VRA Investment Update: Biden is a Disaster. AAII Survey, Extreme Fear! Opportunity is Nearing.

Thursday, January 20, 2022 at 9:16AM by

Thursday, January 20, 2022 at 9:16AM by  Kip Herriage -VRAInsider.com

Kip Herriage -VRAInsider.com Good Thursday morning all. A big about-face in the markets yesterday, as another weak smart money hour brought steady selling pressures, with each index finishing right at their lows of the day. Nasdaq has now fallen into correction territory, down 10.7% and doing so in short order. And we’re hearing more chatter about Russia-Ukraine…certainly if you watched Biden’s presser yesterday. The permanent ruling class owns the vast majority of our media (through well placed intelligence community assets), so it was no surprise that more than 50% of the questions were about Russia. The drumbeats of war.

What do presidents tend to do when their ratings are in the toilet, with an election coming up? Wag the dog.

And trust me when I tell you that the last thing the Fed will do is start hiking rates aggressively if global conflict, between 2 nuclear powers no less, becomes a possibility.

I’m not a big TV news guy but I will say that Tucker Carlson has been all over this issue the last few nights, putting the military industrial complex on notice…we’re on to you.

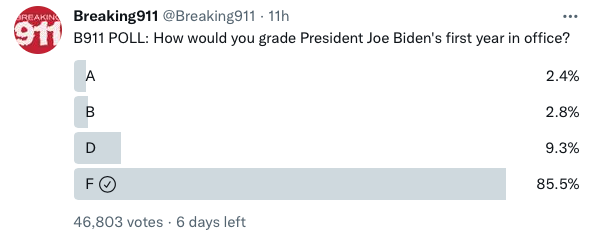

One of the more popular online polling orgs is Breaking 911. With 6 days left to go on their latest Twitter poll, “what grade would you give Biden”, check out the early results: 85% give him an “F”. Desperate presidents do desperate things. What a horrible presser, from this pretender in our White House. 81 million votes my ass.

The internals were better but that’s not saying much. Another day with poor readings for nasdaq 52 week lows (772 new lows, following Tuesdays 818). This market is trading very heavy. Selling pressure of size.

But we smell opportunity approaching, as covered in yesterdays VRA Update with our pre-alert on TQQQ (3 x Nasdaq 100 ETF) and the NEW pre-alert that we have for you this morning NAIL (3 x Housing ETF).

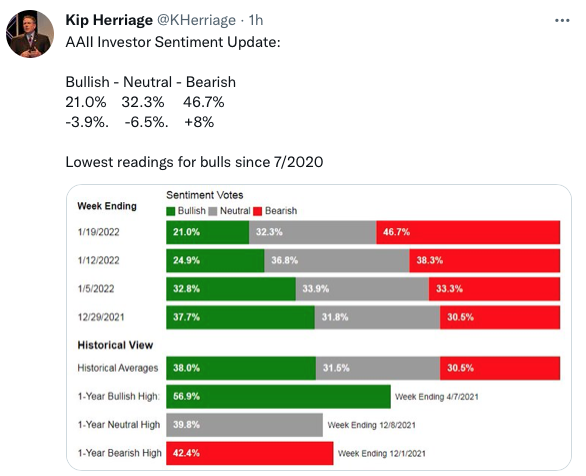

AAII Investor Sentiment Survey

Last nights AAII Survey (weekly, which I’ve voted in for >20 yrs) shows a big drop in bulls, down 3.9% to to 21%, with bears up a very big 8% to 46.7%. This is the lowest number of bulls since July 2020.

As contrarians this is music to our bullish ears.

LOTS of fear is building in this market. The bricks are going up in our wall of worry. It’s the stuff of short term bottoms.

But the reality is that this trading has been heavy….ugly…frankly the Fed’s first rate hike can’t get here soon enough.

They should do it now….raise rates by .50% this week and be done with it for 6 months. The markets would scream higher on this, IMO.

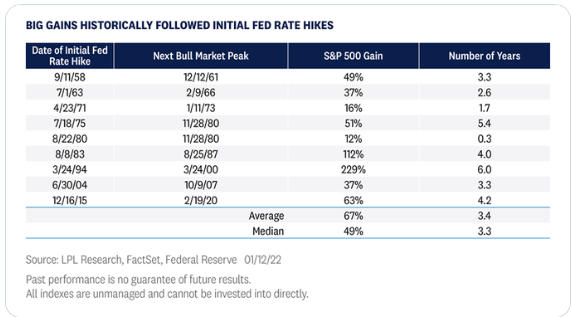

Three Steps and a Stumble

That’s what my first mentor, Ted Parsons (RIP) called it, once the Fed started hiking rates. “3 steps and a stumble”, meaning that stocks continue to rise until “at least” the 3rd hike.

Here’s the supporting data. Going back to 1958, big gains have historically followed the initial rate hike, on average for more than 3 years with an average gain in the S&P 500 of 67%.

Personal note: I am stunned by some of the fear mongering we’re seeing from long term market watchers (“gurus”) over rate hikes. The data above is available to all…it’s not exactly a secret.

A reminder to be careful about listening to permabears. They are, more than anything, list builders. That is their business model…building lists…and they know that fear is the most powerful motivator in getting people to act. Man oh man, have we ever seen this with the plandemic called CV insanity.

Be Prepared To Act

With a wall of worry that’s quickly building, I look for us to first get a “flush” before bottoming and reversing higher. That’s mine and Tyler’s wish, as Tyler covered in detail on his podcast yesterday. We have 2 targets that are setting up perfectly as VRA Investing System as our strongest buy candidates; check them out with our 14-day free trial at VRAInsider.com

Until next time, thanks again for reading…

Kip

Join us for two free weeks at VRAInsider.com

Sign up to join us for our daily VRA Investing System podcast

Reader Comments