VRA Investment Update: Improvement Under the Hood. 4 VRA Horsemen. Tax Day, Mask Day.

Thursday, April 21, 2022 at 9:55AM by

Thursday, April 21, 2022 at 9:55AM by  Kip Herriage -VRAInsider.com

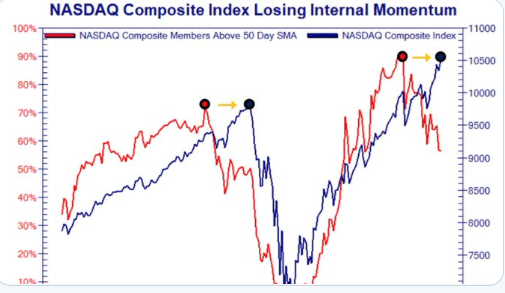

Kip Herriage -VRAInsider.com Good Thursday morning all. As Tyler covered in detail on yesterdays VRA Investing Podcast (sign up for alerts @ vrainsider.com/podcast), something interesting could be brewing to restore our (short term) faith in the markets. Even as Nasdaq (-1.2%), on the back of the Netflix implosion was hit yesterday the internals actually showed improvement. Pretty remarkable that Nasdaq advance/decline was positive while nasdaq also put up its first +100 new 52 week highs since January. Hey, its a start. And again, with NFLX getting smashed 36% (-$125/sh), yesterday could have been especially ugly.

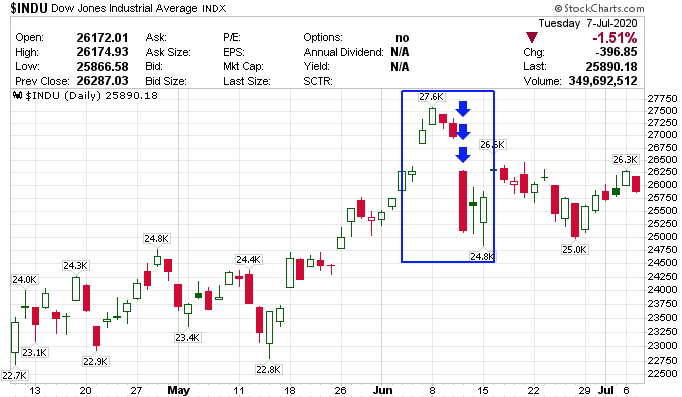

In addition, our 4 VRA Horsemen (Housing, Trannies, Semis and Banks) once again put up gains on the day. Folks, as long as these groups hold their 2/24 to 3/14 lows, we’re looking at a pattern of higher lows to keep building on. The big negative remains the fact that each broad market index remains below its 200 dma, although the S&P 500 is right on the line. Remember, we need to see 7 straight days above the 200 dma before we can have confidence that the 200 day has a solid chance of holding.

Markets are higher this morning. DJ +250 and Nasdaq +150.

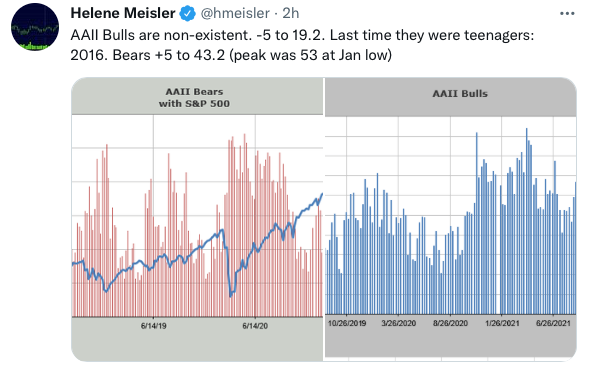

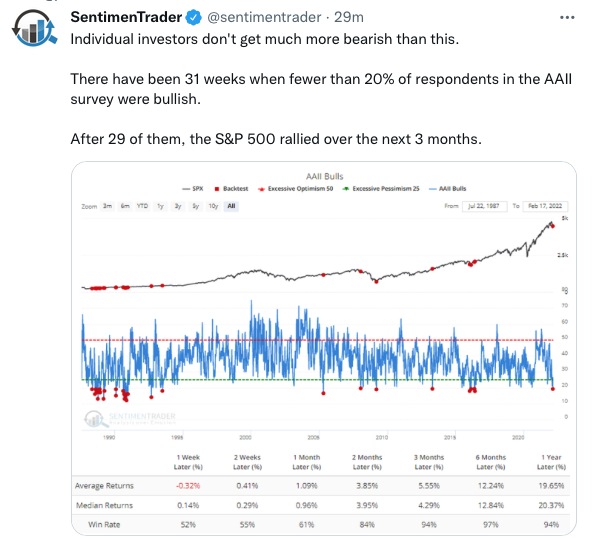

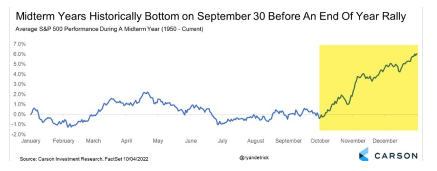

Last nights AAII Sentiment Survey came in with bulls up 3 to 18.9% and bears -5 to 43.9%. History tells us that when AAII bulls drop below 20% its a remarkably great time to buy stocks, assuming your window is at least 6 months out. Going back to the origins of this survey (1986), when bulls drop below 20% you would have made money in the S&P 500 100% of the time over the following 6–12 months. It’s only happened 9 times, prior to now, with an average gain over the next 6 months of 13% and an average gain over the next year of more than 20%. High probability repeating pattern.

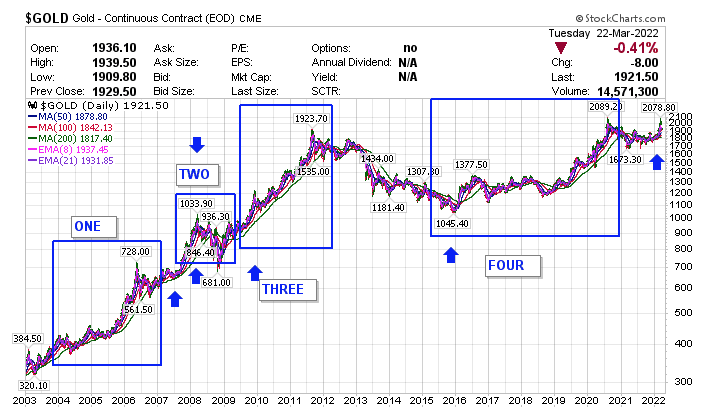

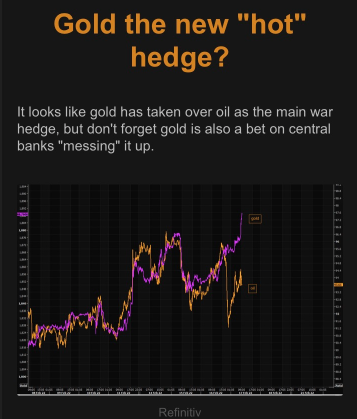

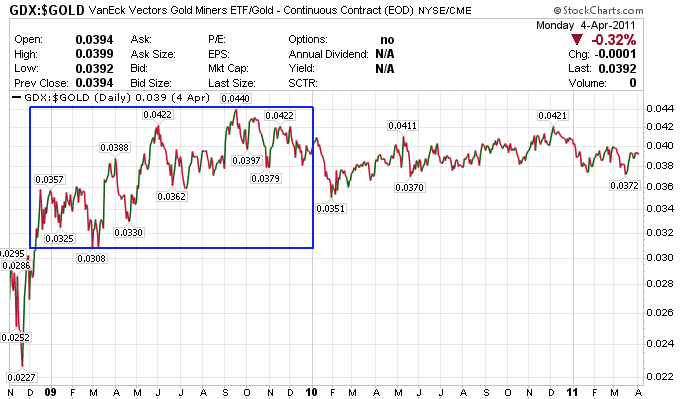

As the broad markets have rallied, precious metals and miners have been soft. The pattern of hitting 90% OB on stochastics and pausing…we’ve seen this pattern repeat everywhere over the last year +…has briefly struck metals/miners as well. Importantly, these pauses are short-lived. Below, in the chart of GDX (miner ETF) we see it clearly; from the birth of the current breakout (early February) GDX has seen support right at 100% of the time at the 21 ema (purple line), with dips through the 21 ema lasting no more than a day. This morning GDX is trading down 1%, roughy .50/share above the 21 ema.

Use this pause as a buying opportunity in the miners. Our positions in VRA 10 Baggers have held up like the beasts they’ve been all year (learn more at VRAInsider.com).

Tax Day, Mask Day

So this week, they matched up tax day in the US with “masks-be-gone” day…we’ll take it I guess, but that’s still a 99:1 losing proposition. Taxes are theft and cloth masks were always a joke.

Next up…and this should be happening now….all jab mandates MUST be removed. Then, we must re-hire everyone that was fired for not bending the knee for legitimate medical or religious exemptions…for any reason whatsoever…we simply did not want to be forcibly injected with experimental poisons over a flu that 99.9% recover from. After everyone is re-hired, pay them for their damages and lost wages. Then, every employee that was forced to take these jabs should be compensated “handsomely”.

Where might all this money come from? Big pharma can kick off the contributions. And, if we can send 100’s of billions of dollars each year to foreign countries, we can certainly afford to take care of our own.

I am so ready to be done with CV insanity. We all are. But, our work is just beginning. Nuremberg-like trials must take place. Those guilty of these criminal levels of medical malpractice must pay the price. Doctors that backed, endorsed and prescribed these jabs must pay with their licenses. First, do no harm.

Frauds like Fauci, Gates, Imperial College, Birx, Wallensky…obviously the criminals in HHS, CDC, NIH and big pharma must face public nazi-like trials so this evil never ever happens again.

For me, this is what the midterms are all about. Every R that’s running should have Nuremberg 2 at the top of their platform. That and impeaching Biden and investigating/prosecuting everyone that helped rig the 2020 election. Facebook/Zuckerberg and Twitter near the top of that list (another reason we’re so interested in Musk gaining access to the State secrets inside of Twitter).

Until next time, thanks again for reading….

Kip

Please join us each day after the market closes for our Daily VRA Investing Podcast!

Sign up for email alerts @ vrainsider.com/podcast

And check Out Our Latest (now daily podcast!) Videos on Rumble