VRA Update: Lowest unemployment in 50 years, Trade War continues, market sentiment, and the 1st of many Trillion Dollar Valuations

Friday, August 3, 2018 at 11:39AM by

Friday, August 3, 2018 at 11:39AM by  Kip Herriage -VRAInsider.com

Kip Herriage -VRAInsider.com Good Friday morning all,

A heads up on the broad market and VRA System readings. Weakening internals could be pointing to short term market weakness. In mid-term years, August can be a shaky month, seasonally speaking. I am not sounding a fire alarm here by any stretch, but do not be surprised to see a bit more market weakness in the near term. But know this as well; over the last 18 mid-term election years the S&P 500 has been sharply higher (post August) in all 18 years. We also know that markets that rise each month from April to July have a 100% probability of moving higher over the next 6–9–12 months going back to 1954 (10 instances).

If you noticed Las Vegas casino stocks this week…well, they got shelled. No love lost there for me…I won’t be returning to Las Vegas (for fun) until we learn the truth about the 10/1 Las Vegas massacre (which could well mean that I’ll never play blackjack on the strip again). The bigger point is that casino stocks “could” be a harbinger of a weaker US economy (tourism, discretional spending). Personally, I know “many” people that feel like I do…no reason to go back to sin city after co’s like MGM enable an attack like this to take place and then SUE the victims of the attack.

Jobs Update

Sifting through this info as jobs reports came in this morning, after two very strong months of non-farm payrolls increasing, jobs came in lower than the expected 190,000 at 157,000. However, an important point here, June jobs numbers were just revised higher by 35,000 with 248,000 jobs created in June vs the previous number of 213,000. May jobs numbers were revised higher as well, we could see this July number revised much higher in the near future, AND the overall unemployment rate just dropped to it’s lowest number in 50 years at 3.9%. Another positive point here to look at is that wage growth grew by .3%, as there is greater competition in the work force. This is a number we have been waiting to see in these wage increases on the back of Trump’s tax cuts.

Futures update

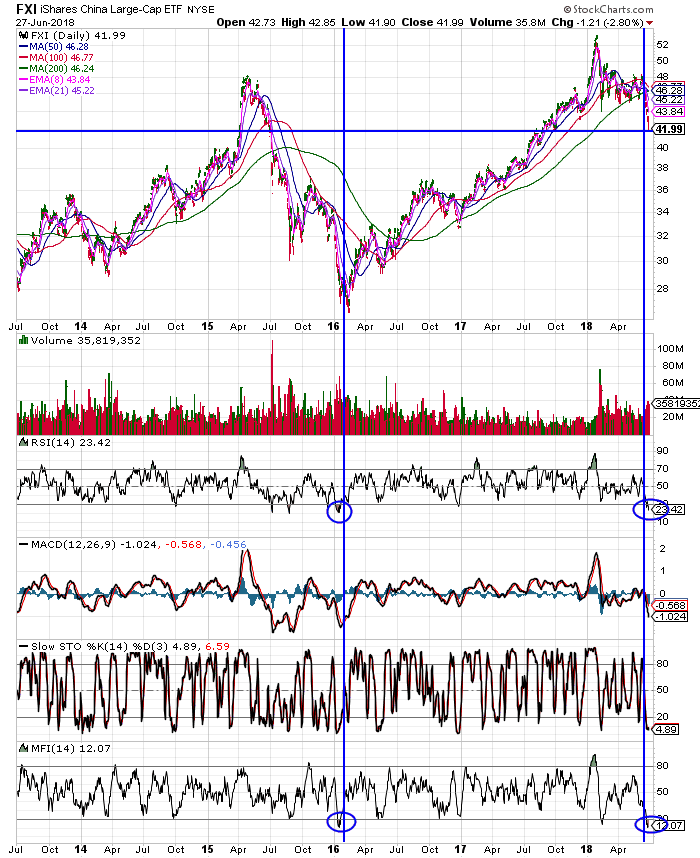

Futures were pointing to a higher open today before the jobs report was released, now looking roughly flat to negative here before the open. Another item weighing on the market, believe it or not, more talk of trade war as China is said to be imposing tariffs on $60B of U.S. goods. Again we see this as a non-issue in the long-term. China is doing everything it can to hold it’s ground as it is losing this trade war and we see more evidence this week of that as China’s stock market has just given up their ranking as the second-largest stock market in the world to Japan. This is the first time since 2014 that China has ceded it’s position as the second largest stock market in the world.

Sentiment

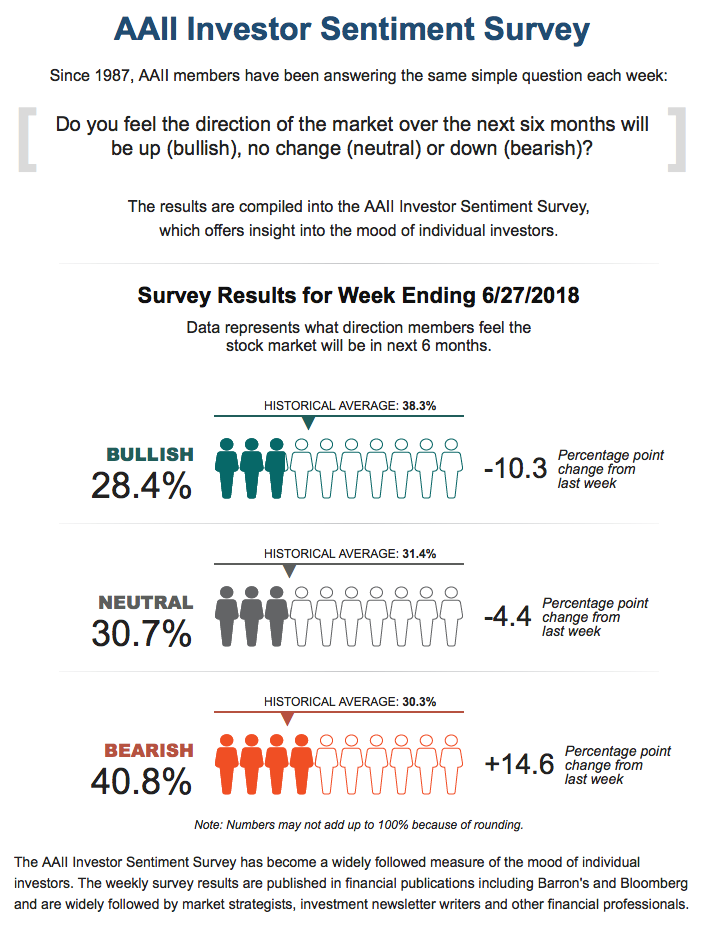

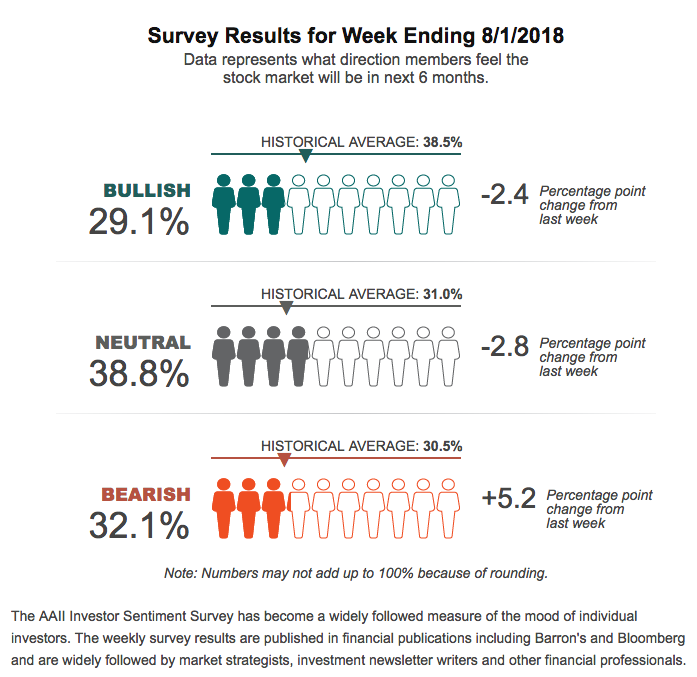

AAII and the CNN Money poll came in at different ends of the spectrum this week, something that we found interesting, first below is the AAII survey and Kip’s tweet on the results

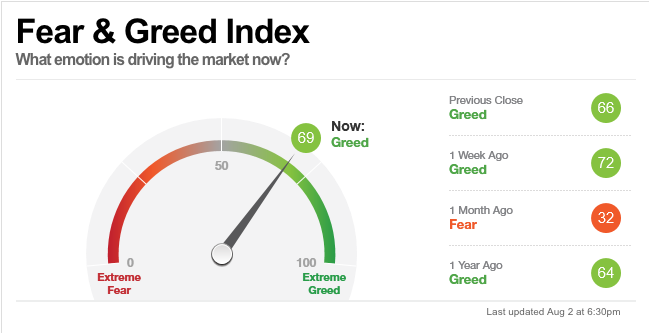

The CNN Money Poll looks a little different now at a 69 level of greed, however, this is down 3 points from last weeks reading

Now we do have to say, this poll makes a little more sense as we simply do not see how one can be bearish right now. With both fundamental and technical factors screaming positive signals, as of right now 10/12 VRA Screens still remain very bullish.

And no we do not see any reason to be concerned by the slight greed level from the CNN poll, as we reference here often, until we get to the point where AAII is showing us that 50–60% of investors are turning bullish for an extended period, we will see no reason to be concerned. The market loves to fool as many people as possible and we simply aren’t at those levels yet, this is just not how market tops happen.

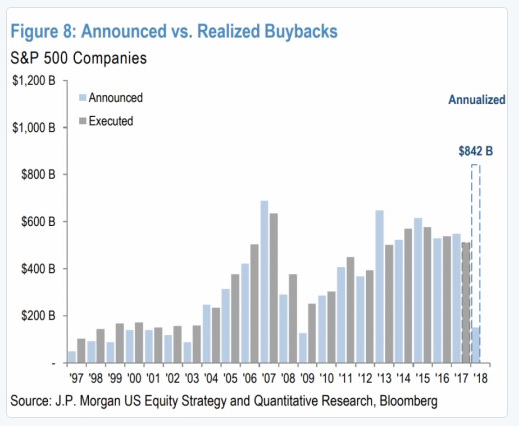

Another reason to be bullish, share buybacks

Now that we are almost out of the earnings blackout period, that we have referenced here often, we should see share buybacks coming in higher than ever to close out the rest of this quarter. Before the year began estimates were that with tax cuts there would be roughly 800 billion in share buybacks, and as we approach the end of the year, it looks like it could be even greater than that.

Check out this tweet below from a great follow, bull markets co

As you can see, share buybacks are already well ahead of the last 9 years, what you can’t see is that this is actually the highest level of share buybacks in history. With a record level of share buybacks by far, pair this with the record breaking lows we continue to see in many sectors of unemployment, it is a very hard time to be bearish on the direction this market is heading, at least in the short term.

What the 1st Trillion Dollar company means for the market

As we just had the first company in human history reach a $1 Trillion Dollar Valuation, Apple, some are worried that this could signal a similar market top to the 2000 Dotcom bubble top when Cisco hit the highest market cap at the time, valued at $550 Billion before losing three-quarters of it’s value in the next year.

What people forget is that breaching the $500 billion market really opened the door for other companies to reach $500 billion and head higher than this never-before-seen $500 billion mark. We see this as a domino effect, over the next few years we will see companies like Amazon, Google (alphabet), Microsoft, and more begin knocking down the door of a $1 trillion dollar valuation. Just like the $500 billion mark, $1 Trillion dollar valuations will become the new norm for the world’s largest companies.

Until next time, thanks for reading and have a great weekend.

Kip