At the beginning of 2018 I made the comment (to anyone that would listen pretty much) that I believed this year would our best year…possibly ever…for the VRA Portfolio and our bottom line results. If that sounded like marketing rhetoric, I get it…but it was simply what I believed, based on what the VRA System was telling us.

On all VRA Buy Recommended positions we have a total net gain of 897% with an average gain per position of 69%. This is why the VRA is a top performing investment newsletter. We can find no one who has done better.

We’ve got a long ways to go in 2018 and it will take hard work and some very good fortune to put up these numbers for the full year. To the investment gods (little g), please know “this is not me bragging” (karma isn’t a big fan of bragging), I’m simply passing the results on so we can celebrate them together.

Crushing the Markets Year After Year. Who we are and how the VRA Investing system works.

For those of you who are new to, or maybe just learning about, the Vertical Research Advisory (VRA) I wanted to put together a video that explains how the VRA's Investing system works, tell you a little bit more about my story and how we generate returns, year in and year out, in good markets or bad.

https://youtu.be/8-8y21NvwCw

To receive two free weeks to the VRA, visit us atwww.vrainsider.com/14day

VRA Market Update:

January closed with gains of 5–7% for the major averages (SPX, DJ, NASDAQ), while the Russell 2000 finished the month with just a 1% gain. To put things in perspective, for those that think this was the end of some sort of “melt-up”, China (Hang Seng Index) finished the month with gains of 13%.

Still, a great month to start the year. And no, we almost certainly will not keep us this torrid pace for the rest of ’18, unless we believe that the markets will end up 60–84% higher for the full year (January’s gains annualized). I’m ultra bullish…have been for a long while…but not that bullish (if I was, I would expect you to laugh me out of the business).

But here’s the most important point; the VRA does not invest in the broad market. We pick and choose our spots, with individual stock/ETF positions, using the VRA System to handily beat the broad markets (year after year). Remember, it’s not a stock market…it’s a market of stocks. As long as we’re in the right stocks at the right time, we’re good.

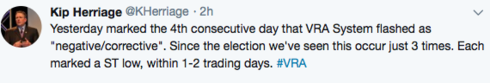

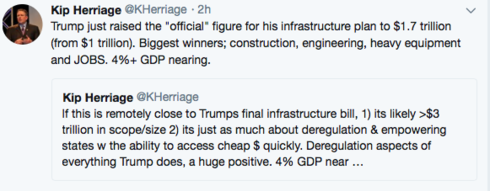

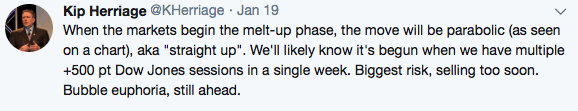

Note: The last 4 days marked just the 3rd time since the election that the VRA System has flashed “negative/correction”. For this pattern to continue, we should see a reversal higher in the next 1–2 trading days. If not, this will mark a pattern change, which could signal something larger than just a ST pause lies ahead.

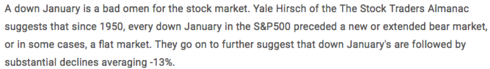

As goes January, So Goes the Year. From the Stock Traders Almanac:

Conversely, a strong Januarys signals “high odds” that the full year will close higher. My year end target for 2018 continues to signal 30,000+ on the Dow Jones (or 14% higher from todays prices, minimally).

Still, its a market of stocks…

Booming January Jobs Data.

This mornings January employment report showed 200,000 new jobs created, beating estimates by roughly 10,000, with the official unemployment rate at 4.1%. But the real kicker was wage growth, which powered to an 8.5 year high. Wage growth grew a big 2.9%, beating estimates by a country mile. This is what a strong economic recovery looks like…this is also how we get back to 4%+ GDP. In fact, this weeks Atlanta Fed’s estimates for Q1 were a shocker even to me, with an estimate for first quarter GDP hitting 5.4%. We’re seeing hard core evidence of what a Trump economy looks like…just imagine what he might be able to do over the next 7 years.

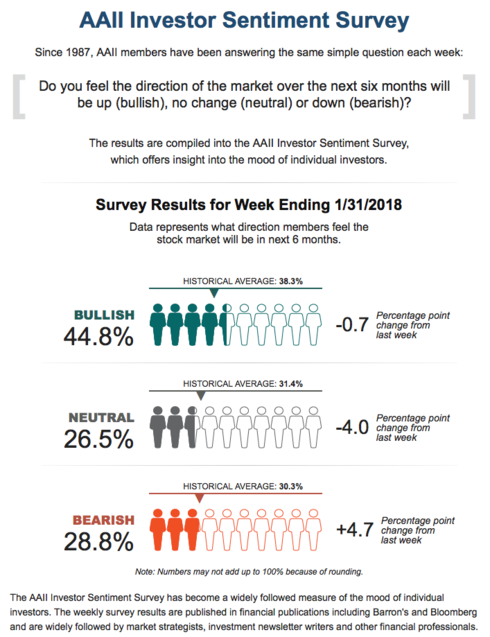

But even range expansion bull markets need to take a breather. As we covered yesterday, if the entire year were to follow Januarys lead, the market would finish the year with gains of up to 70%. Just not gonna happen…hence the overbought pause from time to time, always necessary to remove excessive optimism and stow some fear back into the market. Fear is beginning to show up, as seen in this weeks AAII Investor Sentiment Survey.

Bulls at 44.8%, bears up 4.7% to 28.8% with neutral investors still at a high reading of 26.5%

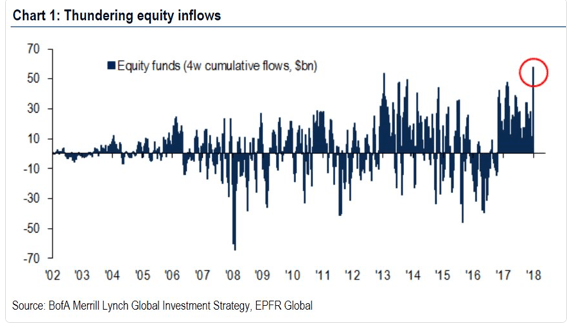

I’m looking forward to next weeks readings….I can almost guarantee you that bearish readings will surge by double this weeks 4.7% gain, following the sell-off of this week. Remember, especially for our newer members, until the AAII survey shows bullish readings of 60%, for weeks on end, there will be no signifiant top in this bull market. I’ve followed this survey since the late 80's…highly reliable. We have yet to see investor euphoria in this market, certainly not from the retail investor. Just last year I was reporting that investors actually in the stock market had hit 19 year lows. Without question, the public is falling back into love with stocks…but that’s a process that will take years to play out.

Think of it this way; when most every market guru is predicting Dow Jones 50,000, we’ll know its time to reverse my bullish viewpoint. We’re not there…not close. This is the power and importance of investor psychology, both as a short term and long term indicator. These are the lessons my mentors taught me some 30 years ago. I don’t see them even going out of style.

But again….it doesn’t mean that we won’t have corrections. Stock market corrections are necessary to the health of a long term bull market. Trees don’t grow to the sky.

Rising Interest Rates Causing Concern

A primary boogeyman, according to those that are bearish, is that rising rates will suffocate the stock market. While its true that the move higher in rates (10 year) has accelerated, with the 10 year yield hitting 2.72%, my view remains that rising rates are a natural end game from an economy that is picking up speed. Perfectly natural.

We can see the fear in this one year chart of XLU (utilities ETF), which has crated some 14% since its November highs. Utilities are the largest borrowers of money in the country, which explains the move lower. Pretty ugly chart, yes? But keep reading…

Now, take a look at another chart of XLU…this time the 8 year chart. Here, this correction looks perfectly normal, taken into broader context. Interesting…no?

While we’re on the subject of perspective, if you’re on social media like I am, it can feel like we’re living on the edge…so much going on in the world of politics and business…but are things “really” that crazy?

I was too young to remember much of the 60’s, but again, some perspective might be in order. How crazy were the 60's!

State of the Union

Wednesday’s SOTU was off the charts fantastic…of course I say this as a Trump supporter…an early Trump supporter that both predicted his victory in late 2015 and then wrote a book about his winning (that I started 2 months prior to the election). The strength of my conviction.

Dems hated it. We know this because they refused to stand throughout the night. Even for our flag, our veterans, a booming economy, the lowest black/hispanic unemployment, possibly ever. Sickening, frankly. And they wonder why they’ve lost 1031 net national elections over the last 9 years? They wonder why their fundraising efforts are collapsing? But somehow, they think they can take back the House/Senate in this years mid-terms….uhhh…..no chance, not as I see it anyway.

The markets sure like the SOTU. MANY billions in fresh capital will come flooding into stocks (month beginning money from corps, pensions, retirement plans, etc). And the BIGGIE; Trumps tax cuts start showing up in paychecks.

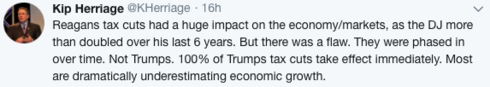

Important Point: Reagans tax cuts caused the DJ to more than double over the last 6 years of his presidency. But Trumps could be even more powerful…I fully expect that they will. Here’s why; unlike Reagans tax reform (where the cuts were phased in over years), the beauty of Trumps tax reform is that its all hitting NOW. No phase in…no waiting…everyone gets to keep/make more today. I cannot overstate the power of this. This is why pullbacks, like the last two days, must be bought.

Biotechs

FYI, I still want to own this group… And our timing looks to have been spot on. Early this week Amazon (with partners Buffet/Berkshire & JP Morgan) announced they are moving into the healthcare industry. Hello….

If you remember the beating that grocery stocks took when Amazon bought Whole Foods, you’ll have an idea of the carnage that may be coming to healthcare/insurance stocks. And, hell yes. Since Obamacare was forced on us, our insurance costs have skyrocketed while healthcare/insurance/hospital stocks soared at the same time. Gee…wonder is there’s a connection here? Bottom line; I am perfectly fine with Amazon running our entire US healthcare industry. I know this kind of blanket statement sounds a bit insane/stupid, but I also know that when Amazon enters a field, consumer costs plummet while our level of service actually improves. Talk about a win-win.

Until next time, thanks again for reading…please remember to login to your VRA Members Site at least 1–2 times each week to make sure you are positioned properly.

Kip

To receive updates like this Daily sign up to receive two free weeks from the VRA at www.vrainsider.com/14day

Thursday, June 7, 2018 at 10:39AM by

Thursday, June 7, 2018 at 10:39AM by  Kip Herriage -VRAInsider.com

Kip Herriage -VRAInsider.com