VRA Weekly Blog Update: Fed Meeting, is profit-taking on the way? AAII Investor Sentiment. The Gold, Silver Criminal Conspiracy.

Thursday, September 19, 2019 at 11:45AM by

Thursday, September 19, 2019 at 11:45AM by  Kip Herriage -VRAInsider.com

Kip Herriage -VRAInsider.com Fed Meeting, Powell Getting Better!

1/4 point rate cut and presser behind us. All pretty much as expected. Fed Chair Powell did ok. The trading action during and just after the Fed presser is typically sporadic and not always easy to trust.

Here’s what we do know; the cut has now taken place. That “good news” that is behind us. What will the markets key off of next…whats the next “buy the rumor event”.

In addition, the first 1/2 of September is typically bullish…like this has been…but the second half is just the opposite. Bearish. Analytics of the last 50 years support this.

Why? October is “crash month”…just about every major crash has occurred during October. Some profit-taking would not surprise me.

We remain medium to long term bullish and short term cautious. It’s entirely possible that the markets keep blasting off higher from here but we rely on market internals as a ST guide…and they were weak yesterday. Roughly 2:1 negative across the board. Again, by no means a “bear market” signal…but yes, we will be watching internals closely. They are our best ST signal indicator. And we’re following the Fed’s actions in the repo market as well. Tyler got into this in yesterdays podcast. Is QE lite now in place.. and what is happening in the repo market?

https://soundcloud.com/user-640389393/vra-podcast-tyler-herriage-daily-investing-podcast-sep-18-2019

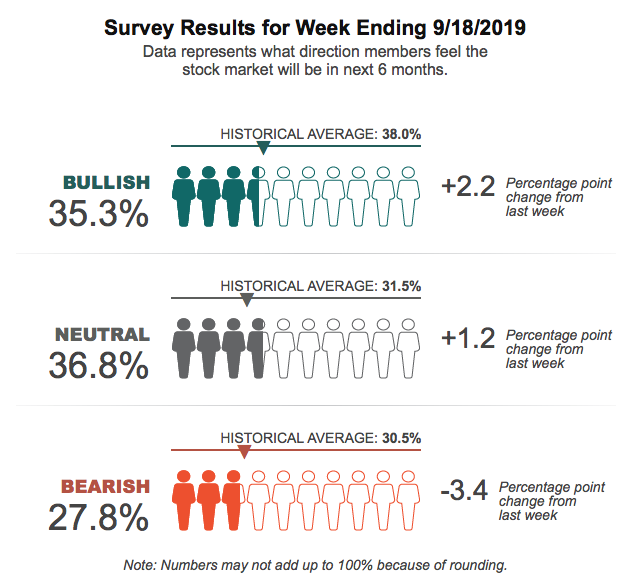

AAII Investor Sentiment: The Public is Returning

35% bulls to 27% bears. Sentiment follows price. As expected, the public is returning. Finally.

VRA Bottom Line: the VRA System is flashing extreme overbought on every broad market index. Our wall of worry move higher is dissipating. We’ve already had ECB rate cuts and QE. We’ve had good news on US-China trade. And the public is no longer bearish, with investor sentiment flipping to neutral-bullish. J Powell has a history of mini-crashes and we are entering the worst period of the year, filled with major market declines. And this, remember what happened to the markets in Q4 of last year? It led to the worst December since the great depression.

We want little to do with any of these risks. Lets be the smart money.

Not a time to be bearish…just a time to be smart.

— —

US JUSTICE DEPT INDICTMENT: JP MORGAN GOLD/SILVER MANIPULATION CARTEL WAS A “CRIMINAL CONSPIRACY”

As discussed in these pages for 15 years, and as GATA and Bill Murphy have battled for 25 years, the commodities markets have been rigged. Absolutely and completely. Late yesterday news broke that the US Justice Department charged JP Morgan (and others) with RICO charges for multi-decade criminal practices of gold/silver rigging . Racketeering. The RICO statutes were put into place to catch the mob. Sounds about right for the banking cartel.

— -

This should be just the beginning of legal worries for the banking cartel. RICO is no joke. This criminality ran rampant in major money center banks, in the US and Europe, for up to 3 decades.

We’ll follow this story closely. If there’s justice there will be class action lawsuits that we can join as well. No, we were not conspiracy theorists.

This will be a busy week. Again, we don’t believe in picking tops. But we stand ready to act in the event a short term market top and correction is about to unfold.

Until next time, thanks again for reading…

Kip

Since 2014 the VRA Portfolio has net profits of more than 2300% and we have beaten the S&P 500 in 15/16 years.

Join us for two free weeks at VRAInsider.com

Sign up to join us for our daily VRA Investing System podcast

Reader Comments