VRA Investment Update: Sentiment & Seasonality Flashing Buy Signals. Q4 Rally, Here We Go.

Thursday, October 20, 2022 at 10:52AM by

Thursday, October 20, 2022 at 10:52AM by  Kip Herriage -VRAInsider.com

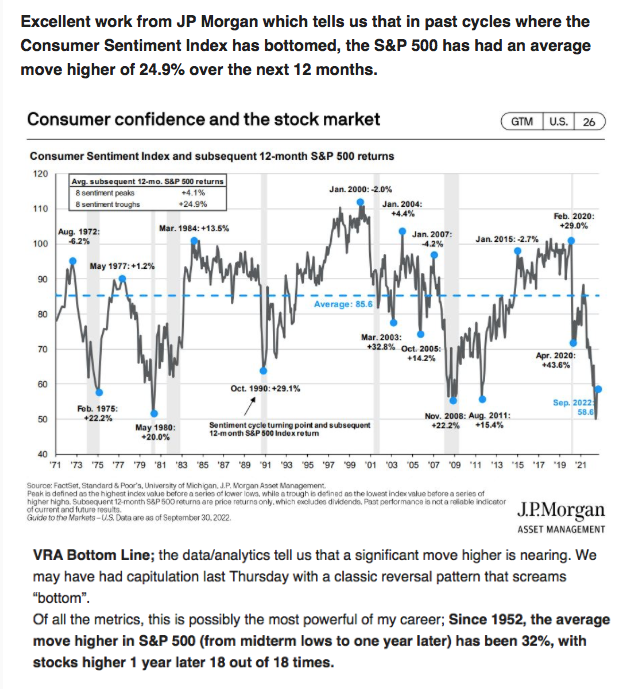

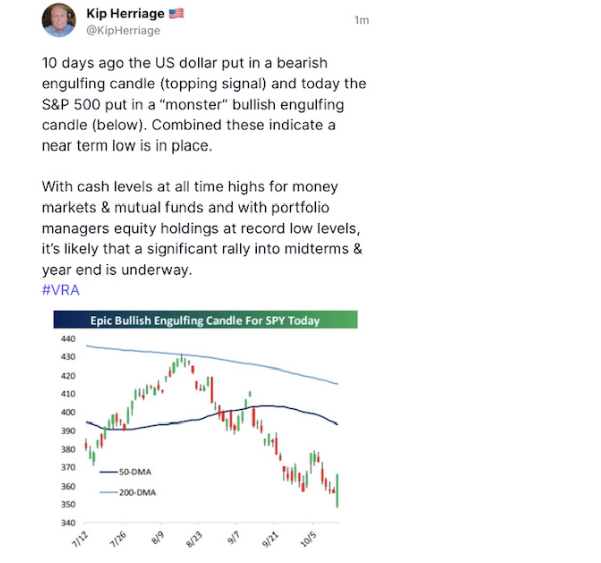

Kip Herriage -VRAInsider.com Good Thursday morning all. After solid back to back days our markets gave a bit of it back yesterday but we remain buyers into what we expect to be a solid move higher into the midterms and year end. Sentiment, seasonality and analytics are combining to make a strong case for a significant bear market rally. And, as Tyler covered on his podcast yesterday (sign up for alerts at vrainsider.com/podcast), the power of the midterm election year cycle is overwhelmingly bullish, featuring a 32% move higher (on avg) from the midterm year lows to 1 year later, with the markets higher 18/18 times (post 1952).

We may also be seeing an interesting development in the semis (SMH), which closed 1% higher yesterday even as Nasdaq closed lower by .90%. If the semis are going to begin leading higher, you most definitely want to be long this market.

As of yesterday's close, 62 S&P 500 co’s had reported Q3 earnings with 76% beating analyst estimates on earnings per share and 61% beating estimates for revenues. Overall, corporate earnings continue to grow, albeit at a slower pace than in the first two quarters, as balance sheets remain remarkably solid for both consumers and corp America. As always, its not the news that matters as much as the markets reaction to that news. The question we’re pondering now is, “how much of any bad/recessionary news is already baked into the stock markets cake?”

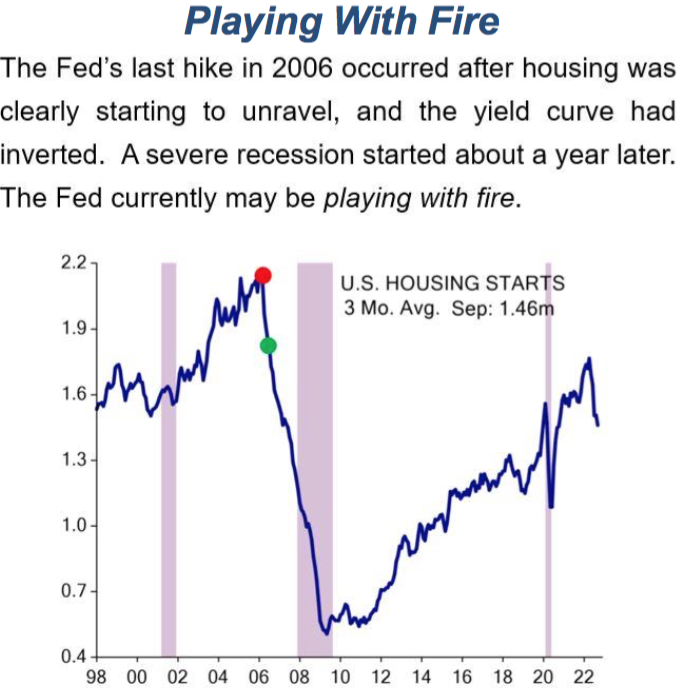

Ed Hyman, Evercores Chief Economist and likely the best on the street for close to 50 years, is out with his strongest language yet for the Fed, saying that they may be “playing with fire” with their aggressive rate hikes and monetary tightening. Of course he’s right….the Fed is always most comfortable when they are breaking things. As a reminder, the Fed hiked rates 17 straight times from 2004–2006, for those that may have forgotten why we had a housing crash and market meltdown that came close to frying the global economy in 2008. Since their creation in 1913 the Fed has caused every boom and bust cycle. It’s what our money printers do best.

We Remain Highly Bullish on Energy Stocks.

Below we see that XLE has dramatically outperformed oil over the last 4 months, which tells us that oil is about to scream higher (the equites lead the underlying commodity).

We bought ERX (2 x Energy ETF) 3 weeks ago and have current gains of 20%. As you’ll see below, ERX is nearing extreme overbought levels on the VRA Investing System. We would hold ERX here.

Small Caps Lead Coming Out of a Slowdown/Recession

Small caps have outperformed large-caps coming out of recessions 6 out of the last 6 times with average outperformance of 14%. We see it happening now (below) in this relative strength chart of IWM (Russell 2000) to S&P 500.

The Trend Line That Matters

This chart of 10 year treasury yields (going back to 1991) shows 4 previous points where this dominant/descending trend line was hit with yields then reversing sharply lower.

And I’ll make one additional observation about the chart below (and rates). Check out the time frame from 1995–2000…as US stocks had their biggest bull market in history (dotcom)…while 10 year yields consistently traded in the 5% to 7% area. Same with the big bull market “post 9/11/01, pre Financial Crisis” when 10 year yields traded between 4% to >5%.

As we start trading today, the 10-year yield is 4.15%.

Know this: I am not calling a top in rates. They are in fact acting like they want to go higher. But I am making the observation that “higher yields” (from current levels) have not been the kiss of death for either the stock market or the economy. Quite the contrary, in fact.

CDC Panel Votes to Make Covid Posion Jabs Mandatory for Kids

Remember folks, however they try and spin this, once this decision is made most every blue state and several red states will make it mandatory for grade school kids to be force-jabbed. And yes, this will include kids/babies in day care too. IMO, this “red wave” that we’re hoping for in 3 weeks will mean nothing unless R’s stand up “unanimously” and “forcefully” against this decision from the CDC.

The CDC should be dismantled to the ground. Criminal levels of child abuse cannot be allowed to stand. And we MUST have Nuremberg-like trials for all of the criminals of the plandemic.

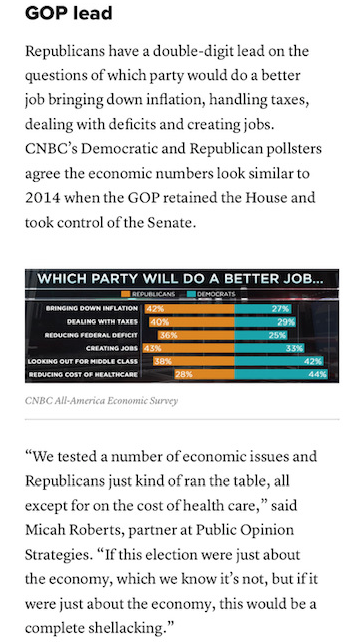

Midterms Solidly Favoring R’s. It’s The Economy Stupid!

When the left-leaning CNBC and far-left globalists at Bloomberg come out with pieces on the same day reporting the likelihood of R’s taking both the House and the Senate, you know that Dems are in real trouble.

GOP holds big leads on key economic issues ahead of the November elections

Until next time, thanks again for reading….

Kip

Join us for two free weeks at VRAInsider.com

Please join us each day after the market closes for our Daily VRA Investing Podcast!

Sign up for email alerts @ vrainsider.com/podcast

Also, Find us on Truth Social and Rumble

Reader Comments