VRA Weekly Blog Update: The Next Leg Higher In Precious Metals and Miners

Thursday, December 12, 2019 at 12:32PM by

Thursday, December 12, 2019 at 12:32PM by  Kip Herriage -VRAInsider.com

Kip Herriage -VRAInsider.com Good Thursday afternoon all. For today’s update, we want to get into PM’s and miners.

PRECIOUS METALS AND MINERS

For our newer VRA Readers, a quick trip down memory lane. In our second ever VRA Update (2003) we recommended gold and silver, which were coming out of a brutal 20 year bear market. Gold was below $400/oz and silver was below $5/oz.

Over the next decade we crushed this group, over “many” trades. Our best was 1300% 10 month profits in Ivanhoe Mines (now Turquoise, TRQ). It wasn’t all roses….we were also crushed in NUGT and JNUG, giving up big gains and riding it into big losses, after QE “mysteriously” bombed gold prices. But bottom line, we have done quite well in this group over the years. Know this group well. And yes, I am a gold bug.

The fundamental side of the story is well known. PM’s are the only true currency…for 6000 years. Cannot be printed and hold their value amazingly against inflation. Since the FED was created in 1913, the USD has lost 94% of its value, while you can buy exactly what you could have in 1913 today with the same amount of gold. Today, with more funny money floating around than ever and a world that is locked in to negative rates, owning gold and silver here makes more sense than ever.

Bank on this; not only is inflation returning…its already here. If you pay for housing, college, healthcare or any of the gazillion new and hidden taxes we’re increasingly forced to pay, you know that the cost of living has never been higher. Currency inflation will not decrease…likely not ever in our lifetimes. Gold is a must own asset for the smart money investor.

The pariah for PM’s has been “manipulation”. Spend a few minutes getting to know GATA.org, if you don’t already know this story. They’ve been fighting the good fight against the JPM’s of the world since just before I met them some 20 years back. It’s the one downside story for PM’s that remains our biggest risk. The banking cartel has had this game wired. But, that may be changing…another story for another time.

After a great start to the year (gold was +27% by September and GDX was +47%) the group has been trending lower the past 3 months. We believe the next move higher is nearing. This is a highly seasonal period (now til March). And we see two charts that are of interest. Many think that if rates are rising, that must be bearish for gold prices.

This is a fallacy.

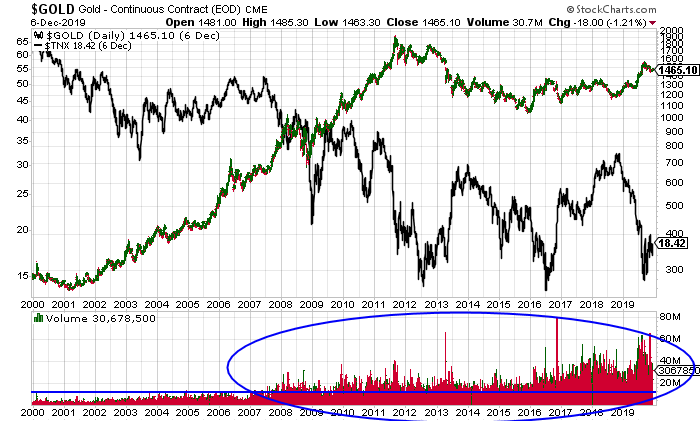

As this 20 year chart of gold to 10 year treasuries shows, there is actually a small correlation between gold and rates. We’ve had bull markets and bear markets in both scenarios. There is just a 28% correlation between gold and rates, over the past 20 years.

What this chart also makes clear is that we’ve had an explosion in volume over the last decade.

In fact, its picked up speed over the last 3 years. Volume begets price movement…a timeless truth as taught to me by my mentors.

We want to see a move back through $1500/oz. The rounded bottom you see in this chart…its been developing for 8 years now…it should send gold to new ATH. $2000/oz + is coming.

Below is a 4-year chart of GDX to gold….our top timing signal. The miners lead gold…in both directions. This is where the leverage is (similar to oil to energy stocks). We went aggressively long PM and miners at that circle you see below in 2016. That marked the first rate hike since the ’08 crisis. (as we just covered, gold in fact does rise when rates rise). The miners led the way straight up for 9 months…massive gains in the miners. The repeating pattern is marked below as well. The miners tend to make explosive moves higher coming out of mini-rounded bottoms, just like we’re seeing right now. Over the past 2 months, the miners have been leading gold. We want to see GDX break $28.50 with velocity…last trade here $27…then new highs of $31, then much higher, look likely.

The next leg of the Precious metals and miners bull market looks to be kicking in.

Following the Fed meeting yesterday that contained no real surprises (no rate increases on the horizon), the group is taking off. Gold and silver both spiking 1–1.5% yesterday, but as always the action is in the miners.

One step at a time, we want to see gold break $1500/oz (1482 today) and GDX break $28.50 ($27.75 today), which should then lead to new 52 week highs, and we are watching volume in both continue to ramp higher. We believe this is the beginning of the move that takes gold to $2000/oz. We’ll make fortunes in this group.

Until next time, thanks for reading…

Kip

Since 2014 the VRA Portfolio has net profits of more than 2300% and we have beaten the S&P 500 in 15/16 years.

Join us for two free weeks at VRAInsider.com

Sign up to join us for our daily VRA Investing System podcast

Reader Comments