VRA Investment Update: J Powell, the Embarrassment. Is The Bear Market Over? R's Are Surging!

Thursday, November 3, 2022 at 11:17AM by

Thursday, November 3, 2022 at 11:17AM by  Kip Herriage -VRAInsider.com

Kip Herriage -VRAInsider.com Good Thursday morning all. If you were as confused as 99% of Wall Street and the English speaking people of the world were by Fed Chair J Powells presser yesterday, where he reverted to previous form and crushed the stock market, I encourage you to listen to Tylers podcast from yesterday afternoon: https://anchor.fm/podcast-c2cff90/episodes/VRA-Investing-Podcast---Tyler-Herriage---November-02--2022-e1q55gc

No J Powell, you are not Paul Volcker. You are instead an embarrassment to the office that you hold.

The Fed statement held important clues and once the markets saw this in the Fed’s written statement, a near immediate 400 point rally in the Dow Jones kicked in; “we will take into account the affects of cumulative rate hikes and the lag effects of our inflationary indicators”. That sounded very much like a “pivot” to a data dependent, common sense approach to Fed policy.

But then the money printer in-chief started talking and to this observer it sounded very much like someone that deliberately wanted to take the air out of the room and indicate that the Fed was going to be anything but data dependent. Powell’s hawkish stance screamed “we don’t care what we break…and we’re just getting started”.

But know this; I’ve done this too long to believe the Fed about much of anything. They are deceivers, liars and frauds. Ron Paul nailed it 30 years ago….”we must end the Fed”.

Here’s What The Bank of England Just Said….

“If the market's expectations are right (about much higher rates) we are going to have a two-year recession”. The BOE is saying that the market's expectations are wrong. J Powell, are you listening??

Here’s what I expect; just over 1 year ago the Fed told us “inflation was transitory”. They were adamant about it…and they could not have been more wrong. How embarrassing.

They’re going to be wrong again. That’s my call. And here’s how we’ll know.

The Fed never leads….they always follow. Always.

And here’s what the Fed will be following; the 10 year yield. As can be seen in this 30 year chart, each time the 10 year has hit its upper trend line it has then reversed lower. Frankly, this chart is even more powerful when you zoom back to 1980, but I doubt that it will matter much. Rates will soon head lower…and the Fed will follow the 10 year yield lower.

To be clear, the Fed’s future interest rate decisions MUST be data-dependent, as even Powell has insisted in the past. Monetary policy is hard to predict merely because the future is so uncertain. The trouble is, Powell seems to forget his uncertainty once he gets in front of a microphone. The truth is, he is more confused than just about anyone in the room. Watch.

Final point about Powell’s presser; does this guy detest Joe Biden and the Dems or what?! Just 6 days before the midterms the Fed chair destroys the markets and kills what was shaping up to be one-helluva melt up into the midterms, a rally that would have almost certainly helped the left get more votes. I find this very interesting…the Uniparty and elite ruling class typically protects their own.

A Chart That Matters

Wall street insiders (that we respect) are pointing to this chart of the S&P 500, compared to the massive bear market rally of 1962 (I also like this comp because its the year of my birth).

You can see the chart has matched up fairly well this year and if it continues to play out it will mark a further move higher in the SPX to 4500–4600, or an approximate 18% higher from here.

Is The Bear Market Over??

Our forecast remains unchanged…a sharp “bear market rally” move higher (featuring short covering) into the midterms (at minimum) which will likely extend into year end and into Q1 2023. With the combination of deeply bearish sentiment (contrarian buy signal), seasonality (the calendar says “BUY”) and overwhelmingly bullish analytics (post-midterm data and more), this should be a good time to own stocks.

We believe we have 4 “tells” that point to the near-term lows being in place. Signs that point to a sharp rally into midterms/year end (and into 2023):

1) Analytics: the most compelling data of my career; “Since 1950, in midterm years, the S&P 500 has had an avg gain of 32% from the midterm lows over the following 12 months (with the markets higher 18 of 18 times). Add that with a divided congress and lame duck Biden, the markets should soon get their wish for gridlock in DC. There’s little more that the markets love than DC gridlock.

2) Seasonality: November is the best month of the year in the midterm cycle and Q4 is the best quarter in the midterm cycle.

3) Market Internals and Technical Buy Signals; 10/13 “CPI Capitulation”, featured a bullish engulfing candle for S&P 500 and two breadth thrusts (>90% up volume in both NYSE and Nasdaq…rare!)

4) The semis are leading. When the semis are leading the way higher it pays to be aggressively long stocks.

Portfolio Note: While we remain in a bear market (and below the 200 day moving averages) we will continue to look for trading opportunities in our selected ETF’s (using the VRA Investing System for timing) while using market weakness to dollar cost average each month into VRA 10-Baggers, our top ranked growth stocks with the potential/promise to produce gains of more than 1000%.

And yes…now is the time to be adding to your holdings in physical gold and silver.

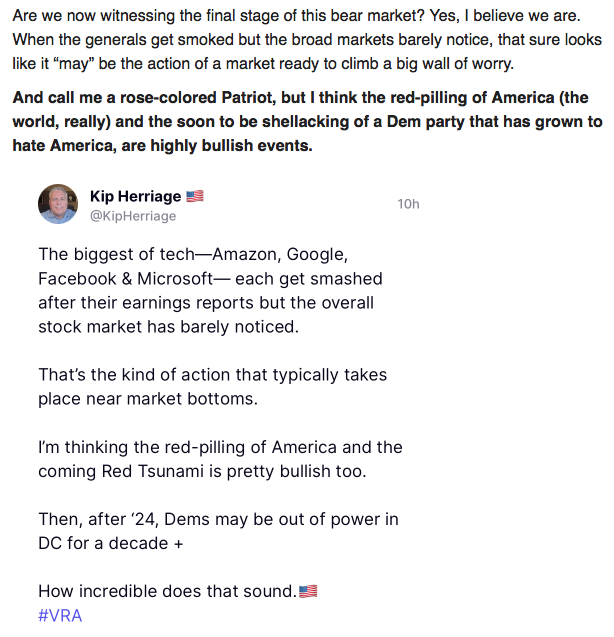

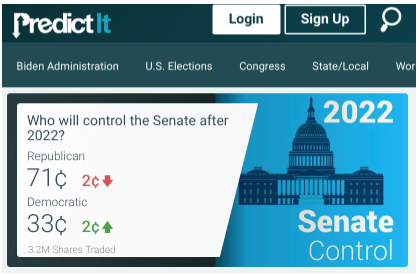

Midterm Update: The Betting Sites Are ALWAYS The Most Accurate

PredictIt has R’s with their highest lead yet in the race for the Senate

Just So We Stay on Track and Keep Our Eyes on the Prize (immediately after midterms). Go ‘Merica!

#Nuremberg2

Until next time, thanks again for reading….

Kip

Join us for two free weeks at VRAInsider.com

Please join us each day after the market closes for our Daily VRA Investing Podcast!

Sign up for email alerts @ vrainsider.com/podcast

Also, Find us on Truth Social and Rumble

Reader Comments