VRA Market and System Update. In Memory of Pearl Harbor. November Employment Data Soft. NewsMaxTV Interview.

Friday, December 7, 2018 at 1:40PM by

Friday, December 7, 2018 at 1:40PM by  Kip Herriage -VRAInsider.com

Kip Herriage -VRAInsider.com Good Friday afternoon all and what a week it has been. Markets were closed this Wednesday for the DC memorial of former President George HW Bush, and today we remember the attack on Pearl Harbor and the 2400 American lives lost. I had not seen the video below until today. If you’ve visited the memorial site in Hawaii you know what a moving experience it is. Thank you to all of our military veterans, past and present, and to those that made the ultimate sacrifice. We’ll never forget you.

https://twitter.com/ArmyChiefStaff/status/1071030062839848960

The November jobs report is out, with a slight miss to estimates of 155,000 jobs created and an unemployment rate of 3.7%. As far as the markets are concerned, it looks like a Goldilocks number. DJ Futures were -180 this morning…went positive... now back down this afternoon.

The furious rally higher yesterday, from -800 to -78 at the close, came on the backs of the news we’ve been expecting here, as the WSJ broke insider news from the FED that they will take their boot off the threats of the US economy and will “review their previous rate hike plans, going forward”.

We’re still likely to get this months hike…but next year is a different story. The pattern of “higher lows” we’ve been talking about here is still intact. We look to have just had a double bottom.

And this news was barely covered yesterday…doesnt fit the MSM narrative. Real progress is being made between the US and China. Obviously, a big plus for US and global markets.

One of our biggest macro themes has gone like this; the global reset occurring today…from China trade and business policies to the global transition from globalism to nationalism/populism…is a MAJOR long term positive for both the US and global economies/markets.

This reset is setting the stage for a global boom, with the US leading the way. This is a fundamental reason that we have remained positive on the markets, along with readings from the VRA Investing System, which today sits at 8/12 screens positive (gotta get back over 200 dma in our major averages).

TV Interview with Wayne Allyn Root

Last night I had the opportunity to go on WAR NOW with Wayne Allyn Root to discuss this weeks volatility, to get my full take tune in here. My segment begins at 23 Minutes

https://www.newsmaxtv.com/Shows/The-Wayne-Allyn-Root-Show

Bearish sentiment

After Tuesdays 799 point loss in the DJ the bears seemed to come out in full force. The culprit (according to MSM) is the arrest of Chinese tech behemoth Huawei CFO in Canada (with extradition requested to the US). The comparison being made is this would be the equivalent of Apples CFO being arrested by China….aka, not exactly great news for already strained US-China relationship.

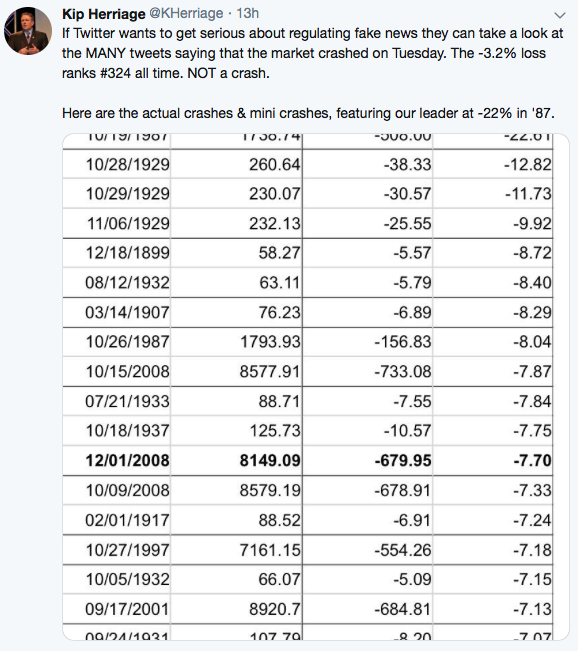

Now, the bears are growling, calling Tuesdays 799 drop a “crash”…except that it was not, as I prove in this tweet from yesterday. Lotta fake news out there…

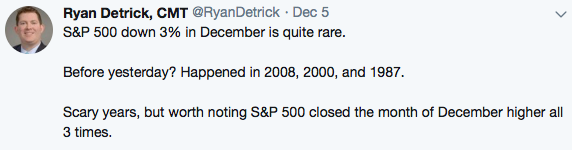

And this from Ryan Detrick, a solid follow with LPL. 3% losses in December are rare…but not the kiss of death by any stretch.

Its important that the DJ level of 24,122 holds…thats the 10/29 lows. We closed at 25,027 on Tuesday and 24,947 yesterday. Market bottoms are typically ugly and a bit scary. Thats what I believe this will prove to be.

Until next time, thanks again for reading…have a great weekend

Kip

Experience the Vertical Research Advisory free for 2 weeks!! For a limited time we are offering a 2 week free trial to the Vertical Research Advisory, visit vrainsider.com for more details.

Since 2014 the VRA Portfolio has net profits of more than 2300% and we have beaten the S&P 500 in 14/15 years.

For our latest free updates tune in to our daily VRA Investing Podcast atVRAInsider.com or subscribe to our free blog at kipherriage.com

Reader Comments