Crushing Mr. Market in a Rising Interest Rate Environment: What rising rates mean for your Portfolio

Thursday, June 14, 2018 at 10:13AM by

Thursday, June 14, 2018 at 10:13AM by  Kip Herriage -VRAInsider.com

Kip Herriage -VRAInsider.com As expected, the FED raised rates…we now have a 2% fed funds rate for the first time in a decade…they also signaled there may be 2 additional rate increases this year.

The central bank’s updated “dot-plot”, a chart of the projections for interest rates of Fed members, should offer a clearer outline for how many rate hikes will be on the way. More than anything, the Feds dot plot (and press conference comments) are what the markets will be listening to as it holds significance for how Trumps fed views the Feds role in managing the US economy. Higher rates and a stronger dollar can contribute to how investors value stocks and other assets, but as we’ve covered here often, the facts are clear; stocks love higher rates…to a degree that is…as higher rates confirm an economy that is expanding, and earnings that will continue to grow.

And remember, the fed funds rate was also at 2% as Lehman Brothers announced bankruptcy, back in the dark days of September 2008, as the financial crisis kicked into high gear. The point being, until the fed funds rate surpasses 3%…possibly even 3.5 to 4%…our stock markets will almost certainly continue to rise.

Yes, my view is the contrarian view…but it also has the advantage of being supported by historical investing patterns and returns. We’ll continue to ignore the chicken littles that tell us…seemingly daily…that higher rates will soon lead to the next market crash. We’ll use their bearish positioning/short selling to keep the markets climbing their wall of worry. Much needed fuel for the bull market to keep charging higher.

Unlike most followers of monetary policy, I like to think I have the ability to think using at least a bit of logic. And logic tells me that rate hikes are a very, very good thing, for all of the reasons we’ve covered in these pages since the first Fed rate hike, back in December, 2015. Rate hikes signal everything thats good about an economy…it also allows savers the ability to make a somewhat decent return on their most conservative of money. How novel a concept…retirees may no longer be required to take uncomfortable levels of risk, throwing money into the stock market. At just 2% yields, we’re not there quite yet…but by this time in the next 12–18 months, when the fed funds rate is approaching 3%, savings accounts might start to mean something, again.

J. Powell…keep up the great work.

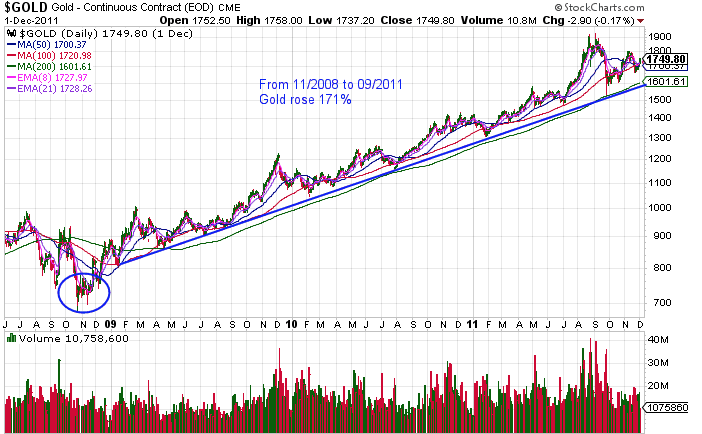

Again, this will mark the 7th hike since December, 2015. Lets take a look and see what gold, silver and GDX (miner ETF) have thought about rising rates, over the past 2.5 years.

Gold bottomed with exactly the first fed rate hike, 12/16, and is up 23%. Still needs to break $1375-$1400/oz before a confirmed breakout, but everything about this chart tells us that pressure for a big move higher is building. Massive volume expansion…smart money global players (including central banks) buying up all they can (even as the price is manipulated over the short term to fool investors to the spike to come).

Silver is up 24% from the first fed rate hike…eerily matching golds move almost completely. The action in silver is even more compelling to me than gold. When multi-year coiled springs like the one in silver break out, the moves can be bitcoin like.

But the big winner…as we would expect…comes from GDX (miner ETF), which is up a big 80% from the first rate hike lows. A nearly 4–1 move advantage over gold/silver. When this big triangle breaks higher we’ll have to wait and see but once volume starts to build (it has gone dormant of late) we’ll have our first real clues.

Bottom line; precious metals/miners love a rising rate environment…most certainly the early innings. Our proof of this is the fact that the biggest bull markets have occurred in exactly this environment

ECB Ceasing QE

We also learned this morning that the ECB will be ceasing QE at the end of this year. Again, more great news, although you wouldn’t know it from the many growling bears this morning, who continue to look for reasons…that simply do not exist, according to the VRA Investing System, to predict the coming recession and global stock market crash.

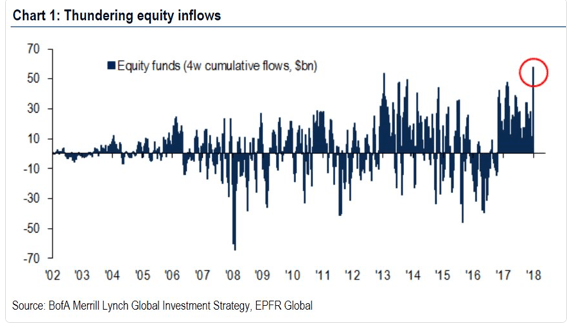

Sanity is finally returning to monetary policy. Combined, from the beginning of QE from the FED and ECB, more than $6.5 trillion in central bank funny money has been printed. Those funds were then used to directly purchase government debt in the US and Europe (among others, including corporate bonds in Europe). Frankly, its a miracle the worlds financial system did not collapse under the weight of it all. Today, the VRA Investing System could hardly be more bullish.

Quick Hitters

1.) This morning, retail sales figures for May came in at +.08%, more than double the estimates. More great news for a very quickly growing US economy. Remember, the Atlanta Fed estimate for Q2 GDP sits at 4.8%. Anything over 4% is a huge win. I continue to look for full year GDP this year of better than 3%, with 4% or better in 2019 (and wait til Trump passes Tax Reform phase 2….this is the phase where our personal rates begin to drop).

2.) Wednesday’s 119 point loss in the Dow Jones (half that % in other indexes), ended the 7/7 run of hugely positive market internals. Still, new highs to new lows were positive nearly 4–1, more confirmation that the broad markets are headed higher.

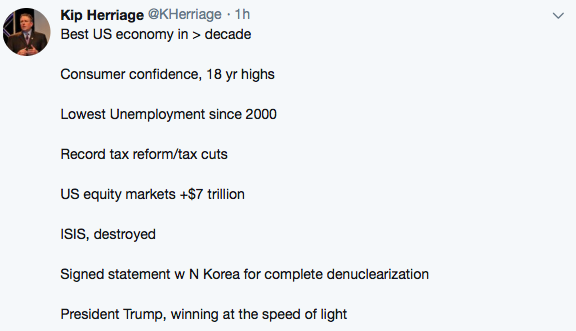

3.)After an historic meeting with North Korean President Kim Jong Un, President Trump has done but what no American president has done before him, getting NK to agree to complete denuclearization. Long ways to go here, but folks, if you’re betting against #45, I have a question for you:

Why? Trumps pattern of winning, on every level, is crystal clear. The man simply does not lose. Stunning successes, time and again. I covered some of his most important wins in an am tweet.

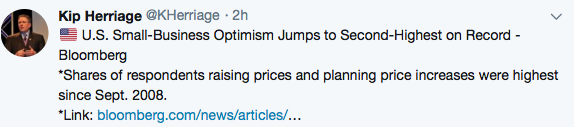

4.) We also learned this morning that US small business optimism is at its second highest readings of all time. The very definition of animal spirits. Yet the Dow Jones remains some 1300 points below its all time high. This spells opportunity.

Finally, if you’re not listening to our end of day podcasts, please join us! Tyler and I tell you…in roughly 5 minutes…what happened in the markets with specifics on VRA Investing System readings. Sign up at vrainsider.com/podcast

Join us as the VRA continues to crush the market, with 2400% in net gains since 2014, beating the S&P 500 14/15 years since inception in 2003!

Until next time, thanks again for reading…

Kip