VRA Weekly Blog Update: Lessons of My Mentors. VRA System 10 of 12 Screens Positive. Small Caps Ready to Rock.

Friday, October 18, 2019 at 10:13AM by

Friday, October 18, 2019 at 10:13AM by  Kip Herriage -VRAInsider.com

Kip Herriage -VRAInsider.com Good Friday morning all. “It’s not the news of the day that matters, its how the market reacts to the news”. Ted Parsons, circa 1987 (RIP Ted).

Ted was my first mentor. As a newbie broker, my cubicle was just outside of his office. Ted was well into his 60’s then. He’d been around the block. His mentor worked on Wall Street during the 1929 crash and Great Depression. So yes…I had a good mentor.

I’d get in the office, read the Wall Street Journal, cover to cover. When Ted got in I’d pepper him with the news of the day and how it might move the markets and stocks we followed most closely. Ted was patient but he didnt suffer fools; so after telling me for about the 100th time “Kip, its not the news that matters, its how the market reacts to the news”…I can still hear him saying “now learn to listen better….get out of my office…go make some calls and build your own book”.

Ted taught me about the markets and about building your business the right way. He was a born contrarian. That stuck. Ted, and my second mentor Michael Metz (also RIP), were stock picking position builders (even as Mike ran research at Oppenheimer). Their passion was being on the right side of the markets (as trend followers), understanding that the market is always smarter than we are and discovering the next great growth stocks. They would build large positions in a concentrated portfolio, getting to know these co’s better than just about anyone else, and then holding them until there was a reason to sell. They made people serious money.

What Ted and Mike taught me led to the creation of the VRA Investing System. Led to my 34 year career.

One of my daily goals is to try and pay it forward. Just as Ted and Mike did for me. “Crushing Mr Market” is my thing…Ted and Mike would love our approach.

And again, its not the news that matters, its the markets reaction to that news. As we see CNBC/Bloomberg and publication after publication tell us that “a recession is coming”, we’ll watch what the markets do instead. Best discounting mechanism on the planet. And right now, it’s telling us that recession news like this is very fake.

Bull markets don’t end when the public is bearish (as today). Recessions don’t occur when the majority expects one.

VRA Market/System Update

VRA System just went 10/12 Screens positive. Pullbacks are to be bought aggressively. Stampede higher into year end. We’ll add new positions as warranted. TNA and our VRA 10 baggers are the play, for now.

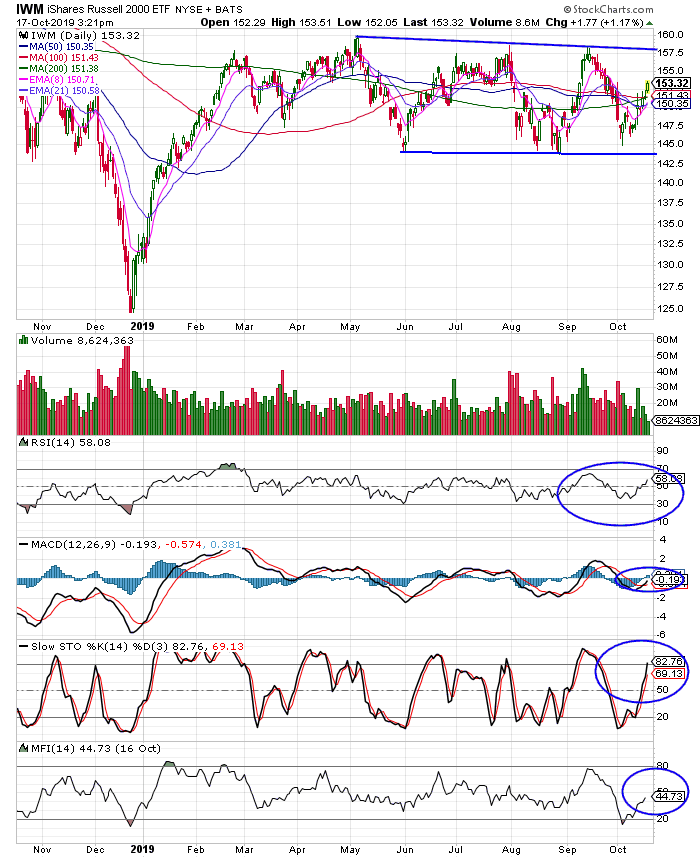

Heres’ the chart that matters. IWM (Russell 2000 ETF), which is the ETF our 3 x leveraged ETF TNA is based off of.

Fresh MACD buy signal today with room to run on momentum oscillators. RSI is playing out as hoped with better than 2:1 gains vs SPX. Need to see volume…I expect thats coming soon.

Our scans include approx 50 key sectors and indexes, US and globally. Across the board, we’ve seen a rally back above 200 dma (everywhere), including R2k and trannies, which had been trading like death prior to this latest move.

VRA Bottom line: The VRA Investing System is back to 10/12 bullish. Here’s what we see as most likely; bears and underinvested big money are about to be forced back into the markets. The reasons are clear, as we see it; seasonality, sentiment, easy Fed policy and continued earnings beats will result in a stampede-like move higher into year end. The opposite of Q4, ’18 (which has kept investors fearful and out of the markets, fearing a repeat).

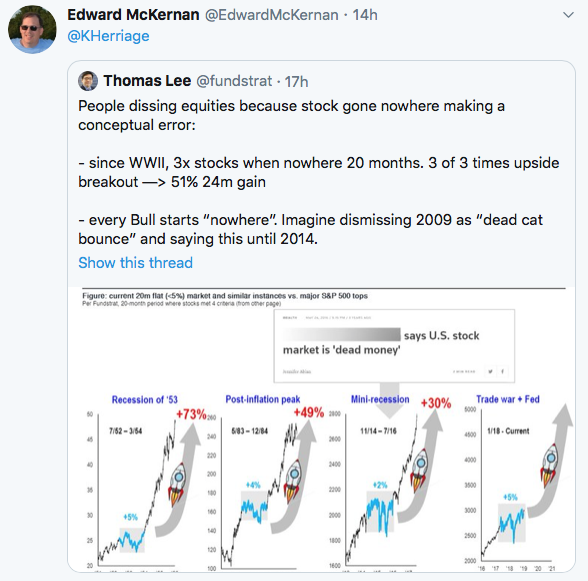

How remarkable that even as earnings have increased steadily over the last almost 2 years (in the 35–40% range), the DJ is just 400 points higher than it was on 1/18. S&P 500 is just 20 points higher in that same time frame and the R2k is actually 90 points “lower” than on 1/18.

That’s a whole lotta chop, even as earnings have continued to ramp higher. In our view, all it will take is a move through ATH to get investors excited again.

And this; when SPX yields more than the 10 year T-bond, it’s higher 1 year later 95% of the time. If memory serves…and we posted these analytics a couple months back when it first took place….the average move higher is in the 15–20% range, with aggressive ST gains as well.

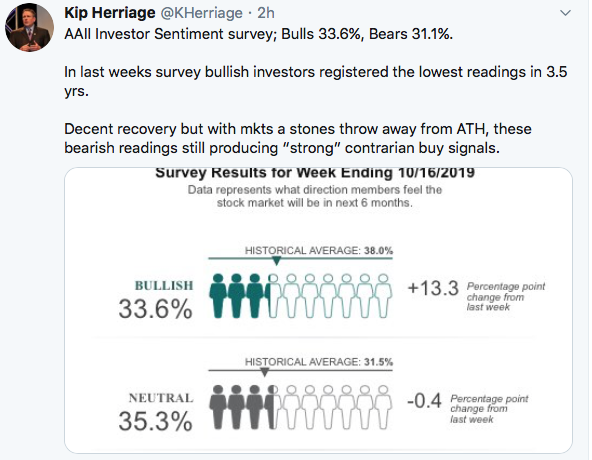

AAII Investor Sentiment: Still Flashing Strong Buy Signals.

As to sentiment, know this; From a medium-long term investment outlook, we know of no more important indicator than market sentiment. We’ll start becoming cautious on the longer term outlook when bullish readings hit 50%+. We’ll almost certainly see readings of 60% + before this bull market ends….likely in the DJ 50,000 + range, in circa 2024. Bull markets do not end when investors are highly fearful. That’s the very nature of a wall of worry move higher.

Finally, thanks to VRA Member Ed for sharing the following. As Tom Lee points out, since WW2 there have been 3 instances when the markets went nowhere for 20 months and in all 3 cases what followed was a breakout with an average gain of 51% over the next 24 months. Today, this would take the DJ to 40,700 over the next 2 years. Fits with our VRA game plan nicely.

Please make sure and join us on our daily market podcasts at the close. Sign up at vrainsider.com/podcast for email reminders when posted.

Until next time, thanks again for reading….have a good weekend.

Kip

Since 2014 the VRA Portfolio has net profits of more than 2300% and we have beaten the S&P 500 in 15/16 years.

Join us for two free weeks at VRAInsider.com

Sign up to join us for our daily VRA Investing System podcast

Also, Find us on Twitter and Facebook

Reader Comments