”.

And then again, as the markets bottomed in March, 2009, the VRA System had us aggressively buying. Those March 2009 lows, which we called within 5 minutes (documented), proved to be THE lows.

Today, the VRA System sits at 8/12 screens bullish. Our biggest concerns are the FED (don’t fight the FED) and the fact that our indexes remain well below their 200 dma (day moving averages). Otherwise, the fundamentals in the US remain solid. Mixed bag, for sure…which is why we cannot allow ourselves to be lulled to sleep. But I’ll repeat…December was an aberration. A capitulation of importance. That remains our view.

Today, on the back of earnings misses and a short term, overbought market, we’ll get a good sense of what this market wants to do. If we can overcome this mornings DJ -100 futures, on the heels of some not so great news, and if the market can continue to climb a wall of worry and find a way to move higher still, there is no better market “tell”. As always, we’ll be watching the internals closely. Yesterday brought us another day of across the board positive readings. $3 trillion in money market funds on the sidelines, plus a return of share buybacks and M&A activity, tell us that a whole lot of bears are likely on the wrong side of this market.

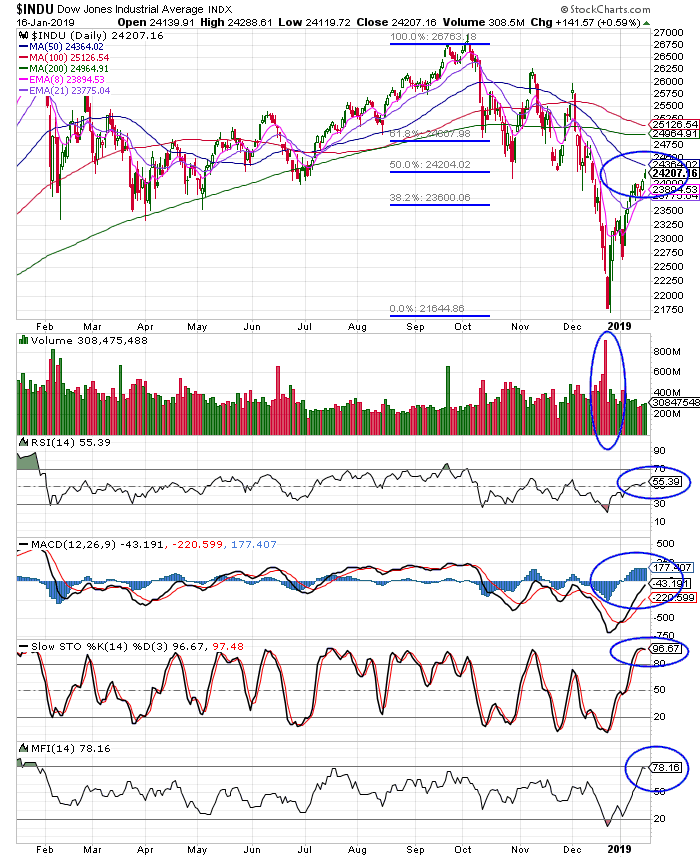

Dow Jones Technicals

In late December we began pointing to our minimum move higher, which we placed at 24,200. We hit this level exactly yesterday. 24,200 was a 50% retrace from the early October highs to the 12/24 Christmas Eve massacre lows. Let's take a look at the chart of the DJ and see what might happen next.

Again, we have now reached extreme overbought on some momentum oscillators (stochastics and money flow) while relative strength still has a ways to go. But let’s also remember that markets/stocks that reach overbought and remain overbought (without falling) are the single biggest bullish sign that we’ll ever see. And check out that selling climax volume in December. That big red line of volume we see was the single biggest sell side volume in history. Forever is a long time. Selling climaxes also mark significant turning points in the market (which also matches the many reversal indicators we’ve talked about often…sentiment, internals, analytics).

If the markets can find a way to move higher, in the face of the items laid out above, then it's telling us much higher prices are on the way. That's just what I believe we’ll see.

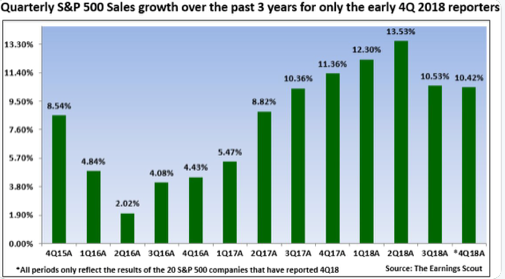

EARNINGS

I’m reviewing Q4 earnings news, which are so far MUCH better than the perma bears led us to believe that they would be. As of Tuesday’s close, here are the readings from the 28 S&P 500 co’s that have reported to date:

- 86% are beating bottom line estimates, with EPS growth of 27.4%.

- 54% are beating top line estimates, with revenue growth of 8.1%

Folks, these are excellent numbers. If there’s a recession on the way, shouldn’t earnings start reflecting it by now?

And check out this graph of S&P 500 revenue growth, in particular, the surge following the election. Consistent growth of 10%+, with EPS growth consistently above 15–20%. Again, no signs of recession. And yes, who the president is matters a great deal.

Bears are insistent that Trump’s tax reform was a 1 year 1 off. That tax cuts were merely a sugar high.

My view? They are not just wrong…they are dead wrong. We expect EPS growth of 10–15%+ in 2019 with revenue growth of 8–10%+. Again, no recession.

Your Emails

I don’t include your emails as often as I’d like to, but here’s one that is timely:

Will from Tx:

“Kip, you talk about the upside potential in your top growth stocks but don’t talk about the downside risks. Two of your top picks are sub $1 penny stocks and I’ve been burned in low priced stocks before. Can we really have confidence that these will survive and make us money?”

Great question Will. My view of penny stocks has been that most are like roach motels. It’s easy to get in…not so easy to get out. So yes, the risks are real. And yes, the VRA is very aggressive in recommending these. However, if you read yesterdays update you may have noticed that my top picks of all time….Ultra Petroleum, JB Oxford, Dynegy and Ivanhoe Mines…were all sub $1 penny stocks when I recommended them. Evaluating risk is what we do.

Factually, the price of a stock rarely matters to me. As long as the company has great potential, with solid management and little to no debt, then it does not matter to me what the current price is.

This describes each of our growth stocks/story stocks, today. None have any debt to speak of, with each having heavily invested management teams with a track record of success. We want a CEO that is a proven winner. A proven founder/builder of co’s. And, one that is invested heavily in the success of his own company (not just there for his 7 figure salary, like so many CEOs today).

And, as we’ve seen from “blue chips” like Enron, Worldcom, PG&E and GE, the risks in $50–100/share blue chip stocks are every bit as real. I’ll repeat, I would rather own VRA growth stocks…across the board….than most blue chips today.

I have a hard time getting the CEO of most blue chips on the phone, but I can pick up the phone and call the CEO’s of small cap co’s with relative ease. I like this fact.

And the obvious…we’re here to crush Mr Market. We’re here to make 50–100% + gains, as regularly as possible. It’s simply not possible to do this in the vast majority of blue chips.

This market wants to go higher. The VRA Portfolio now has an average gain of 30% per position from those 12/24 lows. And we’re just getting started.

Until next time, thanks again for reading…

Kip

Since 2014 the VRA Portfolio has net profits of more than 2300% and we have beaten the S&P 500 in 15/16 years.

Experience the Vertical Research Advisory free for 2 weeks!! For a limited time we are offering a 2 week free trial to the Vertical Research Advisory, visit vrainsider.com for more details.

For our latest free updates tune in to our daily VRA Investing Podcast atVRAInsider.com or subscribe to our free blog at kipherriage.com

Reader Comments