VRA Weekly Update: ATH Broken Record. Small Caps Are Leading…Next Up. VRA Rate Forecasts. MSM is Waking Up to CV Insanity.

Thursday, August 26, 2021 at 10:02AM by

Thursday, August 26, 2021 at 10:02AM by  Kip Herriage -VRAInsider.com

Kip Herriage -VRAInsider.com Good Thursday morning all. Yesterday marked the 51st record close in S&P 500 this year and another ATH in Nasdaq, as it holds above the 15,000 plateau. And our internals put up another positive day…that’s 4 in a row, which hasn’t happened in several weeks. And this biggie; for the 4th day in a row small caps led the markets higher. How bout that sports fans….just 5 days after hitting the 200 dma and extreme oversold on our momentum oscillators, the Russell 2000 is now leading higher.

Our friends at the Stock Traders Almanac have some interesting seasonal research this AM on the small caps (I first met STA founder Yale Hirsch in 1988 over dinner at Tavern on the Green. Yale is true Wall Street legend….one of the fathers of analytics). STA says small caps should outperform here, have a tough September and then really pick up speed in October, as they melt up into March.

“In the below chart, daily data since July 1, 1979 through August 20, 2021 for the Russell 2000 index of smaller companies are divided by the Russell 1000 index of largest companies, and then compressed into a single year to show an idealized yearly pattern. When the graph is descending, large-cap companies are outperforming small-cap companies; when the graph is rising, smaller companies are moving up faster than their larger brethren. The most prominent period of outperformance generally begins in mid-December and lasts until late-February or early March with a surge in January. This period of outperformance by small-caps is known as the “January Effect” in the annual Stock Trader’s Almanac.

In recent years, another sizable move is quite evident just before Labor Day. One possible explanation for this move is individual investors begin to return to work after summertime vacations and are searching for “bargain” stocks. In a typical year, small-caps would have been lagging and could represent an opportunity relative to other large-cap possibilities. As of today’s close, Russell 2000 is up 13.4% compared to the Russell 1000 being up 19.0% year-to-date. Lagging small-caps and resilient U.S. consumers could be the ideal setup for a repeat of this pattern this year. However, the small-cap advantage does historically wane around mid-September.” — —

Here’s the relative strength chart of small caps (IWM) to S&P 500 (SPY) over the last year. Talk about a tale of two seasons. From last September to March, small caps trounced their large cap brethren. But since the March top, small caps have been battered hard. Here at the VRA, where we own multiple small caps, we are adding to positions aggressively for the next melt up move higher. A rising tide lifts all boats…we see little chance that this bull market continues without taking the small caps with it.

Amazing value in our small caps (to learn more join us free for 14 days at VRAinsider.com)

All eyes are on our money printing rock star J Powell tomorrow as he graces us with his presence at the annual Jackson Hole Wyoming celebration of our financial masters of the universe. Last year at this time the 10 year yield was 1.9% and as our PHD economists (most all employed by the Fed in one way or another) reminded us daily, “without question” the 10 yr was headed to 2.5%…then 3%. Then higher still. Oops!

The VRA forecast remains unchanged.

- Rates will only go lower. This is Obama’s 3rd term (slower growth is “the way”).

-The Fed doesn’t raise rates when a Dem is prez. So it is written, so it must be.

-We’re about to enter the flu season…get ready for mass hysteria fear mongering…which of course sets the table for mail in ballot and drop box vote rigging in next years mid-terms. Rates CANNOT rise during CV propaganda season.

- And continued lower rates will only be a positive for US equities. And if we had to pick a single reason to be hyper-bullish, it would have to be investor sentiment. The AAII sentiment survey sits at just 39% bulls…the fact that it’s not 60% bulls with ATH after ATH is both stunning and fully understandable (the last 20 years have fried our minds…and the last 19 months have charred our souls).

But seeing the Fear and Greed Index at just 37 (fear) just drives the point home even further. This bull market has FOREVER to go.

And even the infamous Martin Armstrong is actually getting positive. Martin agrees with us…R’s will steamroll next year and Bidens reign of cowardess will soon be neutered.

“I know it can get depressing. I really hate this nonsense. But when I look at the charts, all the markets are indicating that this merry band of Climate Change fanatics who has organized the biggest scam in human history over COVID to change the economy suggests that they will FAIL. Yes, there are climate concerns, but those are natural. That is the imminent collapse in the Gulf Stream which will send Europe into a much colder period.

Our Yearly Political Models on the combined Left (House & Senate), have shown Panic Cycles in 2021 and 2023 with the biggest turning point being here in 2021. The numerous Directional Changes also show a conflicting pattern so I do not see that this Democratic Trend is some new direction that would even last into 2024.

When we focus just on the Senate, here we have Panic Cycle in 2022 and 2024 in both the Republican and Democrat databases. So, once more, this does NOT look like this is going to be clear-sailing for Biden. Given his unbelievable handling of Afghanistan, his approval rating fell below that of even Trump. He is now asking for contingency plansbecause like everyone I knew in Washington, on both sides, always had the same opinion. Biden was never a leader. Meanwhile, the Democrats have totally lost their mind proposing a $3.5 trillion bribe they think will secure their election in 2022.

So Cheer up! They will fight hard, but they will lose this battle. Their entire idea of crushing the economy to Build Back Batter is absurd. At some point, even the sheep wearing their masks in the car will wake up when it comes to the loss of their entire future. Resistance is NOT FUTILE! The police in New York City are refusing to comply with these mask mandates and we see similar rejections by the police in Switzerland and Italy.

So Cheer UP! — We are going to win this immediate battle.”

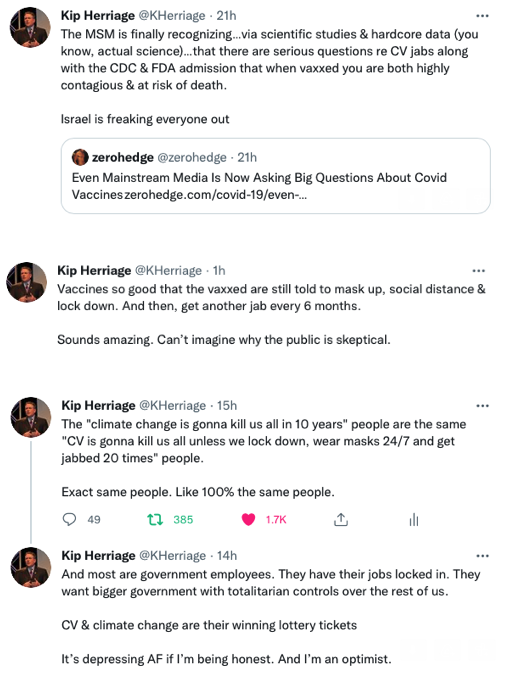

CV Insanity. The MSM is waking up to actual science.

Until next time, thanks again for reading…

Kip

Join us for two free weeks at VRAInsider.com

Sign up to join us for our daily VRA Investing System podcast

Also, Find us on Twitter