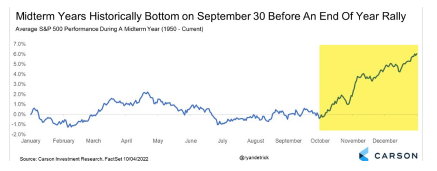

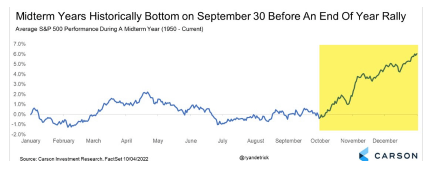

Good Thursday morning all. Not only was yesterday a big up day across the board, with gains of 1% to 1.5% in each of our broad market indexes (small caps led the way, +1.51%. Importantly we had confirmation from the internals, namely in NYSE up-volume, which came in a big 85.6%. Roughly 3:1 positives everywhere else. After Mondays 90% down volume day in NSYE, which looked to us like a clear sign of capitulation, yesterdays stellar readings were ’significant”.

I’ll repeat; Monday’s sell-off, which had the Dow -950 at one point, should mark the lows for this cycle move higher (into year end at minimum). Remember, we really didn’t just have a 1 week sell off or capitulation. Most stocks have been declining for months. Through Monday more than 50% of all NYSE stocks had declined by about 15%. And it was worse among small caps, with more than 60% down more than 20% from their March highs. Thats why Mondays capitulation was so important. It represented a true wash-out. And it’s exactly what every great bull market needs in order to begin its push higher into the next levels of the stratosphere.

Important point to remember: when investor sentiment reaches extreme fear levels (as it did this week) just 2 years into a new bull market thats driven by a) unprecedented global liquidity ($32 trillion) and b) surging corp earnings, as investors we must be prepared to back up the truck and add to our favorite positions.

J Powell and the Future Moves of the Fed.

If there’s one thing we know about Fed Chair J Powell, the money printing rock star of our financial masters of the universe, it’s that he has a massive tell when it comes to his pressers. When JP starts talking, the markets start falling. It happened again yesterday as the Dow fell from +510 points to a close of +338. This was actually outperformance from JP. Reminds me of one George W Bush over the last 18 months of his presidency. We aggressively shorted the market beginning a couple minutes before Bush was due to give an address. To this day I believe Bush’s speeches made us more money as traders than any single one-off trading strategy over my entire career. Just another example of how horrible W was as a president. And now he’s the darling of the liberal media…of course he is.

But investors locked on to two specific things that Powell said, and folks, it’s the markets reaction overnight (overseas markets) and in trading this morning (Dow +210) that looks to be another important tell.

1) Tapering of their $120 billion/mo in QE will be announced at the November meeting with it beginning in December and ending in 6 months, a reduction of $15 billion in the taper per month. Here’s the schedule, with thanks to Zero Hedge

2) Half of the voting members of the Fed believe that rate hikes will begin by year end 2022.

One would think that the markets would dislike both of these announcements but that’s not been the case. Why is that? It’s because the markets don’t believe it.

Take this to the bank folks; once we have our first 10% correction, the Fed will pause any taper. Should we have a 20% correction, the Fed will act to increase QE.

This is our brave new world of financial engineering. Our financial masters of the universe know that this is QE Infinity.

Take this to the bank too; as rates in the US ultimately head towards zero percent, the Fed will announce they are (officially) buying stocks too. Just like the Bank of Japan. Just like the Peoples Bank of China.

And for all of this, TINA will continue to apply to US stock markets. This bull market has “forever” to go.

VRA Playbook: Our broad market macro views on the economy, market, bonds, energy, precious metals and cryptos….along with some top buy rec’s for the next year.

BIG PICTURE: We have entered the 3rd term of Obama’s presidency. Get ready for slower growth, lower rates, more QE/stimulus and a melt-up stock market driven by central bank financial engineering.

ONE: Stock market (remember, the stock market is NOT the economy).

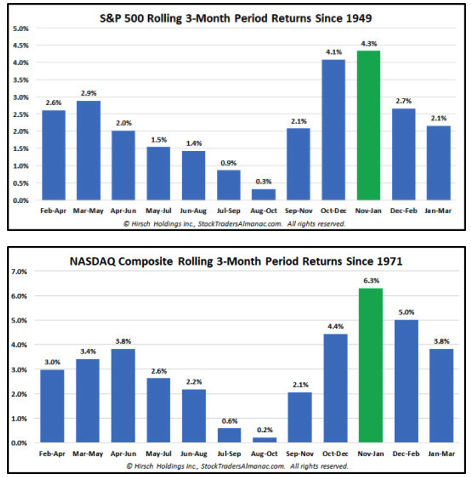

We’re in just the second year of a new bull market that will take the Dow Jones to 100,000 +. Three times higher from current prices, in approximately 5 years (by 2027).

This melt up will rival the Dot com melt up and is being driven by two major factors:

a) unprecedented global liquidity of $32 trillion; fiscal (government stimulus) and monetary (central banks)…with much more on the way. TINA (There is no alternative) and FOMO (fear of missing out) will continue to force stock markets higher. Don’t fight the tape, don’t fight the Fed.

b) surging corporate earnings that won’t peak for 5 years (the power of a new economic cycle…they last more than 5 years, on average)

Best ways for a long term, more conservative equity investor to invest: a 50/50 mix of $SPY (S&P 500 ETF, plus dividends) and $IWM (Russell 2000, plus dividends) should produce gains of 30% + per year. More aggressive investors should of course use the VRA Portfolio. And oil/nat gas prices will soar with the insanity of The Great Reset depopulationists climate change.

And remember, cash is trash!

TWO: Bonds

If you’re a true contrarian, you MUST believe that interest rates will continue to plummet. While 99% of PHD economists (most all employed by the Fed) are telling us that rates will rise sharply from here, here’s why they are wrong:

*the majority of PHD economists are NEVER right.

*rates have fallen for 40 years. It’s hard to find a more powerful repeating pattern.

*We are in a new world of financial engineering, run exclusively by central banks. The financial masters of the universe. They cannot stop QE, ever, or the system implodes.

* We believe rates in the US will be negative, likely by 2025, just as they continue to be in Japan and Germany (broadly throughout Europe)

Best way to invest: Use the VRA Portfolio in recognition of TINA. Buy real estate/homes. As rates continue to fall, home values will continue to skyrocket.

THREE: Precious Metals

- We’ve just entered the most bullish seasonal period for gold and silver (now through year end).

- Central banks have resumed buying at record levels

- The publics ownership of gold is right at all time lows (as a percentage of investable assets). As a contrarian, there is no bigger buy signal.

- Record Currency inflation demands that precious metals move higher.

- If/when it all blows up, precious metals will be the only real place to hide.

Best way to invest: physical gold and silver and gold/silver miners

FOUR: Cryptos

Bitcoin is the top play (with Ethereum #2).

Because they will never create more than 21 million BTC, this is a unique “supply and demand 101” story.

Timing wise, BTC is now below its 200 day moving average at $42,000…its important that BTC regain this level.

BTC also just had a “golden cross” where the 50 day moving average crosses over the 200 day moving average. Golden crosses are highly bullish, high probability technical events….to date, not so much.

Regulation is becoming a larger risk to cryptos. The SEC just started targeting them as “securities”. This is a battle that cryptos have been trying to avoid.

Until next time, thanks again for reading…

Kip

Join us for two free weeks at VRAInsider.com

Sign up to join us for our daily VRA Investing System podcast

Also, Find us on Twitter

Thursday, November 18, 2021 at 9:49AM by

Thursday, November 18, 2021 at 9:49AM by  Kip Herriage -VRAInsider.com

Kip Herriage -VRAInsider.com