VRA Investment Update: We Are Buyers. Ted Parsons, From the Grave. Interview with WAR. BTC & Taiwan. Russia Deja-Vu.

Friday, February 25, 2022 at 9:11AM by

Friday, February 25, 2022 at 9:11AM by  Kip Herriage -VRAInsider.com

Kip Herriage -VRAInsider.com Good Friday morning all.

While everyone was panicking yesterday morning, we were buyers.

We never forget the people in our lives that made the biggest impressions. Professionally, that’s my first mentor Ted Parsons (RIP Ted). Ted’s mentor worked on Wall Street during the crash and Great Depression…even as a clueless 23 year old rookie broker, I understood the significance of that...and its still rare when a day goes by that I don’t hear his voice in my head.

It was Ted that taught me “on first shots fired, sell your hedges and buy stocks”, which was our exact war game plan going into Russia-Ukraine.

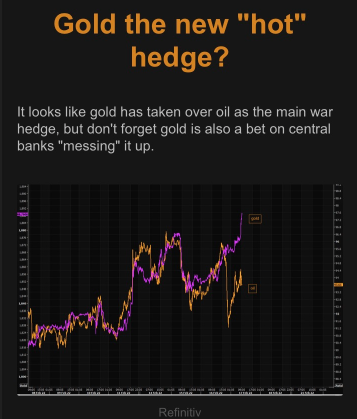

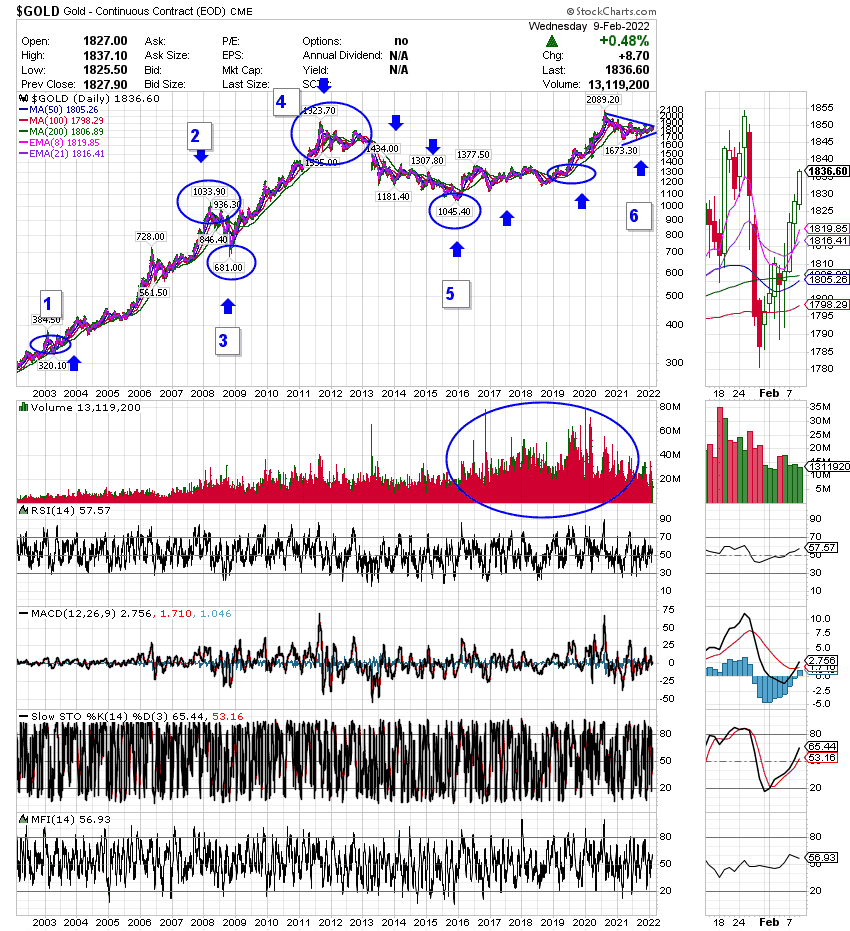

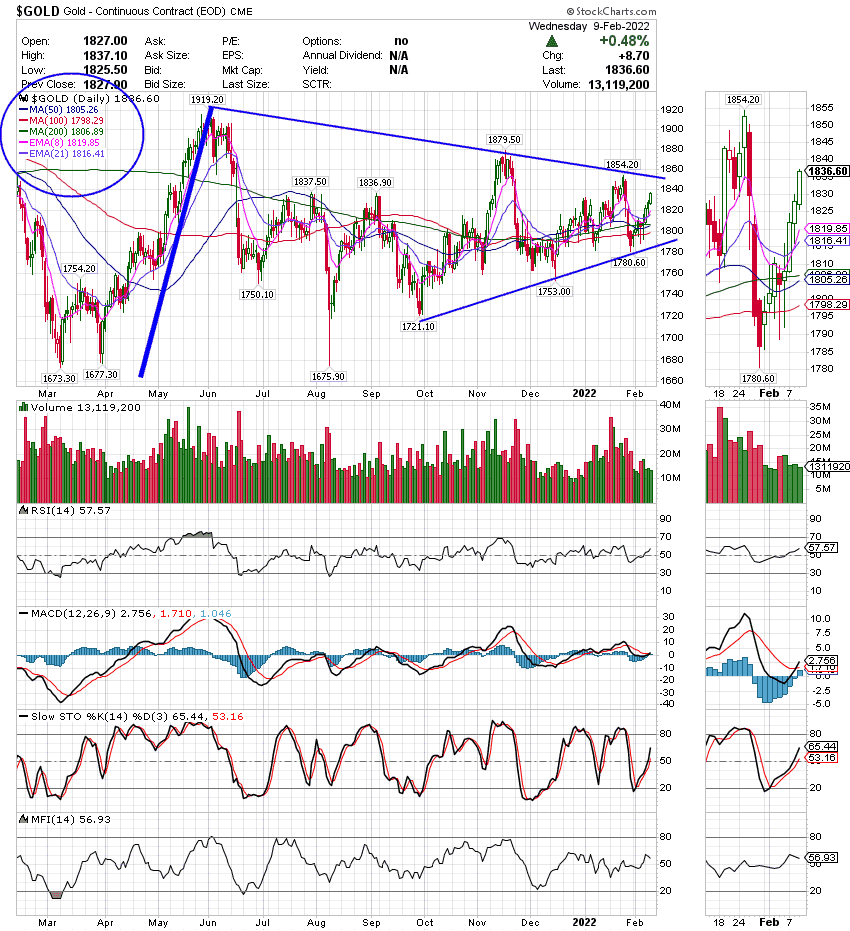

Nasdaq, from yesterdays lows, has now rallied close to 1000 points in just 24 hours. We have 6 positions in the VRA Portfolio that are up between 10% to 22%, over this time frame, plus we steered clear of buying anything tied to a hedge (energy, precious metals, miners, shorts). In Parabolic Options yesterday we booked 230% profits in GDX (gold miner ETF) calls.

Ted, even from the grave, you’re still crushing it.

Next Up: Interview with WAR

I was on The Wayne Root Show last night with our great friend WAR. Wayne follows our work closely here. In addition to being a great friend of almost 20 years, he’s also been a VRA Member for nearly that long. Last night we covered what happens next; Russia takes Ukraine entirely…why wouldn’t Putin conquer Ukraine after Bidens welcome mat (again) and that embarrassing presser from yesterday. Following Ukraine, Wayne and I fully expect China will take Taiwan. And we got into what happens next in the markets and US economy.

LINK: https://soundcloud.com/user-640389393/kip-herriage-live-on-war-now-with-wayne-allyn-root-22422?utm_source=clipboard&utm_medium=text&utm_campaign=social_sharing

Bitcoin, Watch Closely for Signs of China/Taiwan

We covered this chart and price action of Bitcoin as well, with respect to China taking Taiwan. You’ve heard me get into this on our VRA Podcasts. There is no better or faster method for the elite insiders to quickly move massive amounts of liquid wealth out of a country. Does this help to explain these huge moves in BTC?

1) In the chart below we see a 409% move higher in BTC, just before and in the period immediately following the Las Vegas massacre, as Saudi princes were abducted, tortured and their immense wealth pursued by the Saudi king.

2) The next major geopolitical event…CV insanity…saw BTC soar 1540%. No, I cannot explain this…I only see direct evidence that BTC was almost certainly used to move huge amounts of money.

3) And Afghanistan. Beginning a few weeks before the US announced they would be abandoning the country, BTC began to zoom higher, rising some 130% by that November.

We have no direct evidence that BTC soared during these 3 major events, due to the wealthy transferring their money. But, these moves did occur.

And now, following the invasion of Ukraine…with it becoming increasingly likely that China will take Taiwan, BTC is once again on the move….jumping from $34,300 yesterday to $39,200 this AM.

Are wealthy Taiwanese using BTC to quickly move their money of local banks? Would you?

Watching and listening closely…..

Russia-Russia-Russia (RSX and RUSL)

For those that were with the VRA in 2014 you may remember our trades in RUSL (2 x Russia ETF). Between RUSL and RUSL calls we booked net profits of more than 500% in about 3-4 days.

This was when Russia took Crimea.

I'm having deja-vu.

Below is the chart of RSX, the un-leveraged Russia ETF. Its approaching the same oversold conditions from the March 2020 CV insanity lows.

We are working on potential strategies now, but when you check out RUSL you'll see that its fallen from $38 in October of last year to below $7 yesterday.

Credible reports out of Europe; the EU has already told its allies that it will NOT go along with kicking Russia out of the SWIFT system...that would present some pretty frightening downside for the global financial system. In my mind, this was a worst case scenario that WAS possible. Biden, in his joke of a presser, confirmed this as well.

Frankly, Russia will pay a steep price for their actions, but with a debt to GDP of less than .30 (the US is 1.3), and massive commodity assets, Russia will come out of this. And they will have sent a message to the world that additional NATO forces on their doorstep is an error in the making.

BTW, what kind of dirt do you think Putin has on the Biden Crime Family? The leverage here is with Russia...that's my read.

Just introducing you to the idea now but we see some interesting possibilities in RSX and/or RUSL.

Here in the US we remain optimistic

The economy remains strong…corporate earnings continue to grow…and because of the nature of this structural bull market, it’s been my view that the two things the elite need to keep their constituency in line…a strong economy and stock market…will continue to hold up.

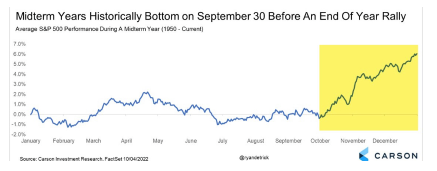

This remains my view today. We are witnessing a market correction…one that is (as of today) taking each broad market index into "extreme oversold levels" on some of our VRA momentum oscillators (stochastics).

And importantly...

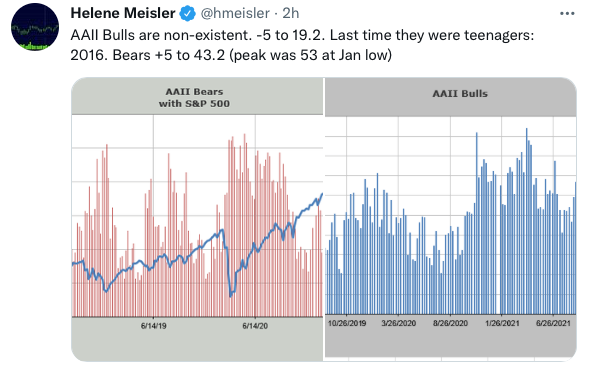

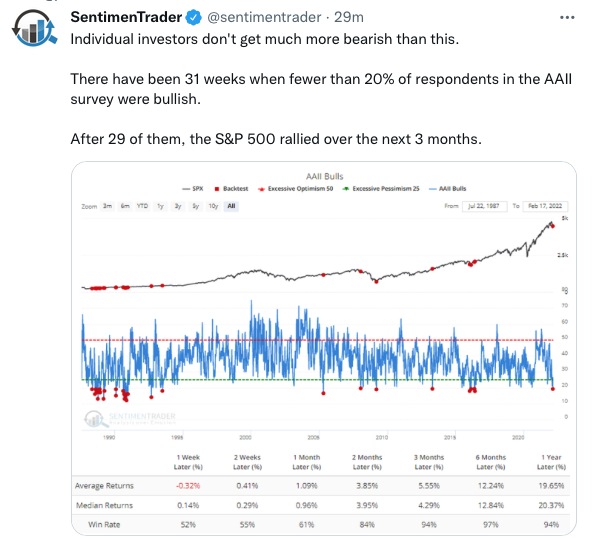

- We know from investor sentiment, like the AAII survey, which hit 19% bulls last week (it may be 15% this week), that this is the time to be a “buyer”…not a “seller”.

- We know that the markets actually “rise” on early rate hikes…not “decline”.

- We know that we have a wall of worry that is now solidly “fearful”.

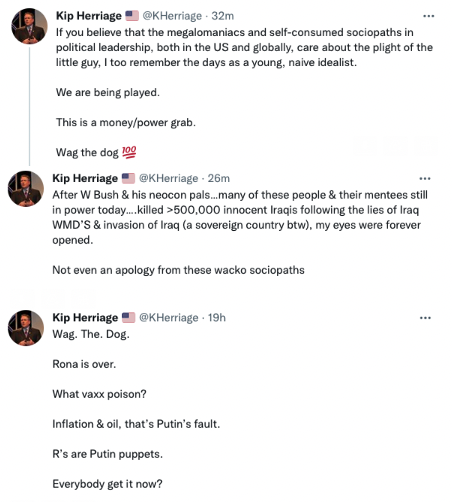

Our focus is on the markets and VRA Portfolio positioning, but I can’t help but find these times so beneath what the great people of this country deserve.

Yesterdays Biden presser was embarrassingly awful, even for him. Freedom, my ass.

Will the left ultimately view Putin as they view George W Bush today, with love and affection?

Until next time, thanks again for reading…

Kip

Join us for two free weeks at VRAInsider.com

Sign up to join us for our daily VRA Investing System podcast