VRA Investment Update: Bear Market Ending as We Climb a BIG Wall of Worry?

Friday, October 28, 2022 at 10:30AM by

Friday, October 28, 2022 at 10:30AM by  Kip Herriage -VRAInsider.com

Kip Herriage -VRAInsider.com Good Friday morning all. As we’ve covered over the last year, the current bear market…the 3rd in 4 years…actually started in February 2021. That’s when groups such as SPACs, meme stocks, China, biotechnology, etc hit a top and started to decline.

The weakness was contained to small-caps and speculative stocks for a long time but started to spread to the broader market in November 2021. The indexes covered up the brutal action under the surface. The action in mega caps and big tech helped to hide the carnage that was taking place under the surface.

This past week the big-cap technology stocks have all posted weak earnings and their shares have been crushed, with bellwether Amazon joining the crash party last night with losses of more than 20%.

Are we now witnessing the final stage of this bear market? Yes, I believe we are. When the generals get smoked but the broad markets barely notice, that sure looks like it “may” be the action of a market ready to climb a big wall of worry.

And call me a rose-colored Patriot, but I think the red-pilling of America (the world, really) and the soon to be shellacking of a Dem party that has grown to hate America, are highly bullish events.

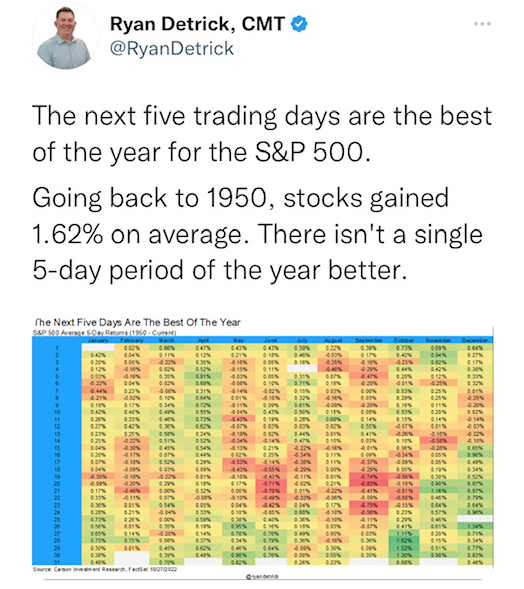

We’re also entering the best 5 trading days of the year….just as we enter the best month and quarter of the year….just as we enter the best 12 months for investors, period (12 months after midterms)

VRA Market Update

3rd quarter GDP was released Wednesday and came in with growth of 2.6% vs estimates of 2.4% (vs Q2 GDP of -.6%). As we’ve been forecasting for some time, the US economy has not entered a recession. While the signs point to growing risks of a recession in mid-late 2023, its been our view since he left office that the power of the “Trump Economic Miracle” and Trumps stunningly powerful “America First” policies would sustain the US economy for years to come (likely a decade)…regardless of the intentional damage that Team Biden is inflicting on us.

We’re seeing more proof of the power of Trump's economic policies in Q3 earnings as well. With 263 S&P 500 co’s reporting to date (through Friday morning), 73% of co’s reporting have beaten EPS estimates on 8.75% earnings growth with 63% beating on revenues with growth of 12.17% growth.

As Tyler also got into on his podcast on Wednesday, this weeks trading has been a testament to the bear market rally that is underway and that we expect to have legs into the midterms and into year end.

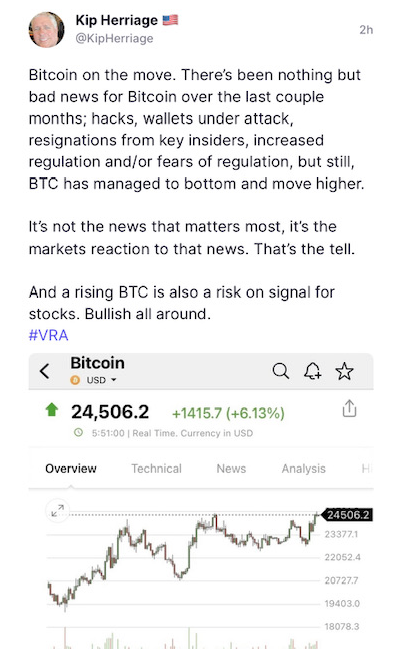

This week saw China’s markets crash yet US markets ignored it almost completely. Then we got multiple 8–9% post-earnings meltdowns in the big tech names like Microsoft, Google, Facebook (Meta), and Amazon, yet the Dow Jones and the Russell 2000 have managed to finished with gains. I can tell you with high confidence that this sort of bullish action in the markets sends shivers down the spines of bears.

As my mentor Ted Parsons taught me some 35 years ago (RIP Ted), “it’s not the news that matters as much as it is the markets reaction to that news”.

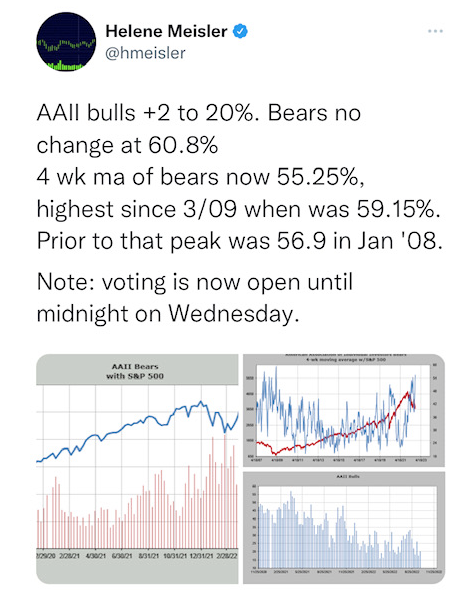

Our forecast…a sharp “bear market rally” move higher (featuring short covering) into the midterms (at minimum) which will likely extend into year end and into Q1 2023. With the combination of deeply bearish sentiment (contrarian buy signal), seasonality (the calendar says “BUY”) and overwhelmingly bullish analytics (post-midterm data and more), this should be a good time to own stocks.

We believe we have 4 “tells” that point to the near-term lows being in place. Signs that point to a sharp rally into midterms/year end (and into 2023).

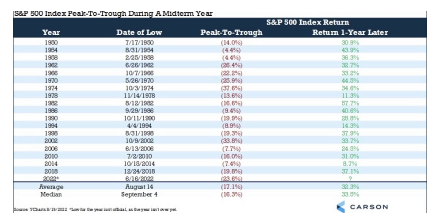

1) Analytics: the most compelling data of my career; “Since 1950, in midterm years, the S&P 500 has had an avg gain of 32% from the midterm lows over the following 12 months (with the markets higher 18 of 18 times). Add that with a divided congress and lame duck Biden, the markets should soon get their wish for gridlock in DC. There’s little more that the markets love than DC gridlock.

2) Seasonality: November is the best month of the year in the midterm cycle and Q4 is the best quarter in the midterm cycle.

3) Market Internals and Technical Buy Signals; 10/13 “CPI Capitulation”, featured a bullish engulfing candle for S&P 500 and two breadth thrusts (>90% up volume in both NYSE and Nasdaq…rare)

4) The semis are leading. Yes, this is a new development, but from the 10/13 lows SMH (semi ETF) is up 13%. When the semis are leading the way higher it pays to be aggressively long stocks.

While we remain in a bear market (and below the 200 day moving averages) we will continue to look for trading opportunities in our selected ETF’s (using the VRA Investing System for timing) while using market weakness to dollar cost average each month into VRA 10-Baggers, our top ranked growth stocks with the potential/promise to produce gains of more than 1000%. Learn more at VRAinsider.com

Until next time, thanks again for reading….

Kip

Join us for two free weeks at VRAInsider.com

Please join us each day after the market closes for our Daily VRA Investing Podcast!

Sign up for email alerts @ vrainsider.com/podcast

Also, Find us on Truth Social and Rumble