VRA Investment Update: Solid Week That Should Lead to a Powerful Short-Squeeze. Everything is So Bearish That We Must Be Bullish.

Friday, June 24, 2022 at 11:16AM by

Friday, June 24, 2022 at 11:16AM by  Kip Herriage -VRAInsider.com

Kip Herriage -VRAInsider.com Good Friday morning all.

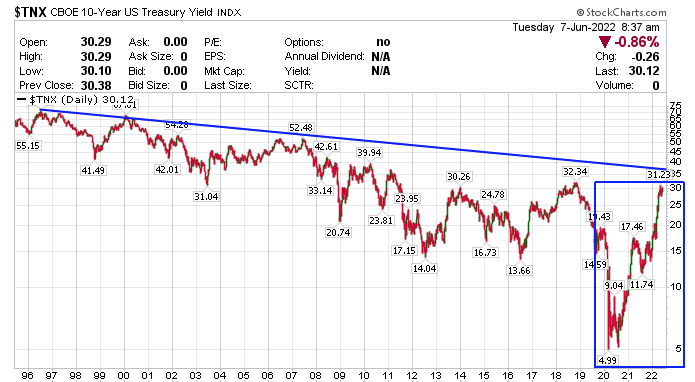

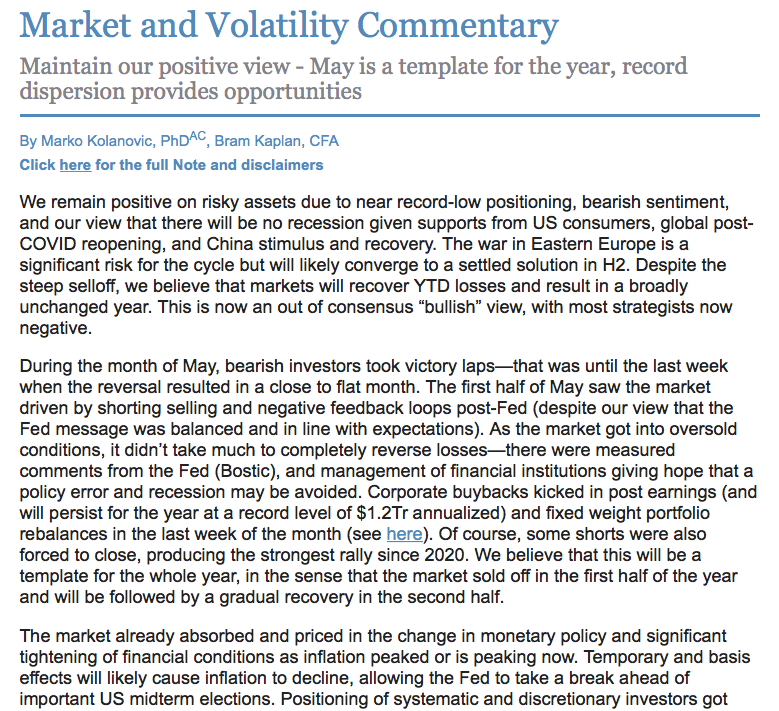

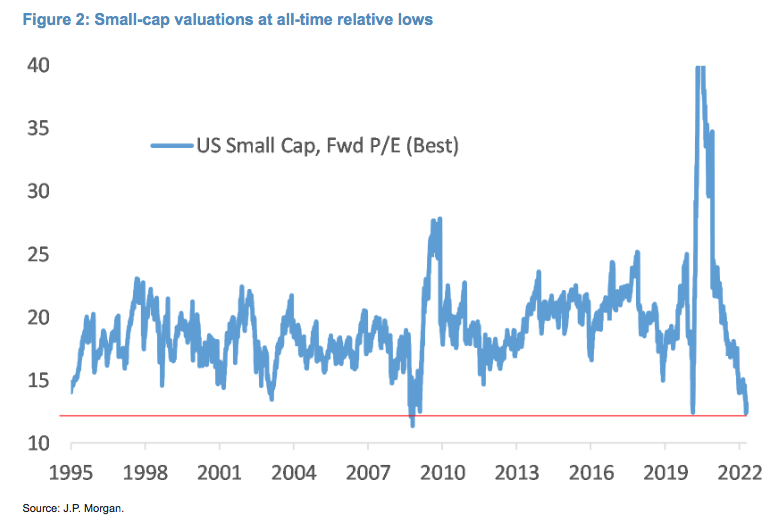

It’s been a solid week for the markets, one that we believe is setting the stage for a strong move into end of month and possibly a mirror image of the first half of 2022. The economy is slowing, inflation is peaking, yields are topping and investors are too bearish. These are my views. If we are going to have the bear market rally that Tyler and I expect, the action of the last three days is pretty much exactly what you’d want to see. A solid day on Tuesday (Dow +640) followed by Wednesdays sharply lower open and then sizable rebound and then yesterdays solid smart money hour which saw each index close at the highs of the day. Nothing makes the shorts more nervous than this kind of action. Seeing follow-through this AM with DJ +220 and Nasdaq +110 in pre-market trading.

Each day we get closer to the end of June is a good day. Soon, beginning of month and quarter equity inflows begin. Sizable buying.

At the same time, share buybacks are occurring at record levels and insider buying has flipped to aggressive. Saying goodbye to the worst month of year in the midterm election cycle might just be a welcome sight for our stock market.

This market should move higher into July. We have some fresh (and powerful) analytics to back it up…

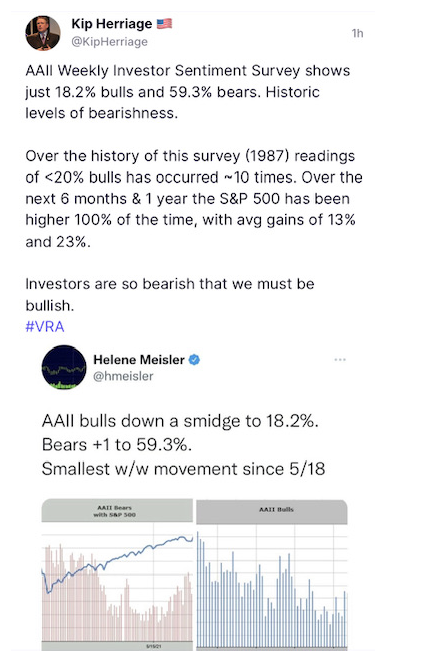

First, this weeks AAII Investor Sentiment Survey from last night shows just 18.2% bulls and 59.3% bears. This marks back to back weeks with historically bearish readings.

Readings of less than 20% bulls has occurred just 10 x since 1987 and the markets (S&P 500) have been higher 100% of the time over the next 6–12 months with avg gains of 13% and 23%.

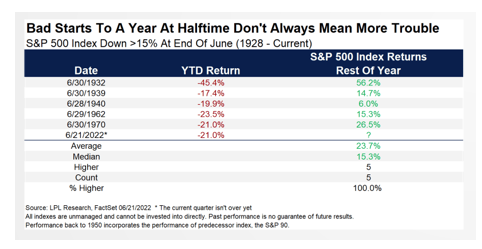

Second, the S&P 500 is down 21% for the year, which would be the worst first half to any year since 1970. The good news is that in previous years we were down at least 15% through June (going back to 1932) we then saw the final six months of the year higher 100% of the time (5/5) with an average return of 23.7% (h/t LPL).

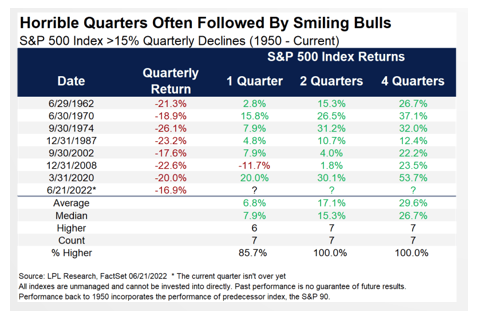

Third, the worst quarters on record are then met with great returns. Going back to 1962 when the previous two quarters were down more than 15%, the next two quarters were higher 100% of the time (7/7) with an average gain of 17% and then higher 100% of the time over the next year with a big 29.6% average gain. (h/t LPL)

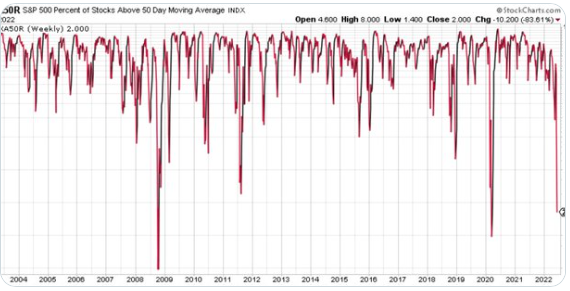

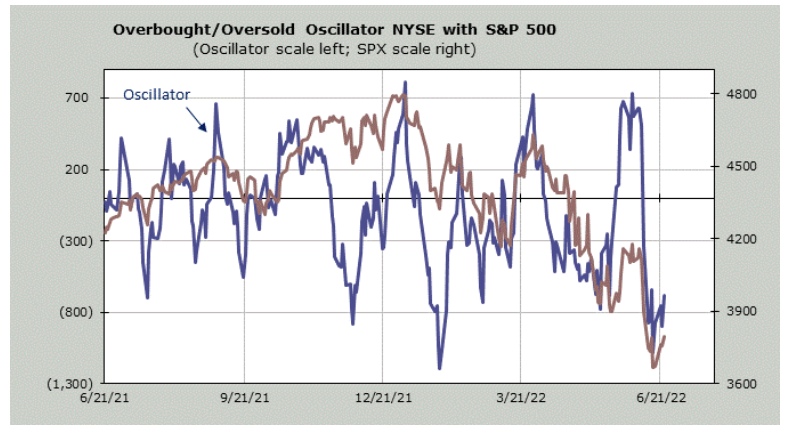

Fourth, as Helene Meisler noted in her update this AM, both NYSE and S&P 500 just reached their most oversold levels since late December ’21, just before the markets rallied 6% over the next 2 weeks.

This matches our VRA System readings of extreme oversold, which we reached last Thursday. This is a near perfect set-up for a powerful short squeeze.

VRA Bottom Line: If there was ever a market facing a “wall of worry” to climb, this is that market. Yes, we are in a bear market and yes, short term moves higher should (likely) be treated as bear market rallies. However, we’ve already fallen 24% in the S&P 500, which is the average bear market decline without a recession. In addition, most stocks have been declining and in a bear market for more than a year with the average stock losing more than 50% in value. This is also our 3rd bear market in 4 years and we should continue to expect everything to keep happening faster, meaning that bear markets can very quickly turned back into bull markets.

I believe most stocks have bottomed, certainly in the VRA Portfolio. As covered above, investor sentiment, analytics and our VRA technicals were so bearish/oversold that we must be bullish.

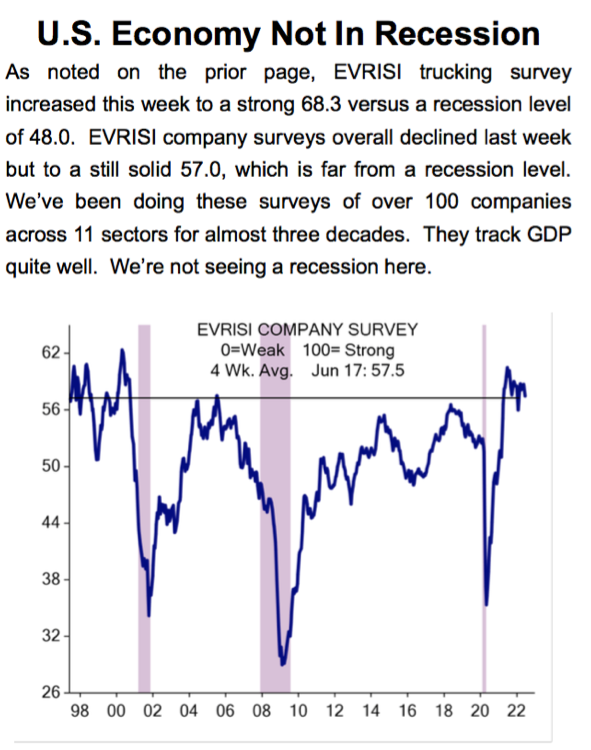

The economic savant at Evercore, Ed Hyman, does not see a recession. Hyman and team, for more than 3 decades, have conducted industry leading surveys with more than 100 co’s across 11 sectors. Historically their surveys have tracked GDP growth well. Their EVRISI surveys are still at a solid 57, which is far from recession level. My view: Biden is a horrible president and is working against America’s best interests. Biden is an enemy to America. America will be in a recession…in 2023. The question is, how serious will it be?

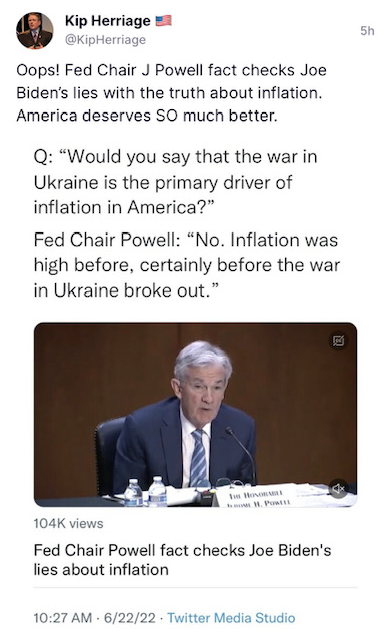

Oops! J Powell fact checked Biden’s “inflation is Putins fault” lies in his congressional hearing this week.

I’d bet serious money that he’ll be forced to “correct” that statement eventually.

Communists don’t like it when you deviate from the official propaganda.

Finally, yesterday I was invited to do an interview with a group of investors that call themselves “DWAC’D”, as in they love Trump Media.

It was a wide-ranging discussion with my latest information on DWAC, as this VRA 10-Bagger heads into the final stretch of completing their merger (which will culminate with a symbol change to TMTG; Trump Media and Technology Group), set to conclude in September.

LINK: https://rumble.com/v19gxf1-dwacd-live-special-guest-kip-herriage.html

Until next time, thanks again for reading…

Kip

Join us for two free weeks at VRAInsider.com

Sign up to join us for our daily VRA Investing System podcast

Also, Find us on Truth Social and Rumble