VRA Investment Update: AAII Sentiment Survey Shocker. Excellent Market Action, Internals. The Breakout in Miners Continues.

Thursday, April 14, 2022 at 9:48AM by

Thursday, April 14, 2022 at 9:48AM by  Kip Herriage -VRAInsider.com

Kip Herriage -VRAInsider.com Good Thursday morning all. Don’t Forget: The markets are closed tomorrow for Good Friday.

Two big developments: last night the AAII Investor Sentiment Survey came in at just 15.8% bulls, one of the 5–6 lowest readings on record. I’ve voted in this survey since the late 1980’s and yes, I voted bearish for this weeks survey. Sentiment ultimately catches up with all of us. Folks, an important market low is either just around the corner or is already here.

Then one hour ago, Elon Musk made an offer to buy Twitter for $54.20 in cash, stating that he intends to take the company private. As I wrote to our member’s earlier this week, I expected Musk to make a play for the company, just not this fast. And taking Twitter private is a genius move. But, his $54.20 offer will not get the job done. Musk will likely be forced to raise his buyout price.

A bidding war wouldn’t surprise me…I half expect it. The elite ruling class/deep state will not like the idea of the planets de facto town square falling into Musks’ hands and once again welcoming free speech. If someone else makes an offer for Twitter, know this; that person/company will not be a friend to democratic institutions…they will be connected to the deep state.

BTW, this creates massive opportunities for VRA 10 Bagger Trump Media (DWAC). One, the valuations for this sector will increase sharply and two, if Twitter is going private, guess who that leaves as the best game in town among public social media co’s? This is big time bullish news for DWAC…absolutely own this stock here.

AAII coming in last night with bulls down 9% to just 15.8% and bears up 7% to 48.4%. As many are pointing out this AM, these bullish readings did not even get this low during the financial crisis, nor during the depths of CV insanity. 15.8% bulls is a shocker.

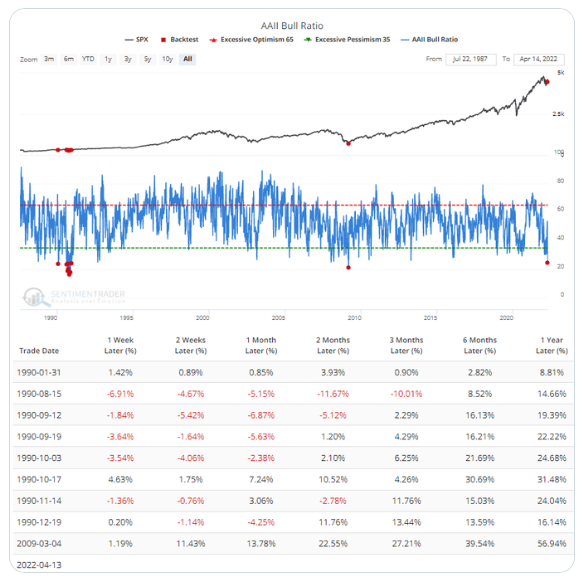

What does it mean? Sentiment Trader is out with this chart (below), showing what happened in the S&P 500 when readings dropped below 19% bulls. The next 1 week to 1 month is spotty to bearish, but then the tide turns. From 3 months to 1 year later the markets are consistently and solidly higher, in close to 100% of the cases. 1 year later the average gain is 24%, with the S&P 500 higher 100% of the time.

We’ve yet to see these kinds of extreme sentiment readings in the other sentiment surveys that we track, but they are certainly trending in that ‘heavily bearish” direction. Again, its not possible for us to be overtly bearish with AAII readings like this.

Yesterdays trading was “impressive” all around. The markets finished at the highs of the day, with internals that were garlic strong. A follow through day today is important.

The Breakout Continues!

Precious metals, and especially the miners, look to be building a head of steam. This is what the beginning of a powerful breakout looks and feels like. If you’re a bit older like me you might remember the bull market from 2003 to 2011 for this group. Based on my memories and the data we’ve been sharing here in these pages, I believe this is equivalent to 2004. If I’m right, every pullback must be bought…and don’t even consider taking profits.

GDX hit another fresh 18 month high yesterday, as the miners continue to significantly outperform both gold and silver. Bullish tell. Next up, if this group follows historical trading norms, both gold and silver should soon get legs (they follow the miners).

On a technical note; gold, silver and miners (GDX/NUGT) have yet to hit overbought levels on the VRA System and each of our VRA buy rec’s in this group remain a buy. Definitely keep buying.

Finally, and I’m still stumped by this, the trading volumes for this group remain on the low side. With 2 hours to go, just 15 million shares have traded in GDX. This will change at some point…how does it not? And when it does, I expect to see a parabolic move higher.

Until next time, thanks again for reading….

Kip

Please join us each day after the market closes for our Daily VRA Investing Podcast!

Sign up for email alerts @ vrainsider.com/podcast

And check Out Our Latest (now daily podcast!) Videos on Rumble

Reader Comments