Happy New Year, Buy The Dip. Apple, Another Important Tell. VRA System Internals Improving. Is China Going the Way of Japa

Thursday, January 3, 2019 at 10:05AM by

Thursday, January 3, 2019 at 10:05AM by  Kip Herriage -VRAInsider.com

Kip Herriage -VRAInsider.com Good Thursday morning all. Hitting as many quick hitters as possible this morning.

1) One of my investing icons has always been Peter Lynch, of Fidelity Magellan fame and author of one of the best investment books you’ll ever read (One Up on Wall Street). Lynch averaged 28% returns for his Fidelity fund. We’re talking about 2 decades of outperformance. Best fund manager we’ve ever seen.

Lynch believed in building positions in companies that he understood, with great products and visionary management, and then holding those positions until and unless things changed. His quote goes like this “in most cases, we made little to no real money in my positions for the first 1–2–3 years…but then we got the payoff in years 4–5–6, often seeing gains of several hundred percent in a single year. By this time we had built large position sizes so the gains actually mattered to our total performance.”

This was the approach that made sense for Lynch. Its also how I’ve been able to book gains of 500–1000% + over the years in our favorite growth stocks/story stocks. 2019 will be the year that small caps reverse their losses from 2018.

2) Yesterday we wrote the following:

“Important VRA Market Note: today may be an important trading day. Many of the biggest market rallies are initially signified by lower opens (like todays -400 DJ) that then get reversed completely, with the market moving higher for the rest of the day. We have panic-like levels of fear in this market. A wall of worry that should give us short covering fuel for the fire. Combined with large levels of bullish fund flow as we start the new year (pensions, retirement funds, share buybacks and insider buying), its important that we see a solid recovery, marked by improving VRA System Market Internals.

Also, this Friday Fed Chair J Powell will give his first speech since setting off a firestorm of stock selling via his post rate-hike speech of mid-December. Look for big, policy making statements from Powell on Friday. Equity markets “should” rally higher into this.”

— -

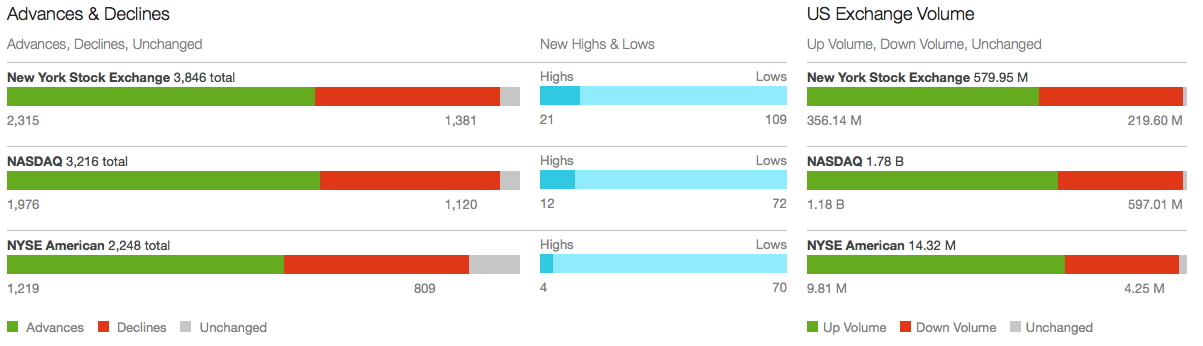

The markets responded just as we had hoped, with a nice rally off of -400 in the Dow Jones and an across the board move higher in each broad market index. More importantly, here are the internals. Better than 2–1 positives in advance/decline and up/down volume. Talk about a pattern change from the last 2.5 months. MOST important for the VRA Investing System (which sits at 8/12 Bullish Screens today).

This is exactly what we want to see going forward.

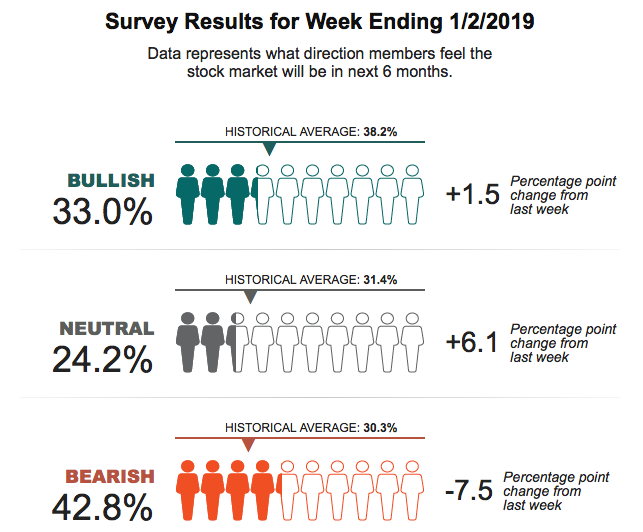

3) Heres the latest AAII Survey. Sentiment remains at “extreme fear” levels, with just 33% bulls and 42.8% bears.

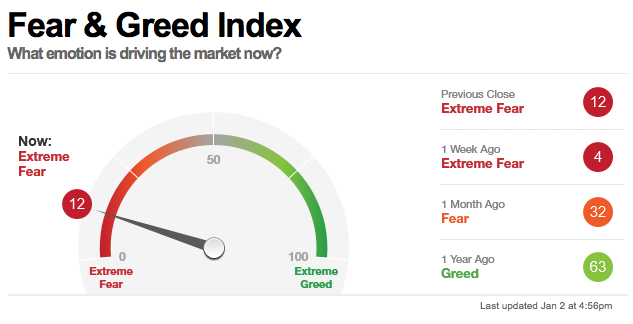

And the CNN Fear and Greed Index sits at 12. Again, extreme fear.

We are contrarians, most certainly when it comes to extreme sentiment readings on either side.

Buy the dips.

4) CHINA — Another Japan??

I’ve written often about the parallels of China today versus Japan of the 80’s and 90’s. At the time, the world believed that Japan was in the process of overtaking the US (economically and even culturally) with parents teaching their children Japanese and Wharton Business School (among many others) teaching Japanese management practices to a young US audience.

At the time, Japan was buying up US properties left and right, including dramatic overpayments on many (including buying the Pebble Beach Golf Course at 5x its present value).

But then the US got serious about Japan…as did the rest of the world. Japan quickly found themselves overextended and the tide began to turn. What followed was a 75% drop in the Nikkei Dow and a 19 year bear market in Japanese real estate. A brutal lost two decades for Japan.

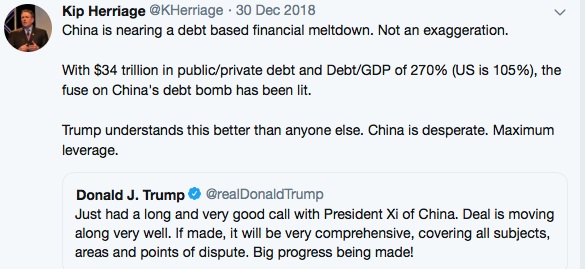

Trump’s actions with respect to China were never designed to be a “trade war”, but unless China wakes up to the worlds demands that they learn to complete honestly on the worlds economic stage, this mornings news that China’s economy is contracting could soon become an ongoing albatross for China’s economic future. With debt/GDP of 270% today, can China afford to make this kind of colossal mistake?

I look for China to have a good 2018. I believe they know their history and do not want a repeat of Japan’s two lost decades. China’s markets were the worst performing of all major markets in 2018. This will reverse in 2019.

Until next time, thanks again for reading…

Kip

Experience the Vertical Research Advisory free for 2 weeks!! For a limited time we are offering a 2 week free trial to the Vertical Research Advisory, visit vrainsider.com for more details.

Since 2014 the VRA Portfolio has net profits of more than 2300% and we have beaten the S&P 500 in 14/15 years.

For our latest free updates tune in to our daily VRA Investing Podcast atVRAInsider.com or subscribe to our free blog at kipherriage.com

Reader Comments