Earnings are Absolutely Crushing it. Biggest Day of Q1, Today. Higher Interest Rates Are BULLISH. Sentiment Update

Thursday, April 26, 2018 at 11:03AM by

Thursday, April 26, 2018 at 11:03AM by  Kip Herriage -VRAInsider.com

Kip Herriage -VRAInsider.com A quick heads up; I’ll be on with the great Wayne Allyn Root tomorrow night at 7:30 PM EST (USA Radio- http://usaradio.com/). Please mark your calendars and join us. If my read on these markets is accurate, we’ll be talking about the strong close to the week for the markets, and yes, the likelihood that the lows are in place.

VRA Alert

There was one major issue that spooked me this week…that spooked everyone really…and that was the solid earnings release from CAT and then the absolute takedown in its share price that followed. We saw the same from Google earlier in the week and this is NOT the pattern that bulls want to see. Not close. Remember, it’s not the news that matters, its the markets reaction to the news that we care about. CAT’s reversal sent an ominous signal to investors…including me. But then, Boeing reported earnings yesterday and the flip scripted. BA opened $4 higher and then just kept going higher, finishing just off the highs of the day (+$14/share). Boeing’s price action sent a powerful signal to market watchers. A signal that said the chop of the correction should have a positive outcome and that rumors of “peak earnings” will prove to be a myth.

Then, just after the close, Facebook (FB) reported blow-out numbers and showed the same pattern (so far, that is) that Boeing did. FB opened $2 higher and as I write is trading up $12. Big time positive for the broad markets to see solid earnings result in sharp moves higher. I cannot overstate this.

Today, we get Amazon, Intel and Microsoft…to name a few…the biggest earnings day of Q1 so far.

Here’s the tally for Q1 to date. With 155 S&P 500 co’s reporting, 79% have beaten estimates on 27.5% growth. TWENTY SEVEN PERCENT EARNINGS GROWTH! Holy cow…and guess what folks, Trumps tax reform is just beginning to kick in. 21% corporate tax rate is here to stay. What I’ve found especially interesting is that 75% of all co’s reporting have also raised their full year 2018 estimates. This means they expect business to only get better. Again, peak earnings will almost certainly be a myth.

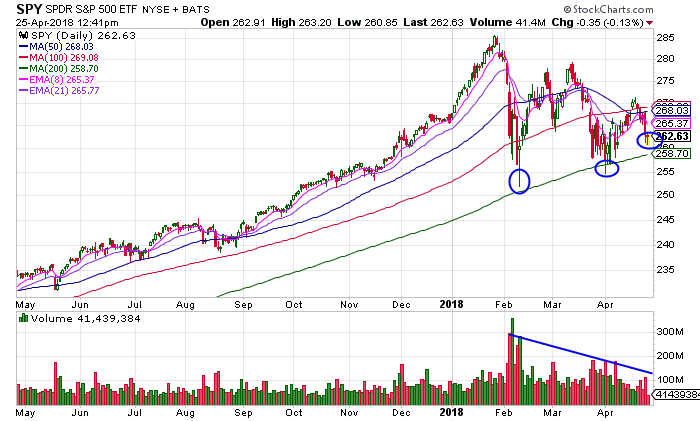

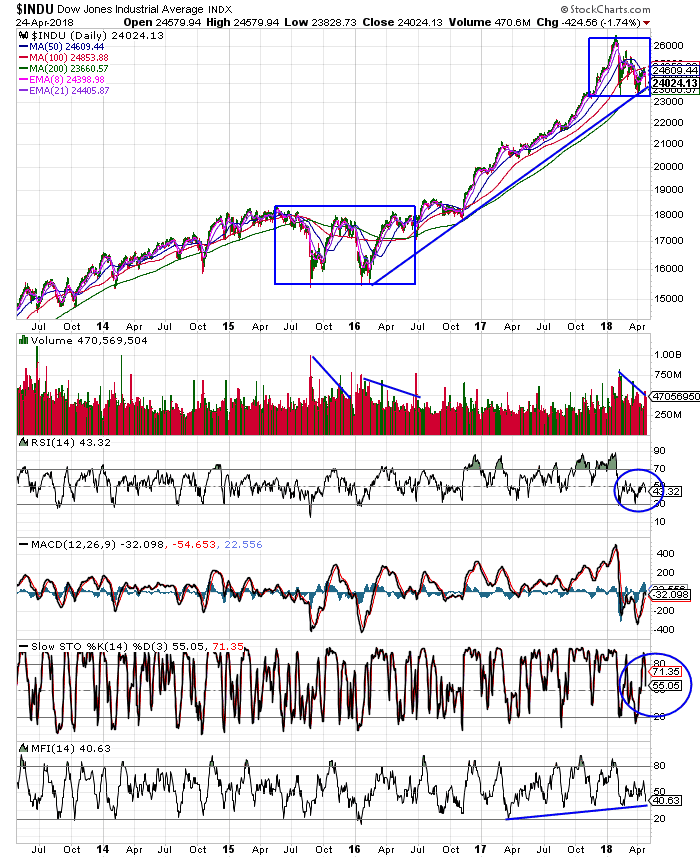

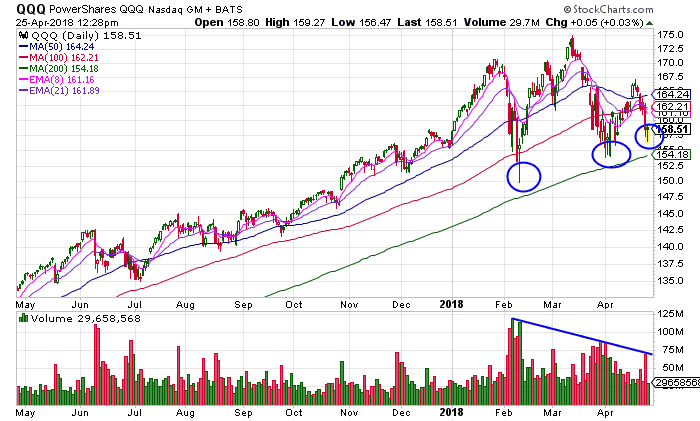

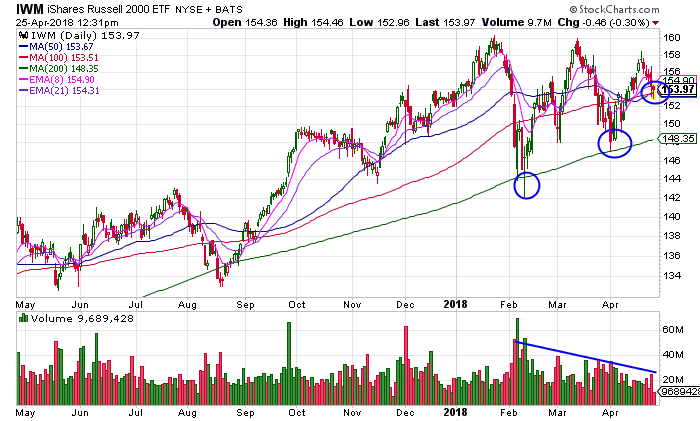

Now, take a look at each of these charts. What do we see? Each of the major indexes…S&P 500, DJ, QQQ (nasdaq 100) and IWM (Russell 2000)…are showing us two very important things:

1) each is on a pattern of “higher lows” (from the 2/9 bottom)

2) each decline is taking place on decline selling pressure, aka lower volume.

The chop of this correction has been awful. And no, it may not be over. But, if these patterns hold up (higher lows and declining volume), then we are very close to a major spike higher. A move higher that will break these descending trend lines and take us to new highs.

*** We’ll know the lows are in place when the markets open higher and then continue moving higher. With a strong close. This is the pattern change that we are looking for. ***

Of the 4 indexes below, R2k (IWM) is the best looking, followed by SPY and QQQ. This is where my focus is.

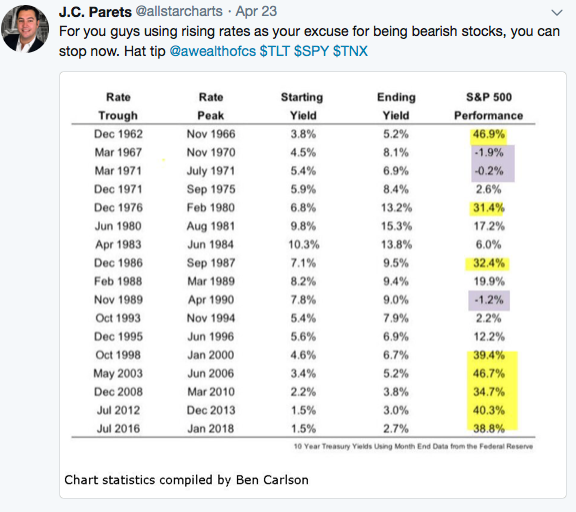

Finally, for those concerned about higher interest rates destroying the market, check this out:

The average move higher in the S&P 500 (as interest rates rose) since 1998 (5 cycles) has been 39.98%, over a roughly 2 year time frame. This confirms what we’ve discussed. The first stage of higher rates is a major positive for stock prices. Ignore the bears (on this point). Higher rates are exactly what we would expect to see in a rapidly growing economy. Highly bullish.

In the VRA Portfolio We have one broad market position; Once the VRA System flashes “all clear” we will look to add 1–2 additional leveraged ETF positions. Stay frosty. Again, it is highly likely that the lows are in place. Lots of bears to squeeze.

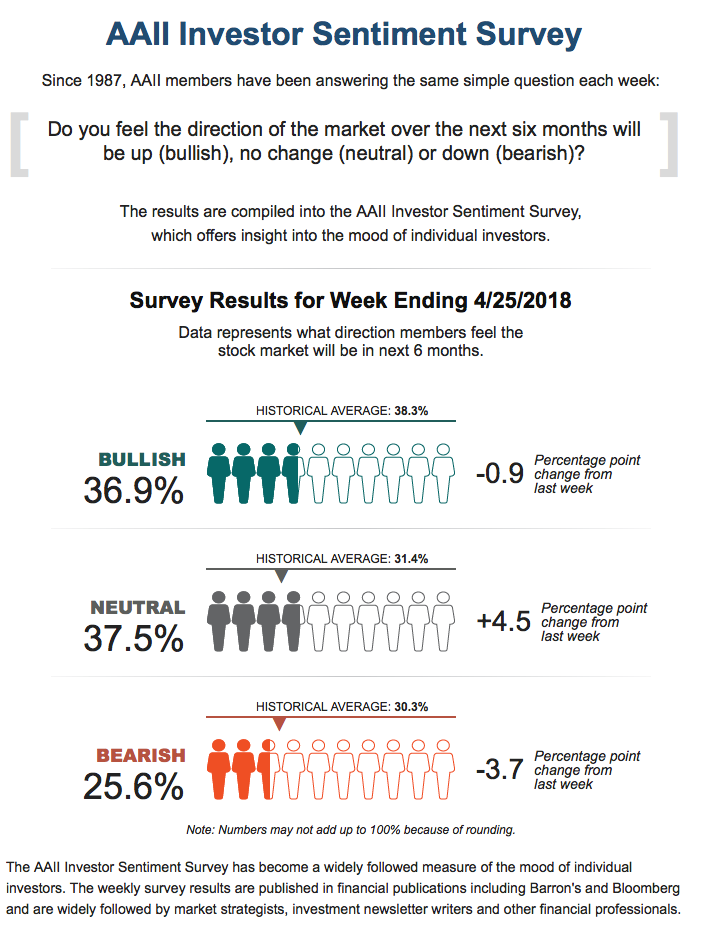

Finally, here are the weekly sentiment readings from AAII. Bulls at 36%, bears at 25% with neutral investors still in the lead at 37%. CNN/Money sentiment reading sits at 36 (fear). As contrarians, we know what these readings mean; we remain bullish.

Until next time, thanks again for reading…

Kip

Reader Comments