The Rise and Fall of Japan, Echoes of China Today. VRA Market and System Update.

Thursday, May 9, 2019 at 10:40AM by

Thursday, May 9, 2019 at 10:40AM by  Kip Herriage -VRAInsider.com

Kip Herriage -VRAInsider.com Good Thursday morning all. All eyes are on US-China trade talks in DC, where Trump has announced that beginning Friday, tariffs on $200 billion in Chinese imports will rise from 10% to 25%.

Frankly, this amount is not a big concern. Think about it. Should the tariffs increase, the total amount raised annually would equal just $30 billion. Sound like a lot? It’s not. China’s total annual GDP is $13 trillion.

Of course, the bigger issue is what happens next. Would Trump actually move forward in introducing additional tariffs of 25% on an additional $300 billion in Chinese imports? If so, then we’re getting into the ballpark of an actual trade war. But as we’ve said…consistently…since early 2018, thus far we’ve had something more like a trade tickle with China. At least that’s how the US has been impacted.

But in China, the pain has been much, much more real. Consider that (according to AP this morning), in coastal cities that ship electronics parts to the US, revenues are down some 40% in just the past year. Now that is REAL pain. There’s no way that these kinds of income losses don’t scare the sh*t out of Chinese leadership.

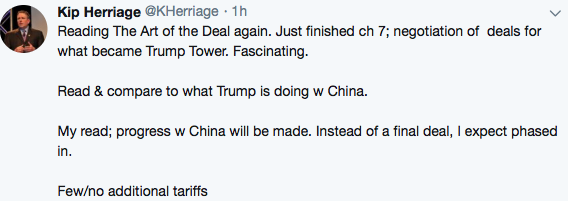

VRA Bottom Line: Trump is a hard-nosed negotiator but he’s also a pragmatist that wants the US economy and US stock markets to continue to lift off. It’s our continued view that a full-blown crisis will be averted this week. China acted almost exactly as the same rogue country when they were being admitted into the WTO in 2001. They backed out of previous commitments going into the final week of negotiations…just as they’re doing here. But at the end of the day, they capitulated and became a full fledged member of the WTO…and their economy soared.

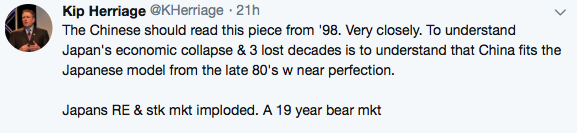

For those that want to understand what happened to Japan in the early 90’s, just as they were thought to be the next global superpower, I think you’ll find this 1998 article from the Cato Institute most interesting. There is zero chance that China has forgotten Japan’s meltdown. The question is, will they egos allow them to change course in time to avert a similar fate?

“The revisionists claimed to have discovered a new and superior form of capitalism: the Japanese capitalist developmental state. Today, however, the Japanese model is better known as “crony capitalism,” and its manifest failures are causing economic pain and political turmoil up and down the Pacific Rim. The revisionists argued that the United States was doomed as a leading economic power unless it adopted Japanese-style practices. It didn’t and is now enjoying spectacular and unrivaled prosperity.

In short, the revisionists’ doom-and-gloom prophecies could not have been more wrong. All their errors trace back to a common source: an inability to understand and appreciate the power of free markets. Suffering from what Nobel Prize-winning economist F. A. Hayek termed the “fatal conceit,”87 they believed that a handful of government planners could outthink millions of private decisionmakers — could pick “strategic” industries, allocate capital in defiance of market signals, and prop up the stock market and real estate values. Like so many others before them, they prided themselves as sophisticated realists, yet in fact their faith in bureaucratic miracles was hopelessly naive. Only a few short years were needed to burst their bubble.”

Know a Couple of Things

1) In my opinion, if you’re considering selling, you are clueless about the underlying strength of the US economy and US bull market in stocks. Again, in all candor, if you are selling into this then you should probably do anything other than invest in equities (unless you are a short term trader).

The smart money move here is to do one thing and one thing only….BUY.

2) The US does not need China. We just don’t. Frankly, not for much of anything. In fact, I can make a strong case that US GDP would skyrocket to 5%+ inside of 12–18 months, without China’s theft and cheap manufacturing that robs US jobs and US GDP. The US would suddenly self produce everything that we import from China. Yes, these items would be more expensive…for at least a short while…but the US economy and US stock markets would explode higher, on the backs of economic production.

But man oh man, the coin flip of that argument looks quite a bit different. Without the US, China would fall into a decade + long depression. Civil war would quickly ensue. It would be game over for the current regime in power. The Chinese economy relies on US buying power to such a degree that it “mandates” that China get a trade deal done with Trump.

So yes…I look for a deal. Again, I look for it to be phased in. But it will also require immediate changes to China’s criminality. Trump owns China. Not debatable.

If you’re not following me on Twitter, why not? You wouldn’t have to wait to see some of my tweets here. Come join me @kherriage!

— -

VRA MARKET & SYSTEM UPDATE

The VRA System continues to read 10/12 screens bullish. No change since late January. This means that we continue to use monthly dollar cost averaging to add to positions. With the best US economy in 50 years and with our targets pointing to a doubling in the stock market over the next 4–5 years, pullbacks must be bought.

We also saw something interesting in the internals yesterday. With the inherent risks and fear that we’re seeing, our VRA Market Internals were positive across the board. Advance/decline, up/down volume and new 52 week highs/lows were all green. A trifecta of positivity, even as the public sent the put/call ratio to 120% (highest since January).

In addition, each broad market US index has worked off its overbought readings. No, we have not reached heavily or extreme oversold, but I’ll frankly be surprised if that should happen.

Bitcoin: THE Market Tell

As we’ve discussed here for some time, Bitcoin has been THE “risk on, risk off” market tell for well over two years, leading equities sharply higher (into the ’18 top), then lower, and finally, bottoming in mid-December of last year. Bitcoin continues to rise, hitting $6000 again yesterday. This repeating pattern bares watching. Should Bitcoin reverse lower, it will send us a warning sign that “risk off” could be returning. So far, so good.

And I find it most interesting that gold is only fractionally higher for the week. If this was the start of a serious global trade war, we would see the fear showing up in gold. Just not happening.

Until next time, thanks again for reading…have a great week.

Kip

Since 2014 the VRA Portfolio has net profits of more than 2300% and we have beaten the S&P 500 in 15/16 years.

Sign up to Join us daily for our VRA Investing System podcast

Learn more at VRAInsider.com

Reader Comments