VRA Investment Update: The Bear Market Rally We've Been Waiting For. Welcome to Unlimited QE.

Friday, July 22, 2022 at 10:45AM by

Friday, July 22, 2022 at 10:45AM by  Kip Herriage -VRAInsider.com

Kip Herriage -VRAInsider.com Good Friday morning all. Another big market comeback yesterday, featuring a Dow Jones that rallied from -350 to close +162, led once again by Nasdaq (+1.4%) and Semis (1.7%) and our new repeating pattern of MUCH better internals. This bear market rally looks and feels like it has the potential to be the first big one that we’ve had to date. The kind of move higher that makes even the permabears start questioning whether the final market lows are in place.

Our view, over the last month, has been:

-Inflation is peaking (looking definite now, but we’re still left with stagflation)

-Interest rates have peaked (almost certainly now)

-The dollar should reverse lower (underway but not a lock)

-Still no (definite) signs of impending recession (that’s a 2023 story)

-Analytics tell us to expect a strong move higher for stocks, into year end (likely the most convincing data of my career).

-Investors are (much) too bearish (still the case, especially among fund/money managers)

-the next big move in the semiconductors will be the tell (up 22% from 7/5)

-gold, silver, miners & energy are buys (explosive moves higher nearing)

Our VRA Strategy Update from June 23rd:

“VRA Strategy Update.

The economy is slowing, inflation is peaking, yields are topping and investors are too bearish. These are my views. If we are going to have the bear market rally that Tyler and I expect, the action of the last two days is pretty much exactly what you’d want to see. A solid day on Tuesday (Dow +640) followed by yesterdays sharply lower open and then sizable rebound. Nothing makes the shorts more nervous than this kind of action.

And each day we get closer to the end of June is a good day. Soon, beginning of month and quarter equity inflows begin. Sizable buying.

At the same time, share buybacks are occurring at record levels and insider buying has flipped to aggressive.

This market should move higher into July. And we have some fresh (and powerful) analytics to back it up.”

* And this was the single piece of analytics that we’ve been most focused on (also from 6/23)…it points to a move higher into year end that could be a rocket-ship:

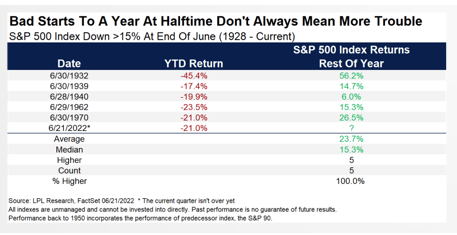

The S&P 500 is down 21% for the year, which would be the worst first half to any year since 1970. The good news is that in previous years we were down at least 15% through June (going back to 1932) we then saw the final six months of the year higher 100% of the time (5/5) with an average return of 23.7% (h/t LPL).

However, trees don’t grow to the sky overnight. This happened a couple of days sooner than expected but as Tyler covered in great detail on his podcast yesterday, each of our broad market indexes (Dow, S&P 500, Nasdaq and Russell 2000) have now reached extreme overbought on our short term VRA Momentum Oscillators. Over the last 18 months +, each time we’ve reached this level of overbought the end result has been a near term reversal lower.

Below we see it in market leader, SMH (Semi ETF), which is at extreme overbought on stochastics and is also hitting a downtrend line that has served as solid resistance going back to the beginning of the 40% collapse in the semis (January). The vertical blue lines show what has happened the last two times that the semis hit this level of ST overbought…near immediate reversals lower.

VRA Bottom Line: what happens next, to both our broad markets (and especially the semis) is most important. Because we have yet to hit “extreme overbought on steroids”, our VRA designation for extreme overbought on all of our momentum oscillators, if the market/semis can continue to move higher…in essence breaking this repeating pattern of the last 18 months…nothing could be more bullish. I’m thinking that this time is going to be different. I think this is the bear market rally that has staying power. The one that makes permabears extra nervous…and forces the shorts to get squeezed. That’s how we are playing it.

More on the TPI (Transmission Protection Instrument) from the ECB:

Tyler also covered the TPI in detail. Yesterday the ECB launched another central bank tool of financial engineering, via the introduction of the TPI. Unlimited QE. Zero transparency. This move from central bankers gave the middle finger to the world, reminding us all exactly who our financial masters of the universe are. We reiterate our forecasts of the last year; by approx 2025, interest rates in the US will be negative. QE will only ramp higher from here. We’re already seeing a collapse in rates in the US, with 10 year yields falling from 3.48% on 6/14 to 2.8% this morning.

And look what’s taking place in Germany, Europes most important bellwether country. Inside of a month 10 year yields have fallen from 1.66% to 1% this morning. The ECB hiked rates to zero percent yesterday but as always, central banks follow, they never lead. Next up, likely by Q1 2023, the ECB will be cutting rates once again. We’re all turning Japanese…just as we have been since 2001, when Japan was the first country to launch QE.

Until next time, thanks again for reading….

Kip

Join us for two free weeks at VRAInsider.com

Sign up to join us for our daily VRA Investing System podcast

Also, Find us on Truth Social and Rumble

Reader Comments