VRA Investment Update: Is This The Pivot?

Thursday, October 6, 2022 at 12:09PM by

Thursday, October 6, 2022 at 12:09PM by  Kip Herriage -VRAInsider.com

Kip Herriage -VRAInsider.com Good Thursday morning all.

The short-covering move higher to start the week marked the best start to a 4th quarter since 1938. The move may have been fueled by short covering and the extreme oversold (on steroid) conditions that we’ve been pointing out.

As investors remain shell-shocked from the first 3 quarters of the year in the short term all eyes are focused on tomorrow’s jobs report. If its disappointing, the 1600 point move higher in the Dow Jones on Monday/Tuesday will make sense, as the much anticipated Fed pivot might finally be here. I expect that to be the case.

While I’m going to resist the urge to call a top in either the dollar or yields, what is clear that is yesterday's PMI (Purchasing Managers Index) showed a surprising level of weakness in manufacturing and economic growth and sent the equity/debt/currency/commodities markets into sharp reversals.

I’ve been wrong over the last 3 months about the Fed pivoting, but with the bizarre financial events in the UK over the last week (featuring a near meltdown in pension funds), and with clear/convincing signs that inflation has collapsed and growth has slowed, the Fed may well be blinking here. Once again, kudos to Jeremy Siegel for his “they know nothing” moment about the Fed from his CNBC interview. That was as good as it gets…it may have just helped to start turning the right heads at the Fed.

Here is Jeremy Siegel’s interview…

https://www.youtube.com/watch?v=9Xnwh_9KV3o

And you know my longstanding view; the markets were always going to rally into the midterms. Team Biden/Uniparty needs all the help they can get. Even moreso after the conservative Prime Minister of Italy was elected and then Bolsonaro’s strong performance in Brazil on Sunday. And yes, it’s all connected.

Now, we’ve entered the best month and quarter of the year, which is especially the case in midterm election years. Following the meltdown of the first 3 quarters of the year we highly recommend using pullbacks to be long this market (at least until we hit extreme overbought on VRA System).

In our view, not only should the markets rally into the midterms but we also expect that rally to continue into year end. We’re now in the best month and quarter of the year and we have reams of analytics that tell us the 12 months after the midterms are the strongest period on record for US stocks; 18/18 x higher since 1952 with avg gains of 32% in the S&P 500 (from the midterm lows).

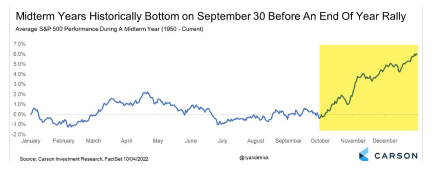

The visual below makes it clear; over the last 70 years, in midterm years, Q4 has been a juggernaut for US equities. A 15% move higher into year end sounds about right to me.

Thursday's action was also bullish, the kind of days that bears hate the most, with a more than 400 point reversal higher in the Dow. The move higher was led by…once again…the semis, which put in another important reversal, from losses of 2% at mid-day to a closing gain of 1%. So far in Q4, SMH is up almost 10%. The semis lead…the markets follow.

The action in 2022 has been so brutal that the vast majority of the “what ifs” investors have considered have been of the ultra bearish variety.

But what If the “what ifs” are about to pivot as well?

What if?

- The war ends…or stalls

- Rate hikes slow/stop

- We don’t have a recession

- Q4 Earnings don’t disappoint

With losses of 24% (SPX) to 32% (nasdaq) have the markets already built in a near worst case scenario?

Because in my view….

- This is not 2008 (not even close)

- Housing, banks, credit, and consumer/corporate balance sheets are in great shape

- An increasingly red-pilled world is great for humanity

- This may be a “great reset” of a different variety, with central banks now in a position to jump right back to a rate-cutting cycle

- With years to “rinse and repeat”

- And yes, after the midterms, “Biden as Bill Clinton” from 1994 remains my sleeper pick

VRA Bottom Line: I see a world of reasons that the markets could ramp higher. All while a “wall of worry” is perfectly set up to climb.

Until next time, thanks again for reading….

Kip

Join us for two free weeks at VRAInsider.com

Please join us each day after the market closes for our Daily VRA Investing Podcast!

Sign up for email alerts @ vrainsider.com/podcast

Also, Find us on Truth Social and Rumble

Reader Comments