Some quick political/economic hitters to start the day…

1.) The last two nights of Dem debates…holy batshit crazy…what a circus. Judging solely from the feedback of long term moderate D’s, the left has gone completely off the rails. Until we see evidence to the contrary, the US remains a center-right country. Center-right voters have NO interest in a) open borders, b) decriminalization of illegal immigration, c) Medicare for all, aka the destruction of private health insurance or d) spending 10’s of trillions combating the hoax that is man made climate change.

If this is the best that the left has to offer, yes, it is possible that Trump could come close to the ’84 avalanche that Reagan put up against Mondale, when he won 49 states and 525 electoral votes.

2.)How bout that Fed presser with J Powell. All was going just fine, following the Fed’s 1/4 point Fed funds rate cut (just as expected) and ending of QT, or quantitative tightening (just as expected) but then J had to go off script and hint that this cut could be a “one and done” by saying “this is not the start of a lengthy cycle of rate cuts”. J Powell should be kept away from microphones…and sharp objects.

Our view is unchanged. The Fed will keep cutting. Stocks keep going higher. Longer-term, the US 10 year could be headed as low as 1% (just over 2% today). After Trump wins next year (knock wood), Powell is likely out of a job.

3.) Gold/miners sold off on Powell's disaster, as the dollar rose to new cycle highs. I have just one comment here; buy the dip. Gold and the miners have broken out…overbought sell-offs are a gift. Check out this piece on the record level of gold purchases by central banks. Wonder what it is that the smart money knows?? #GotGold?

https://www.ft.com/content/b62ebb1a-b3a6-11e9-bec9-fdcab53d6959?list=intlhomepage

VRA System Update

The VRA System remains at 10/12 screens bullish. Much higher prices await, something we received economic confirmation of this week as July’s consumer confidence reading came in with a BIG beat of 135.7 vs 124.3 in June. We’ve always viewed the consumer confidence reading as an LEI (leading economic indicator). When animal spirits are present, as today, the consumer is buying and businesses are building. Folks, we’re not always right…but on this forecast we are highly confident; The Trump Economic Miracle is still in the early innings.

If you’ve been with us here at the VRA for long, you’ll remember that we 1) predicted Trump would win (wrote a book about it), 2) predicted the DJ would hit 25,000 in Trumps first two years and have been forecasting DJ 30,000 by year end, DJ 35,000 by end of 2020 and DJ 50,000+ by end of 2024 (assuming Trump wins. If not, we are OUT).

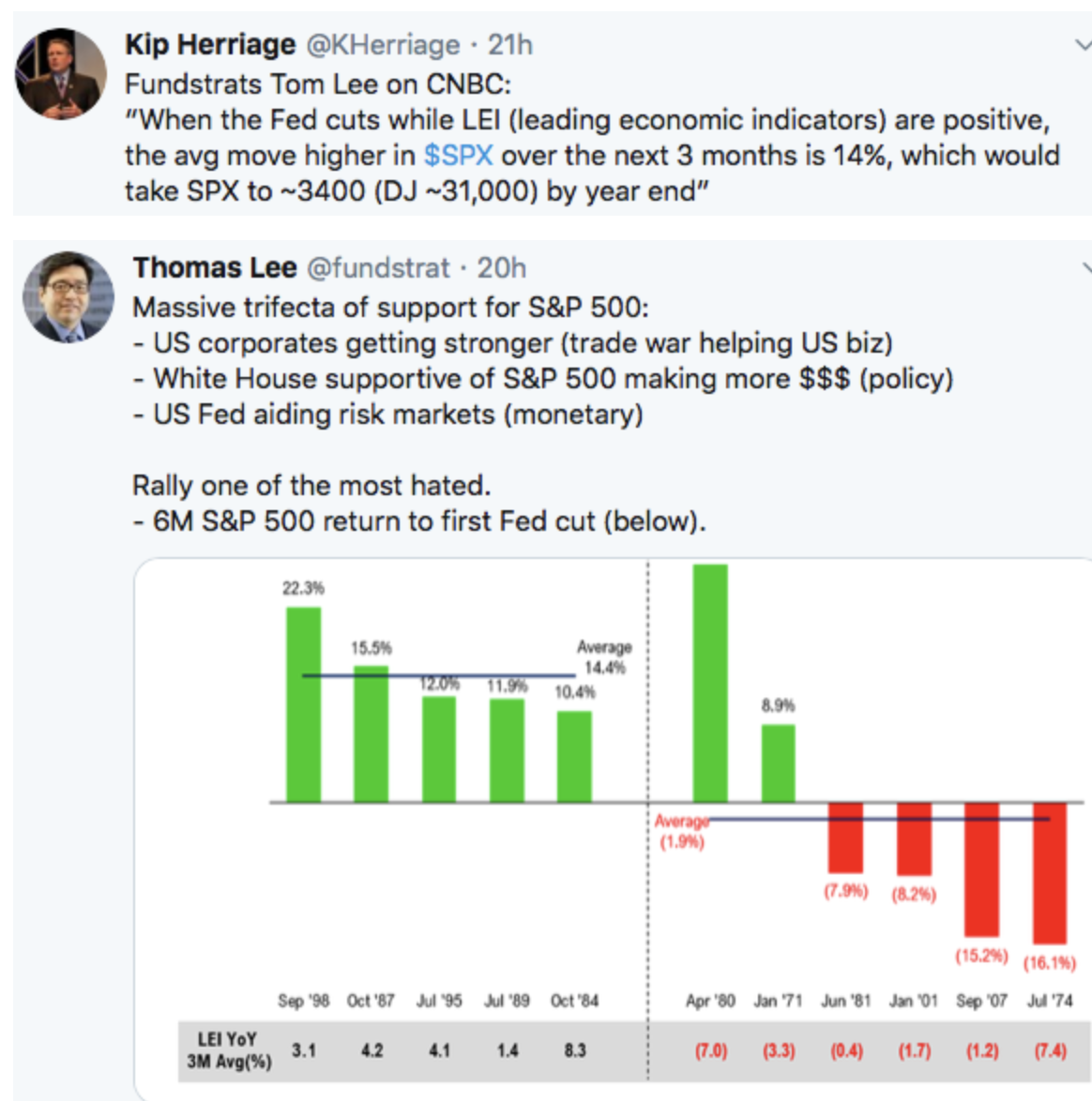

No one has been more bullish…or frankly, more right…than the VRA. But we finally found someone that has higher estimates than us. Tom Lee of FundStrats is out with a year end 31,000 target on the DJ, based on interesting analytics that point to a 14% move higher by year end (details below).

Many saw this as an “incredibly important” week. Over my career I can recall many “incredibly important” weeks like this. Here’s what I also recall about those weeks; they almost always turn out to be a non-event. Here at the VRA we’ll be surprised if we get much in the way of fireworks. Instead, we look for existing trends to remain in place. Those trends are:

- Higher stock prices

- Lower bond yields

- US economy continues to surge

- Skepticism of a final trade deal with China (their loss)

We remain long and strong. DJ 30,000 by year end.

Until next time, thanks again for reading…

Kip

Since 2014 the VRA Portfolio has net profits of more than 2300% and we have beaten the S&P 500 in 15/16 years.

Join us for two free weeks at VRAInsider.com

Sign up to join us for our daily VRA Investing System podcast

Also, Find us on Twitter and Facebook