VRA Weekly Blog Update: We Remain Cautious.

Friday, September 27, 2019 at 12:47PM by

Friday, September 27, 2019 at 12:47PM by  Kip Herriage -VRAInsider.com

Kip Herriage -VRAInsider.com Good Friday afternoon all,

Tyler here with you for today’s update.

As Kip mentioned in yesterday’s update the VRA Investing System has been downgraded from 10/12 screens bullish to 9/12 screens bullish. We have been at 10/12 screens bullish since June 19th, and as we have been writing here, nothing has changed in our medium to long term view, but our short term outlook continues to be “proceed with caution.

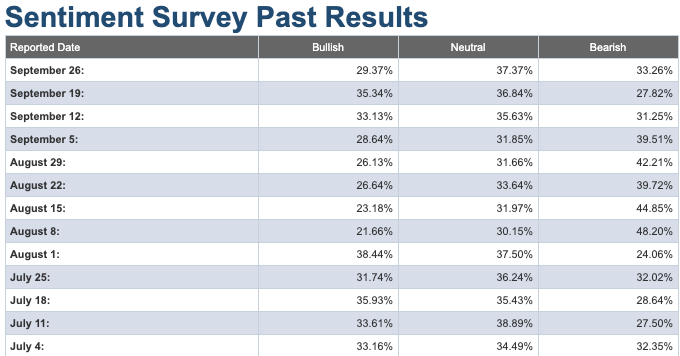

We began alerting to this change in our updates two weeks ago, as our markets were in extreme overbought conditions and we began to see a breakdown in the market internals. At the same time, investor sentiment was returning to bullish/neutral territory. Bulls outweighed bears for two consecutive weeks for the first time since mid-July. As contrarians, this was not what we wanted to see, but in this week’s AAII Investor Sentiment Survey the percentage of investors bearish once again passed the bulls.

The CNN Fear & Greed index, on the other hand, remains at greed. Down slightly from last week, but still up big from this time a month ago. We continue to see a shakeout in the cards for the next 2–4 weeks, by that time our markets will have begun to reach extreme oversold readings. When sentiment returns to fear again and our markets are oversold we will be ready to strike.

“Be fearful when others are greedy and greedy when others are fearful.” — Warren Buffett

Technology was looking weak during overnight trading, as Micron Technology (MU) fell over 6.5% in after-hours trading yesterday after beating on earnings estimates for Q3. MU earnings did fall compared to Q3 2018, and other semi-conductor names, AMD and NVDA were also down over 1% and 1.5% respectively in after-hours trading.

As Kip writes about often, tech is our market leader. Technology leads our markets both up and down, specifically the semis. Right now we continue to see weakness, the Nasdaq has turned negative after opening higher this morning.

Again, not time to panic, but a time for caution. We are now just weeks away from the next round of high-level meetings on trade, and the semis are heavily impacted by US-China trade talks. Yesterday, ministry of Commerce spokesperson Gao Feng said the two countries are maintaining “close communication.” From the outside tensions between the two sides do appear to be easing, and good news on the trade front will send these stocks and the sector higher.

Housing continues to impress

One of the sectors that we have been pointing to as evidence of the underlying strength of our economy is housing. It is our go-to indicator for economic weakness and right now we see no signs of recession.

We continue to get strong numbers in housing this week. On Wednesday we got new home sales data from August and beat estimates by 54,000 coming in at 713,000. July was revised higher as well. Pending Home Sales for August also came in yesterday with a rebound from July’s reading and is now up 2.5% from this time last year.

Housing is the leading economic indicator, no single indicator is more important for the VRA Investing System. HGX and ITB continue to hit new 52 week highs, XHB is right there as well. Individual names like Lennar and KB Homes are also hitting new 52 week highs. We do remain at overbought levels in housing, which is why we will keep our stops in for NAIL(where we have gains in 2019 of 165%), but the charts below tell us that US housing is in great shape overall. If we do end up getting stopped out we will be patient and wait for the right opportunity to get back in.

It is bullish that we continue to see strength in the fundamental economic conditions that matter. Once we see our markets at extreme oversold territory (already on our way there) and our market internals begin to improve, we will be ready to act. We need to be fully prepared, the end of this pause will likely be one of the last great buying opportunities of 2019.

Until next time, thanks for reading and have a great weekend.

Tyler

Since 2014 the VRA Portfolio has net profits of more than 2300% and we have beaten the S&P 500 in 15/16 years.

Join us for two free weeks at VRAInsider.com

Sign up to join us for our daily VRA Investing System podcast

Reader Comments