RECESSION FEARS? Uh….NO. Housing About to Get Hot. Miners, Major Buy Signal.

Thursday, August 22, 2019 at 9:47AM by

Thursday, August 22, 2019 at 9:47AM by  Kip Herriage -VRAInsider.com

Kip Herriage -VRAInsider.com Over the last few days Tyler and I have fielded a ton of questions, from VRA Members, friends and family, about the 24/7 news coverage about “the coming recession” in the US. How could anyone miss it…the media would love nothing better than to topple Trump, even if it means enduring a painful recession that could cost millions of Americans their jobs. Personally, I find the medias behavior disgusting. It’s exactly this type of fake news reporting that keeps investors bearish and out of stocks. It explains why the latest AAII Sentiment Survey (updated last night) shows just 26% of investors bullish with a huge 39% of investors bearish. As contrarians, we know exactly what this means; back up the truck and buy, buy, buy.

The VRA Investing System was built to spot economic booms and busts, and spot them early. Just yesterday, both ITB (Housing Construction ETF) and HGX (Housing Index) hit new 52 week highs. The media seems clueless to this fact, so we’ll report it for them; there has never been a recession in the US when the housing market is solid. Housing is THE leading economic indicator. Today, with two leading housing indicators flashing “strong buy”, the market is doing its job as a discounting mechanism….it’s telegraphing what’s about to take place; the US housing market is about to get hot.

Because housing leads (everything) economically, we see the possibility of a recession as “very slim”. The VRA Investing System remains at 10/12 screens bullish. We continue to see a major move higher into year end. Our DJ 30,000 target is unchanged.

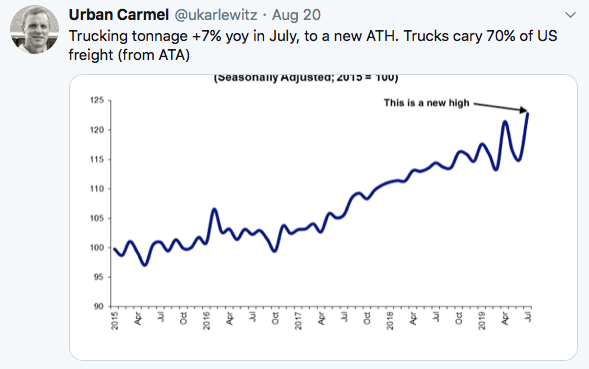

And more evidence that the US economy is rocking and rolling. Trucking tonnage is +7%, year over year, in July. Folks, that’s another new all time high. #NotRecessionary

Now, we look for the transportation index and small caps to regain their 200 dma.

NEXT UP: Mega Global Stock Market Rally

Again, the all clear was given on US-China trade war last week. Recession, in the near term, is a laughable prospect. As the single best discounting mechanism on the planet, markets are about to roar higher. It started this weekend with China announcing a massive easing program and continues this week with Fed Chair J Powell speaking at the annual Jackson Hole meetings this week. Rate cuts are coming…we’re talking coordinated cuts on a scale the world has rarely seen.

The ECB meets on 9/12. Late last week they tipped their hand (aggressively), with the statement that they’re about to launch the “Big Bazooka”, meaning significant rate cuts and the re-launch of QE. Germany, the largest country in Europe, has historically stuck by their commitment to keeping debt/GDP at no more than 35%. Beginning next month, fiscal conservatism begins to go out the window.

Following the ECB, our Fed meets on 9/17 with a rate cut of .25-.50 a certainty. More importantly, we look for the Fed to change their language from the last Fed meeting when they state that we are now in a cycle of rate cuts (not merely just a mid-cycle adjustment).

Don’t fight the tape. Don’t fight the Fed.

Know this; all of the fears out there serve as a BIG “wall of worry”. Markets love to climb them. There will come a time…likely with the DJ at 40,000 to 50,000…that the public starts to forget some of these indelible marks. The fact that we have a fake news media that only stokes fear and divisiveness elongates our mental recovery process.

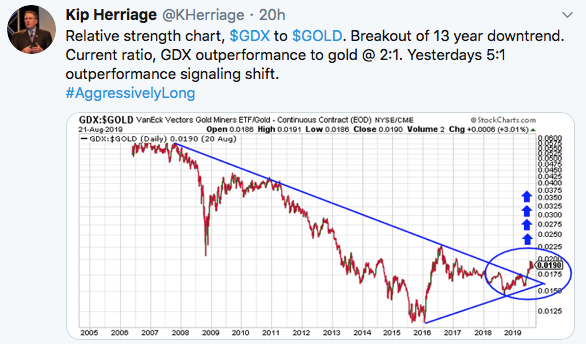

PRECIOUS METALS/MINERS STILL ON MAJOR BUY SIGNAL

Our most important technical buy signal in PM’s/miners continues to flash “strong buy”. The 13 year downtrend line has been broken (miners to gold)..this is when this group gets red hot. While not a ST timing signal, a better than 2:1 ratio tells us that smart money is aggressively buying the miners. This only happens when gold/silver are in full-on buy signals.

In my career, this level of outperformance by the miners is the biggest buy signal of all. Keep buying PM’s and VRA Buy Rec miners. Multi year massive move higher is in process.

Until next time, thanks again for reading….

Kip

Since 2014 the VRA Portfolio has net profits of more than 2300% and we have beaten the S&P 500 in 15/16 years.

Join us for two free weeks at VRAInsider.com

Sign up to join us for our daily VRA Investing System podcast

Reader Comments