Good Thursday morning all. Wayne Gretzky said it best; “a good hockey player plays where the puck is. A great hockey player plays where the puck is going to be”.

As active investors, we want to crush Mr. Market. We have a strong desire to build our investment portfolios for a fully funded retirement account. We cannot do that if we skate where the puck is.

If we listen to the MSM, filling us with this fear, that fear, or the other fear, we’ll forever be buying when we should be selling and selling when we should be buying. We’ll forever be skating to where the puck is.

After doing this for 34 years I can tell you that it took me (at least) 10 years to get a handle on this most important subject. Understanding and controlling the emotions of investing. Nothing is more important. It’s a constant battle. Investing is as much art as it is science…artists are known for being temperamental and emotional…and nothing makes us more emotional than our money.

Think back to December. Investors sold out right at the lows. We know this because equity fund outflows hit an all-time record. Much of this selling occurred just as the Fear and Greed Index was hitting 2…yes TWO…another all-time record, indicating fear had gripped investors even more so than during the ‘08–09’ financial crisis. Remarkable.

If you were here with us then, you know that we were pounding the table to “buy buy buy”. We said exactly this during the last half of December, the worst since the Great Depression, and we said it often.

Investors that bought stocks in late December have massive gains to show for it. Unfortunately, that's not most investors. And even more unfortunately, this is how investment portfolios get wiped out…frequently.

I know, because I’ve done it myself. Tough lessons learned are always the best. Those lessons led me to the creation of the VRA Investing System. They led to getting my clients out of the market in late 1999, just before the dot-bomb, saving them $20–30 million in losses. They led to my warnings to everyone that would listen, beginning in 2006, at 100+ events all over the world, that “the coming financial crisis could wipe out stock markets and drive housing prices into the ground”.

And they led to my bottom calls in March ’09 and this past December. I’ll repeat, both bottoms will be all-time lows. That's how we played it in ’09 and that’s how we’re playing it now.

Where are investors mindsets today? Check this out…as Bloomberg reported this morning, even as global equity markets have gained $9 trillion in value this year, investors continue to pull money from the markets.

Remarkable. Even as our markets have surged higher, investors still aren’t believers. Fear continues to grip them. Our fake news financial MSM has much to do with this, along with the permabears that have taken over social media. Combined, investors have a level of anxiety that may be the highest yours truly has ever witnessed.

But folks, don’t believe it. It is one big psyop. And it’s designed to keep investors afraid and in cash. But trust me on this; as the markets continue to move higher. our financial press will start to become more bullish. We’ll hear them begin to whisper about the global economic recovery. Then, as the DJ crosses 30,000, we’ll hear them start to say “hey, maybe the good times are returning”. Then, as the DJ crosses 35,000, we’ll hear them join the VRA’s major global macro point of “wow…it does appear that populism/nationalism is better than globalism.”

Check out our VRA Daily Podcasts to learn more on this

Then, likely in 2023–2024, as the DJ approaches 50,000, literally everyone and their mother will be wildly bullish on stocks. We’ll hear “100,000 DJ is even possible”!

And that’s when we’ll be selling and taking profits. It’s the very nature of investor sentiment…the very nature of fear and greed…the very nature of the emotions of investing.

VRA MARKET & SYSTEM UPDATE

10/12 VRA Investing System screens are bullish. Ignore the list building clickbait permabears. And please, ignore the 24/7 “yield curve inversion is taking the US into recession” bears.

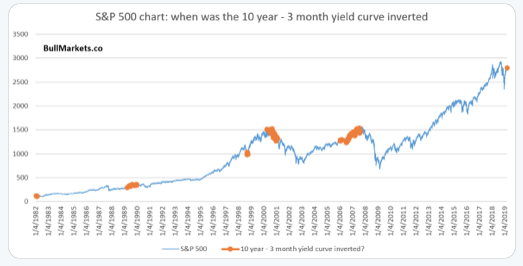

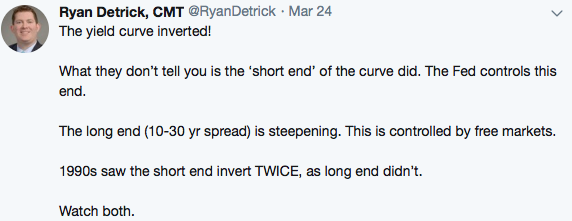

We covered this often when it first popped up last year, but here’s the bottom line, once again; yield curve inversions are only so-so when it comes to predicting a recession. But even when they are accurate, the stock market continues to rise for “at least” 1 year.

Take a look at the S&P 500 chart below, which illustrates each time the 10 year — 3 month yield curve has inverted. Since 1982, the inversion has led to two steep market drops and recessions. Sounds pretty bad, right? But take a closer look. The first inversion that resulted in a recession took place after 9/11/01. The second took place after the 08–09 financial crisis. In other words, yield curve inversions aren’t the boogeyman the financial MSM wants us to believe they are. Not even close.

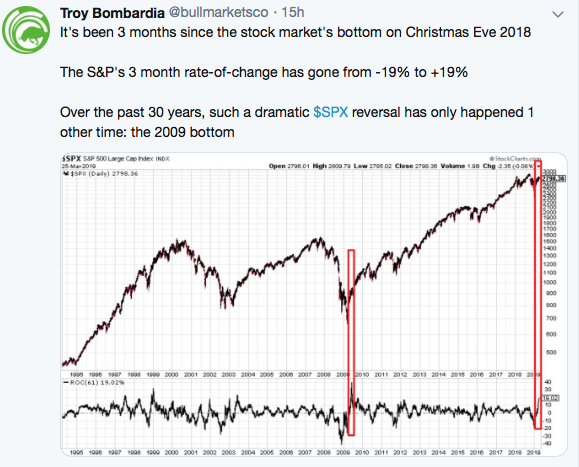

And this solid piece of research from our friend, Troy Bombardia. What we’ve just witnessed, from the 3 month sell-off and v-bottom 19% move higher, has occurred just once in 30 years. The last time? Right at the 2009 bottom. Our view has been, and remains, the same; we called the 09 bottom within 5 minutes. We believed that would be all-time lows. We also called the 12/24 bottom…and we believe it will also represent all-time lows. If you’re not long, you’re almost certainly very, very wrong.

US and global markets are headed much higher.

Using yield curve inversions as a stock market timer has been among the very worst strategies in the history of investing. Period.

Finally for this morning, we’re about to wrap up the best Q1 for S&P 500 since 2009 (+12%). Highly bullish for the rest of the year, with 9/10 occurrences since 1950 ending with even higher S&P 500.

We also know that the markets have been higher in April for 13 straight years.

Long and strong.

Until next time, thanks again for reading…have a great week.

Kip

Since 2014 the VRA Portfolio has net profits of more than 2300% and we have beaten the S&P 500 in 15/16 years.

Learn more at VRAInsider.com