VRA Investment Update: The Fed Statement & Powell Presser Had Little in Common. Dovish! Markets Have (Likely) Bottomed. Sentiment is Screaming "Buy".

Thursday, January 27, 2022 at 10:03AM by

Thursday, January 27, 2022 at 10:03AM by  Kip Herriage -VRAInsider.com

Kip Herriage -VRAInsider.com Good Thursday morning all. Following another wild day in the markets, here’s what looks to matter most. The last 3 days have brought severe intraday weakness…Powell made sure of that yesterday…but on each of the 3 days the smart money hour was “bullish”. On Monday we recouped 1200 points in losses….500 on Tuesday…then 500 again yesterday. Markets that rise in late day/smart money hour trading are typically anything but bearish.

But just a horrible presser…the worst I’ve seen in my career. He was nervous, stuttering and stammering, completely non-committal and man oh man does this guy like to blabber. The markets have no confidence in the money printing rock star, whatsoever. From +500 to panic selling to someone cutting his mic. Of course, the second his mic was cut, it was lift off.

Quick recap of JP’s (latest) disaster of a presser, which I forced myself to go back and watch again last night:

- It was even more dovish than I remembered it. Powell committed to “nothing”, as he said a version of “we don’t yet know” more than 50 x.

- He opened by saying (exact quotes): “The economy is slowing. The implications for the economy are uncertain and its causing great hardships for families. We have not yet made decisions on exactly what we will do”.

- Does any of the above sounds like 4 rate hikes in 2022 to you??

- Again, the FOMC statement read NOTHING like the words that came out of JP’s mouth. Importantly, the statement made clear that they would NOT start selling bonds (they own $9 trillion), but would instead let them “roll off” or “run off”, meaning they will simply let the existing bonds mature. Again, that’s not QT.

My read: Obviously, inflation is the Fed’s biggest concern. Yellen (Treasury Sec and previous Fed Chair) is now a full-on political creature. Hiking rates aggressively in a midterm year and causing a severe bear market potentially in the process is NOT what her boss wants to see happen. JP likely has Q1 to get inflation under control, hence all of the jaw boning and supposed hawkishness.

The markets have little to no confidence that JP know what he is doing. They’re right to have that view, certainly with the fact that he’s already made 4 major policy mistakes since taking the job.

VRA Bottom Line: Mondays lows should be THE lows. Thats:

- 33,150 on the Dow (34,168 today)

- 4222 on SPX (4349 today)

- 33,150 on Nasdaq (13,542 today)

** If these lows are taken out (by more than a hair), lower prices are likely into the first rate hike…then blast off higher. But I see Mondays lows holding. Next up: we must regain the 200 dma’s.

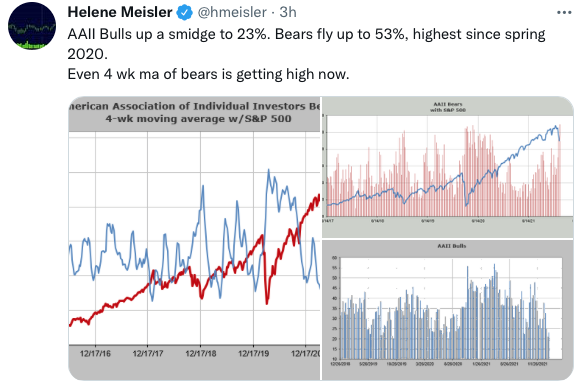

Sentiment HIGHLY Bearish (that’s bullish):

Folks, it’e getting harder to find bulls on Wall Street. But I promise you this; if we get the move higher that Tyler and I expect, these same gurus will tell us that they bought the dip. I was actually a bit surprised to see this yesterday. As flattered as Tyler and I might be that GS (vampire squid), Citi and JPM are following our market calls, you know our views as contrarians; we almost always feel more comfortable when we are in direct opposition to what the NY swamp has to say.

BUT…in this case, since we’re leading and not following, we are in complete agreement.

This is still setting up as a strong rally into weeks end. Likely longer.

AAII Sentiment Survey is hitting the highest levels of bears since the final 2 weeks of CV insanity, March 2020. Bulls are a measly 23%.

Again, if you’re a contrarian (this guy), you are salivating to add to your positions…as we’ve just done.

** Futures are solidly higher as we start the day. I think these gains will hold and I look for another strong smart money hour.

CV Insanity is officially over in the UK. Who would have thought they would end the ridiculous policies of masking and jab mandates before we did in the US??

God Bless The Truckers! Largest convoy in history. 50,000 trucks and more than 1.4 million people. US truckers are on their way now as well. Who knows, this might be enough to give (more) Canadians a backbone.

https://twitter.com/MaajidNawaz/status/1486508908093087751

Until next time, thanks again for reading…

Kip

Please join us each day after the market closes for our Daily VRA Investing Podcast!

Sign up for email alerts @ vrainsider.com/podcast

And check Out Our Latest (now daily podcast!) Videos on YouTube

Reader Comments