First Quarter GDP Blows Away Estimates. What Happened to the Recession Doomsdayers? Move Higher, Just Kicking In.

Friday, April 26, 2019 at 9:55AM by

Friday, April 26, 2019 at 9:55AM by  Kip Herriage -VRAInsider.com

Kip Herriage -VRAInsider.com Good Friday morning all. Permabear after permabear, Trump hater after Trump hater, has been predicting a recession in the US. At minimum, they’ve predicted an “earnings recession”, where corporate earnings decline. Bloomberg even said this morning that their estimate for Q1 GDP was ZERO percent growth…with things getting even worse throughout the year.

Imagine their chagrin when the Q1 GDP report came out this morning, showing US economic growth of 3.2% vs 2.5% estimates, in what is almost always the weakest quarter of the year (Q1). My biggest question this morning? How do mainstream economists and MSM financial experts keep their jobs when their forecasts are this horrible?

You know our thoughts. Full year GDP for ’19 of 3%+. Full year GDP for ’20 of 4% +

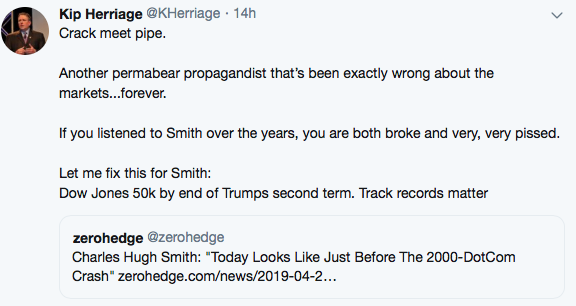

And we have to talk about this guy, this morning; Charles Hugh Smith, one of the biggest permabears around, and who has been bearish for at least the last 8 years. Just yesterday he issued another of his dire warnings for economic growth, going so far as to say that this is a market top similar to the dot-com top of 2000. Charles gets it wrong…WAY wrong…once again.

If you wonder why I single out permabears in these pages so regularly, its not that I enjoy dunking on people (although that is fun), there’s a much bigger reason behind it; good people…regular investors that are just trying to save for their kids college and retirement…they see these dire warnings from people like Smith and fellow permabear Jim Rickards, and it scares them out of the markets. That’s why dolts like these guys MUST be called out. As many people as possible need to know who they can and who they cannot trust.

Track records matter.

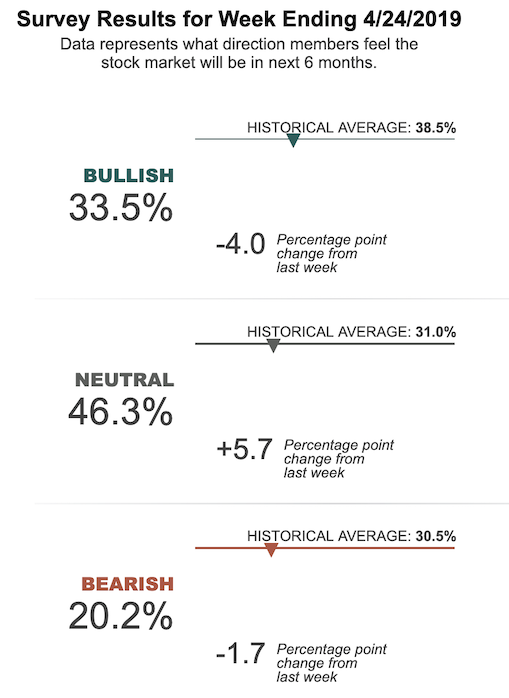

And it’s also why we see a huge 66% of all investors in the AAII survey as neutral/bearish on the stock market. Please, keep this one thought in mind, the next time you see a supposed permabear guru telling you that black is white and white is black; permabears are almost always paid clickbait propagandist list builders. They have no skin in the game…they’re not short the market and they don’t own puts…they just want you to sign up for their sites and lists so you can be marketed to by their corporate masters. Thats the bottom line.

We’ve been a broken record on this issue for many, many years. Help us spread the word on this highly manipulative, marketing fraud.

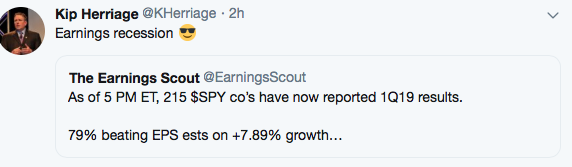

Here’s the reality of what’s happening, in addition to this blowout Q1 number. Check out the updated Q1 earnings report. 79% beating EPS estimates on 7.89% growth. Not recessionary!

VRA System and Market Update

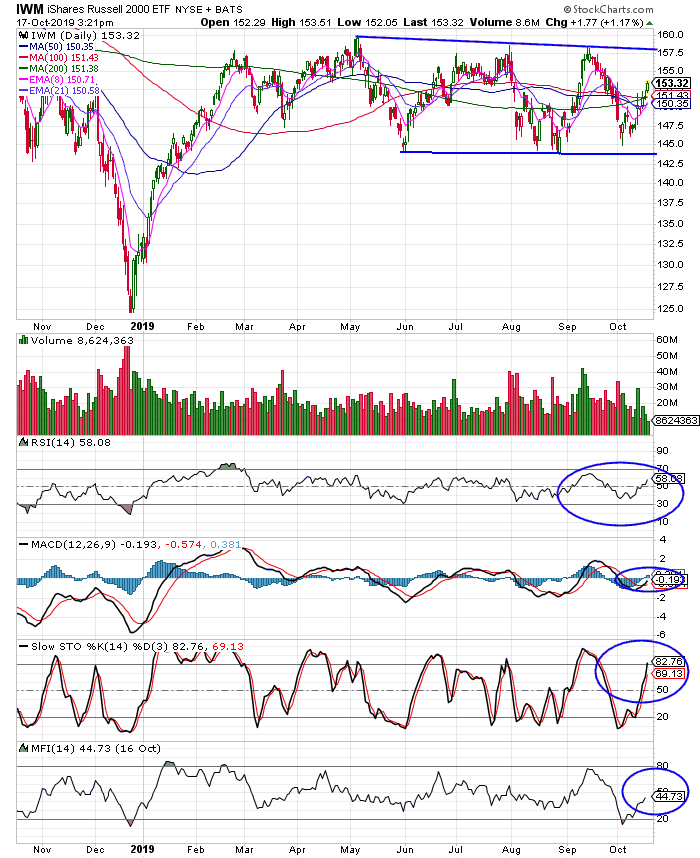

While our broad markets (outside of small caps) still sit at extreme overbought in the short term, we continue to see this as the pause that refreshes. We have seen a bit of weakening in our VRA System Market Internals…something we are watching closely…but VRA System readings still sit at 10/12 screens bullish.

SMALL CAPS ARE NEXT

Here’s the chart that we’re focused on now. The chart of the week. Small caps. IWM (Russell 2000 ETF).

As you can see below, IWM is in the process of breaking higher from its overhead resistance trend line. We believe the breakout will be rather massive…good news for VRA small cap buy recs. In addition, IWM is very close to a golden cross (50 dma crossing over 200 dma). Looks likely today. Another bullish event. With small caps still 7.6% away from all time highs, we’re looking for a big catch up move higher. In our work with technical analysis, this is chart perfection.

VRA Portfolio

Folks, if you’ve been here for a while, heres what you already know. We’ve been talking market melt-up pretty much since Trump was elected. Sure, the December mini-crash was brutal, but we held strong. Those that stayed the course, those that averaged down, or those that joined earlier this year, have some rather massive short term gains. How’s the VRA Portfolio performed, exactly? Hey, thanks for asking… the VRA Portfolio is up 38% vs. the S&P 500’s 17% and has thus far outperformed our bogey (S&P 500) by a solid 126% in 2019. And folks, here’s the interesting part; wait until our 10 bagger VRA growth stocks really get going.

We said this at the beginning of the year, so we’ll repeat it here once more; 2019 should be one of our best years ever. It will take some work to top 2009’s +360% returns…but that continues to be our target.

And this is when my mentors Ted Parsons voice (RIP Ted) starts ringing in my ears. I can here him saying:

“Kip, if you’re not already humble, the markets will make you humble”. As a brash 23 year old, I thought he was a bit of an old fool. How young and dumb was I?

And another of Ted’s favorites “in a bull market, everyones a genius”.

#WISDOM

BTW, in 1987, I had been a broker for 2 years. As the Black Monday crash unfolded (the Dow crashed 23% that day), I watched as 20–30 year veterans completely lost their minds. At -15% they were lined up at the tube system (yep, just like your bank drive through) to enter their pink slips (sell orders). Most all entered their orders as “market orders”, desperately trying to get their clients out at any price.

But Ted remained rock solid. He was entering buy orders, beginning an hour or so before the close. I had maybe 50 clients at the time, with most in muni bonds, so I was able to sit back and watch the crazy unfold.

What these veteran brokers did not know…how could they really…was that their market orders would be sold out right at the lows of the day. And it took 3–4 days before they even learned the prices they received. Volume swamped the floor trading systems (as they were). By the time they learned their fate, the markets had already recovered much of their losses. Careers were ended, that fateful day. Offices opened up, as brokers took early retirement…I wound up getting one of them…certainly not the way I wanted to move up the corporate ladder.

By the end of the year, the Dow Jones and S&P 500 actually managed to book positive returns. And Ted? He came out of it with huge gains for himself and his clients. This was my lightbulb moment as a contrarian. When there’s blood in the streets…buy, buy, buy. When everyone is bullish and bragging about how much money their making…when Uber drivers are giving their hit stock tips…and when your co-workers are quitting their jobs the become day traders. Get. The Hell. Out.

And no, we’re nowhere near this level of froth today. Check out the latest AAII Investor Sentiment Survey, my go to survey for more than 30 years. Bulls sit at 33.5%, bears at 20.2% with neutral investors at a massive 46.3%. Combined, this means that 66% of investors are either bearish or neutral on the stock market. Remarkable, with all time highs and the v-bottom, straight up move higher since 12/24.

We’ll start taking (serious) profits when bulls reach 70%. Then, when bulls sit at 70%+ for weeks on end, we’ll take even more. This is also when we’ll put some short positions on.

When will take happen? Who knows…but not before the Dow tops 35,000 is my best guess. Likely just after the ’20 elections. Then, we’ll be patient and wait for the correction to run its course, before re-loading again.

Important point: this does not mean we will hold all of our positions today til DJ 35,000. We’ll take advantage of interim moves to take profits on some positions, as we add new positions. But that day is not today. We are well positioned. Locked and loaded.

Lastly, a very big thank you to everyone thats listening to our daily VRA System Podcasts! On our 189th podcast yesterday we surpassed 25,000 listens (Soundcloud and ITunes). Sign up for email updates at vrainsider.com/podcast

Until next time, thanks again for reading…

Kip

Since 2014 the VRA Portfolio has net profits of more than 2300% and we have beaten the S&P 500 in 15/16 years.

Learn more at VRAInsider.com

Reader Comments