VRA Update: Signs of Capitulation Everywhere We Look. My Short Term Prediction

Friday, October 12, 2018 at 10:17AM by

Friday, October 12, 2018 at 10:17AM by  Kip Herriage -VRAInsider.com

Kip Herriage -VRAInsider.com Good Friday morning all. Hitting the most important bases this morning…clear signs that the velocity of the sell-off of the last 2 days (Dow Jones 1300 point loss) was algo driven with capitulation everywhere we look.

This is not a crash. If it were, gold would be catching a serious bid, debt markets would be showing signs of panic and circuit breakers would be going off. Instead, this is “elevator up, escalator down” market action that I’ve seen play out more times than I can count.

Here are the “clear” capitulation signs that that tell us an important low is likely in place.

Yesterday:

- VIX hit 29 (volatility index)

- TRIN closed at 1.48

- Put/call ratio closed at 1.21

- Each major US equity index has pulled back to exactly (or just below) their 200 dma, with each hitting “extreme oversold” levels on VRA System

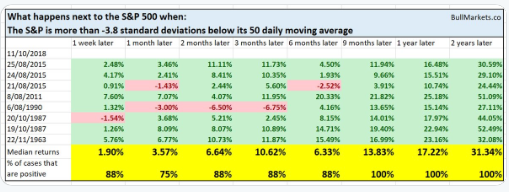

As of yesterdays close, the S&P 500 is now 3.8 standard deviations below its 50 dma. This has happened just 8 times since 1963…check out what happened next.

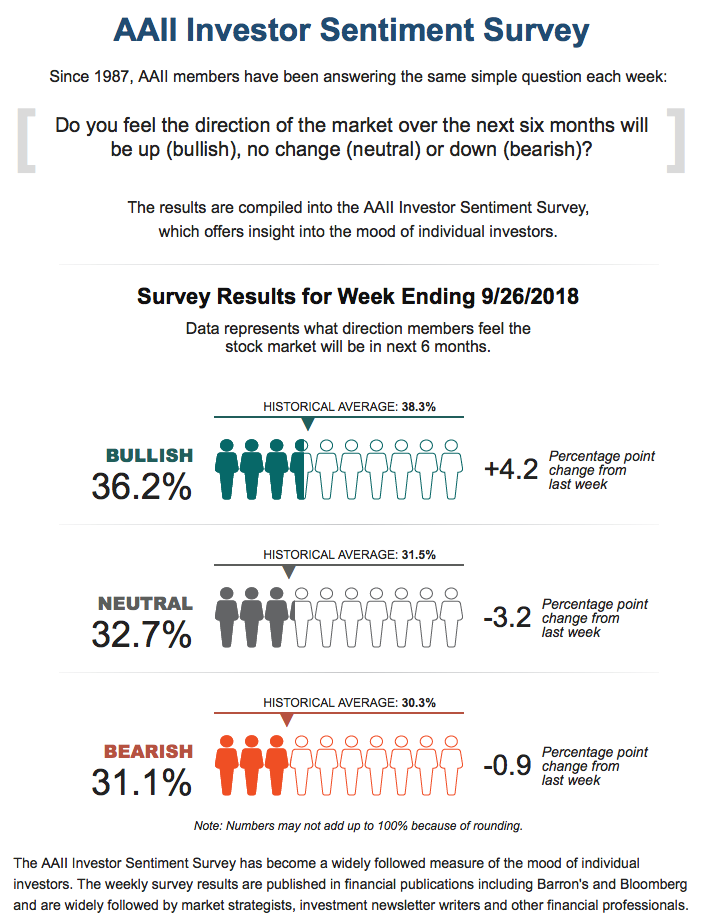

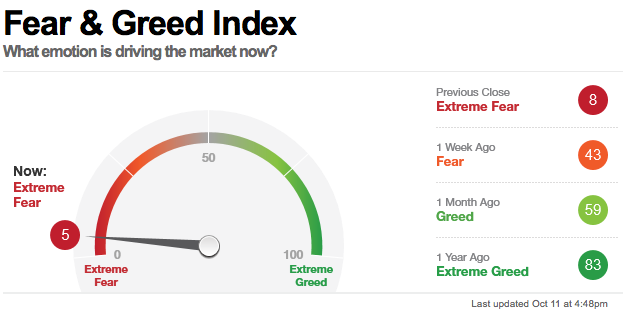

CNN/Money Fear and Greed Index is now at 5. This is the lowest reading in 3 years. Folks, we didnt even see a reading of 5 in February of this year or at the 19.9% S&P 500 brutal sell-off lows from 2016. As contrarians, there may not be a stronger buy signal.

This morning the Dow currently up 300 points higher. I’ll be closely watching the internals today…this is also the worst stretch of negative VRA System Market Internals since the February lows. That was THE time to buy.

With earnings reports resuming, so will share buybacks. That’s $80 billion/month in buying pressure.

It’s hard to buy low when everyone is bullish. We can only buy low when investors are panicky. When there is blood in the streets. The bottoming process is just that…a process that can take time to play itself out. So, while I do not recommend chasing this higher open, every VRA Portfolio buy rec remains a buy rec.

Big picture points to remember:

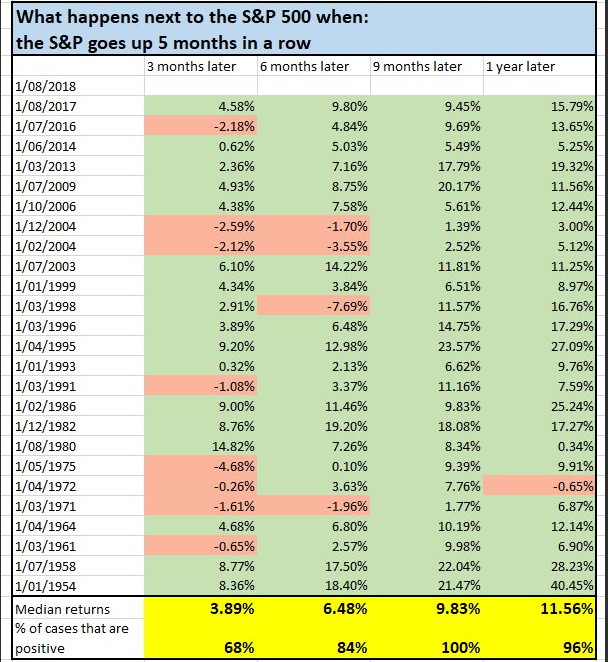

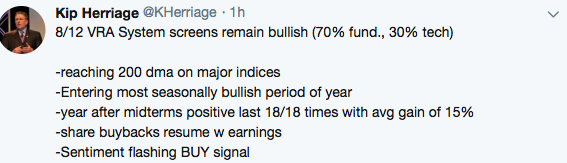

1) October is typically a wild month. It gives us our best buying opps. Mid-October to May are our most bullish months.

2) Midterm election buy signal. Since 1946, the markets have been higher 18/18 times with an average gain of 15%.

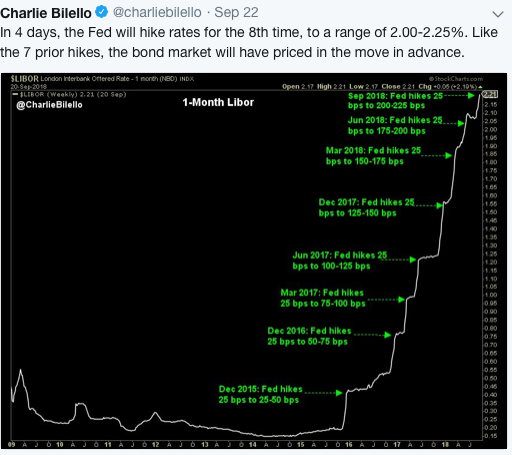

3) the FED has raised rates too quickly. Fed Chair Powell signaled “numerous” hikes were on the way back on 10/3, which kicked off the current sell-off. The bond market is rallying this morning…it will soon take stocks with it.

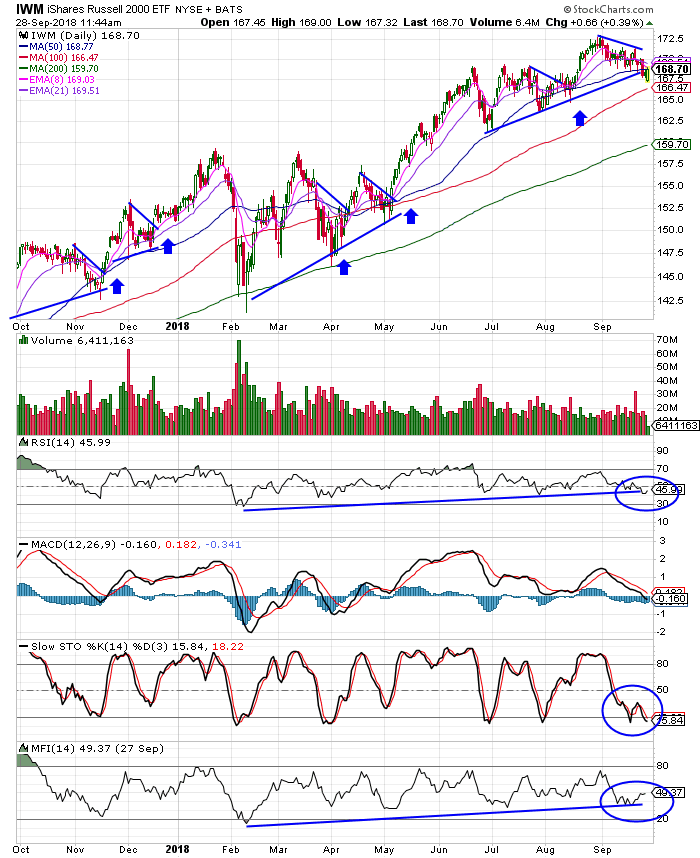

The Russell 2000 is now hitting Extreme Oversold across the board. These levels do not last long. Right behind the R2K is Nasdaq (heavily/extreme oversold) with the Dow and S&P 500 likely reaching these levels today.

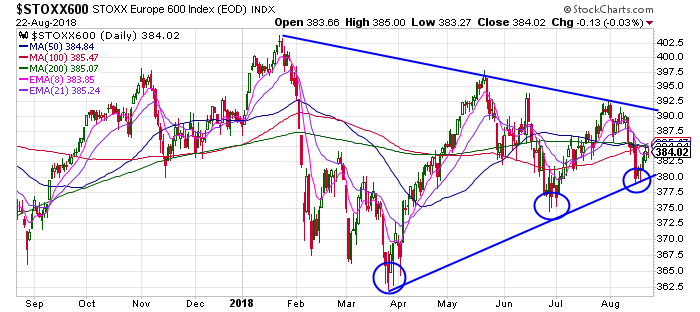

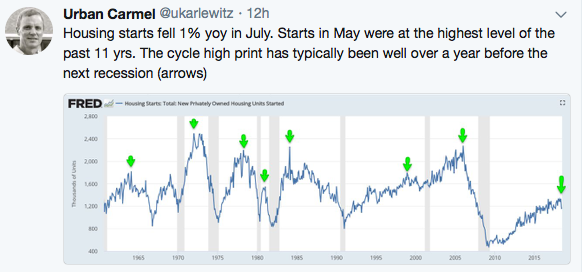

Now take a look at XHB (homebuilder ETF). While still up 16% from election level lows, XHB is now down 25% from its January ’18 highs.

It’s now reached the worst levels of extreme oversold since the ’08 crisis (MACD, RSI, MFI and stochastics). Blood in the streets.

Bottom line: XHB has not been this oversold in a decade. This sell-off in the homebuilders is hugely overdone. I see a sharp recovery move higher in housing stocks, along with the broad market, into year end.

Here are some short term predictions from me:

1) Trump will succeed in getting the FED to put the breaks on rate hikes. We’ve now had 8 straight hikes and unless we want a repeat of 2007–2008 (the FED hiked 17 straight times from 04–06, which helped create the GFC), rate hikes must slow.

2) The ST spike in rates will soon end. I have no problem with a 3.25% 10 year yield…neither does the market…but its the velocity of the move that has had the markets attention.

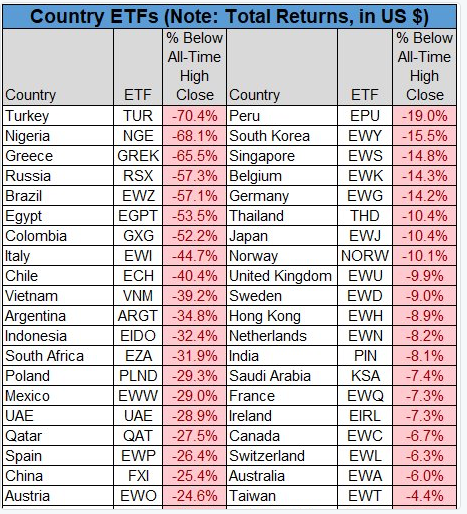

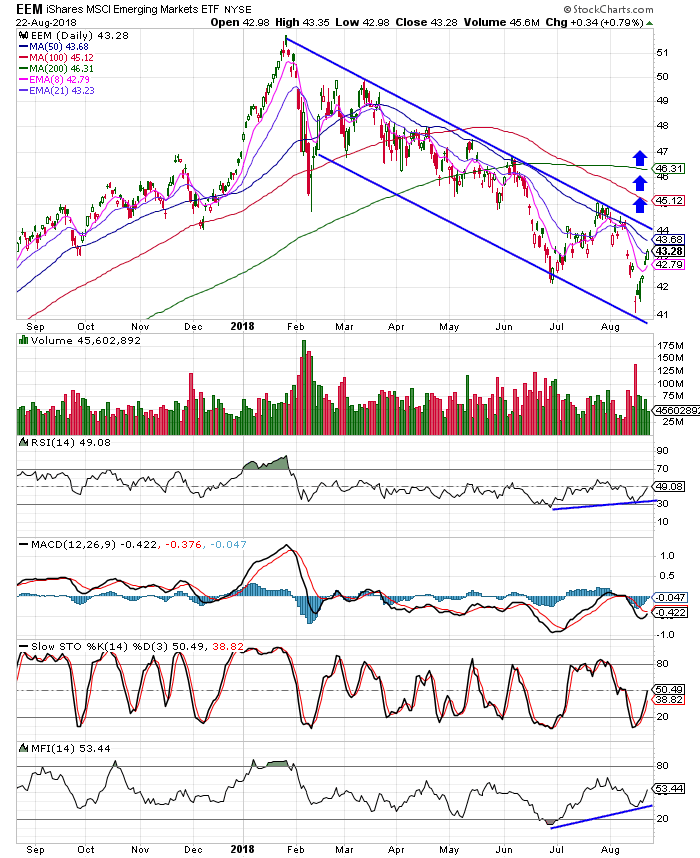

3) Emerging markets have been crushed. We’ve crushed China with it. I continue to predict that China and the US will enter at minimum a basic agreement on trade, prior to year end.

4) Unless gold catches a serious bid, we are “very” close to the end of this reset. I see no systemic issues. An important low is near.

Until next time, thanks again for reading…

Kip