Good Wednesday Afternoon all. I'd like to wish everyone in the US a very happy Thanksgiving. Markets are closed tomorrow and open for just a 1/2 day on Friday. Yours truly will be back with you first thing Friday morning (at the latest).

VRA Market Update: First, the fundamentals.

As you know, I am hyper-bullish on both the economy (US and global) and the stock market. My LT target for the Dow Jones is 35,000. Of course no one knows for sure...but as I've written for a very long time, until a euphoria filled move higher takes place that gets everyone uber bullish, we will not see a market top.

Watching Bloomberg this morning I found the rare Wall Street portfolio manager that agrees with me.

He makes an excellent point. I see FAR too many that continue to fear monger investors that stocks are overvalued. They are not. By my estimates, today the DJ should be trading at 28,000...we're headed there at a minimum...likely far faster than most believe could take place. This is the beginning of the melt-up.

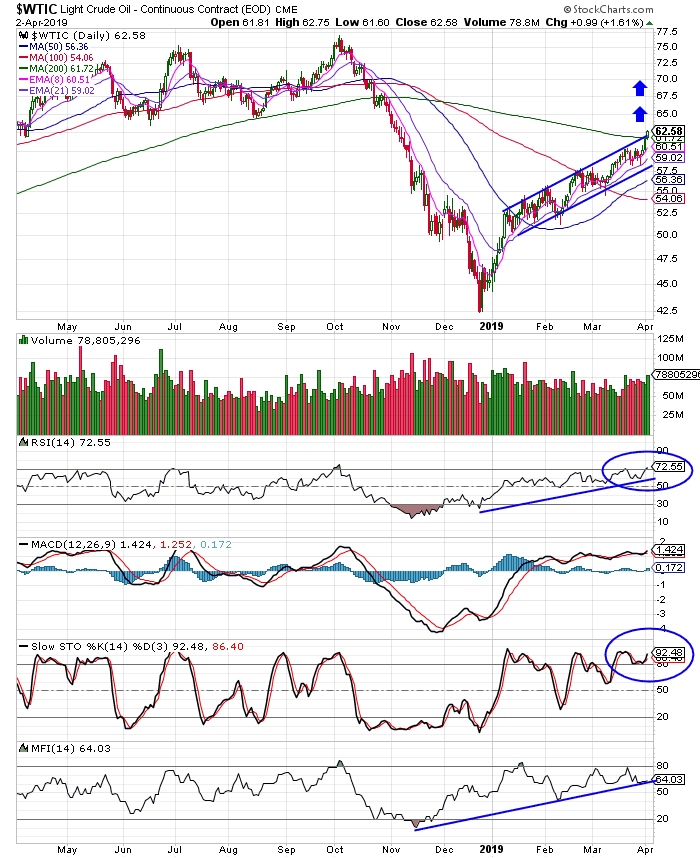

OIL IS FLYING

This morning, the breakout in oil is continuing, with near $58/barrel prices, levels not seen in more than 2.5 years. Take a look at this beautiful chart.

Once we broke through $56, there was little doubt that the next big move would be higher. Again, "volume precedes price movement"...see the massive volume increase in oil over the last year? This chart looks similar to what we're seeing in every major industrial metal...long term, large volume moves higher. This tells us that the smart money is coming in hard and that this move will be more than just a minor breakout higher. BTW, we also see very similar looking charts in gold and silver...as I'll show you next.

Silver

Here's the 2 year chart of silver I referenced. Again, check out the explosion in volume. Combined with the fundamental story of a big global economic recovery (silver is as much an industrial metal as it is a precious metal), plus the fact that inflation will be one of the biggest macro themes going forward, precious metals must be owned. Of course this is even more bullish for the miners. Watch what's about to happen with this sector...coming out of the FED rate hike...we've seen moves of 10% to 127% in GDX (mining ETF) over the last 4 rate hikes. We're going to make SILLY money here....and we're certainly due. Patience will soon be rewarded.

GOLD

Gold is being bounced around like its on a pinball machine. Watching the day to day drip. drip drip in gold/silver/miners, with continued price suppression schemes of the manipulators has reached absurdity, as you'll see in an article from GATA in just a moment.

First, take a look at this LT 4 year chart of gold.The 200 day moving average sits at $1265/oz, meaning that gold is just $10/oz above. Still, everything about the chart below says that it must be owned here...same with silver...and of course the miners.

For one, check out the huge volume increase in just the past year. My mentors taught me that "volume precedes price movement" and based on this single fact alone, the next major move in gold should be higher...much higher.

The FED is set to raise rates again in December. It's my continued belief that while precious metals may be "soft" heading into the rate hike, just as we've seen with the last 4 rate hikes, once it is completed we can expect a big spike higher. Yes, that means we have a couple of weeks to sweat it out...not much we can do about that... gold, silver and the miners will rally hard into year end then into 2018. Inflation is back...we see it everywhere we look...inflation is golds best friend.

The article below, from GATA (gold anti-trust action committee) spells out the atrocity that is the price suppression scheme of central banks and their favorite global mega banks.

This quote sums it up best...92-1 ratio of paper gold to physical gold. This is the criminal amount of dilution that we are hit with daily....

Zero Hedge writes: "According to the Reserve Bank of India's estimate, the ratio of 'paper gold' trading to physical gold trading is 92 to 1, meaning that the price of gold on the screens has almost nothing to do with the buying and selling of physical gold.

Dear Friend of GATA and Gold:

Zero Hedge called attention to Friday's column by Gillian Tett of the Financial Times, to which GATA also had called attention --

in which Tett speculated, as many in the gold sector have done, that the futures market being planned in bitcoin by CME Group would tend to suppress the cryptocurrency's price.

Of course the use of futures markets to suppress gold and commodity prices has been one of GATA's themes for a long time, and a theme of the British economist Peter Warburton for even longer:

So Zero Hedge concluded its post by suggesting that Tett now pursue the gold price suppression angle, noting that GATA has been urging just that on the FT for quite a while.

"This makes the gold market and, therefore, the gold price something of a mockery." As Zero Hedge has highlighted time after time, the gold price has frequently been subject to waterfall declines, as huge volumes of gold futures are dumped on the market with no regard for price. ...

"Perhaps the FT journalist, Gillian Tett, could write an article on gold, instead of bitcoin, explaining how the price of the former -- a widely viewed indicator of financial risk -- is being suppressed by derivative trading. Indeed, Tett was present at a private dinner in Scott's of Mayfair several years ago when the Gold Anti-Trust Action Committee gave a presentation on exactly the same process she expects to lower the bitcoin price."

Zero Hedge's commentary is headlined "Financial Times: Sell Bitcoin Because the Market Is about to Become 'Civilized'" and it's posted here:

Housing Market Rally

As you know, I'm "all-in" on the Trump bull market and ongoing US economic recovery. That's no secret to anyone that's been reading the VRA, since the election.

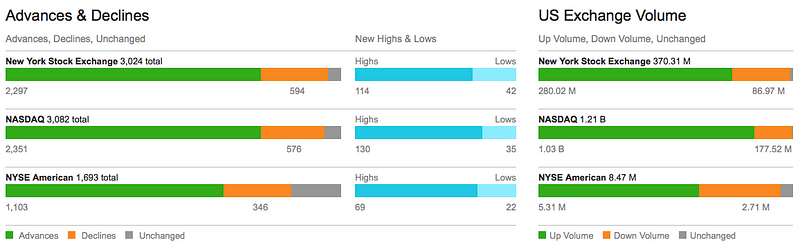

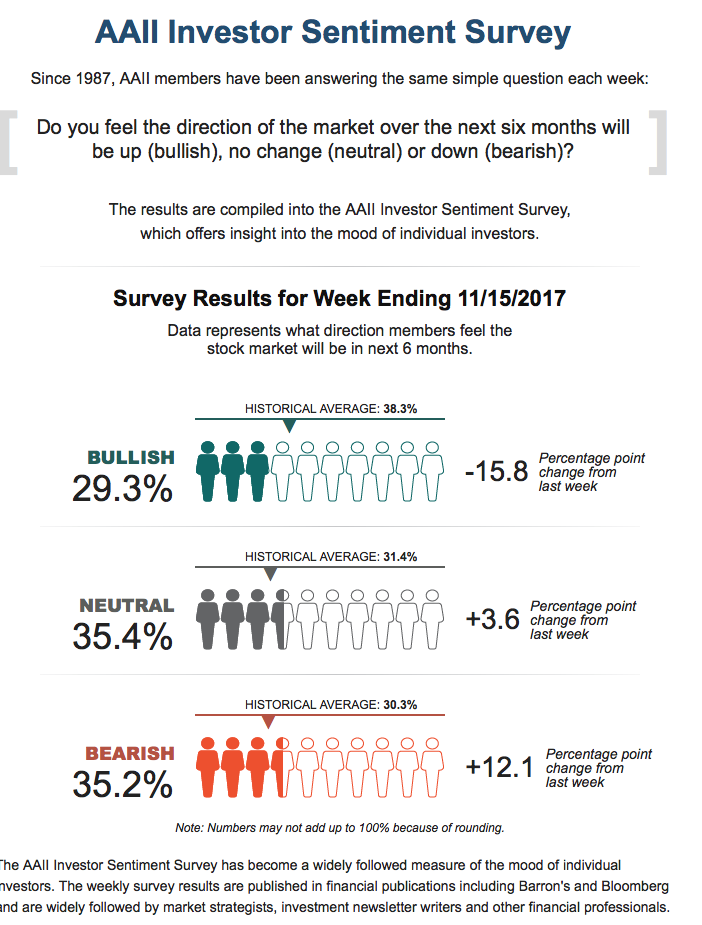

From a quick return to 3% GDP to the remarkable recovery in consumer confidence and spending, one thing is crystal clear; this economic recovery (both in the US and globally) has at least 2-3 years to run. The good news for us, as we witnessed again this past week, is that investors continue to be more bearish than bullish (as we saw in the AAII Investor Sentiment Survey). As a contrarian, bearish investor sentiment is exactly what we want to see. Bearish sentiment confirms for us that we are nowhere near the highs for this bull market. Those highs will come when the AAII survey is 60% + bullish...and for weeks/months on end. Those highs will come when everyone is adamantly bullish and (like me) and predicting Dow Jones 35,000 by 2020.

And of course one of the biggest reasons to be bullish today...seasonality. 90% + of all market gains come during the November to May time frames.

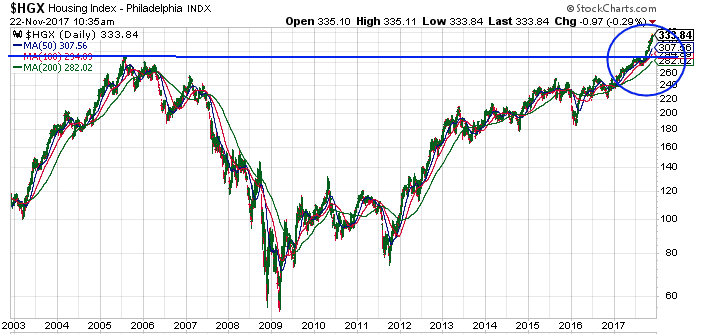

But for those looking for clear proof that the US economic recovery is not only real but still in its infancy, the chart below should provide that proof.

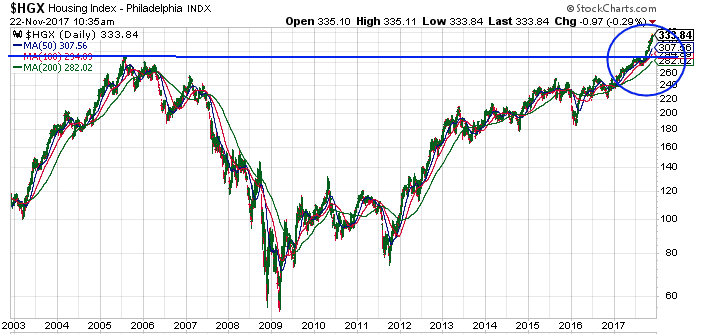

Below is a 15 year chart of HGX, or the US Housing Index.

In 2005, housing topped out. In 2006, housing began to plummet. It was at this time that the VRA began to recommend caution on both the economy and in stocks. I may have been about 6 months early, but I know that my warnings helped many to either sell their real estate or simply put off buying more of it.

In 2008, the crash was on. And what a crash it was. Most Americans are still digging out from the Great Financial Crisis. At least that was the official title our financial charlatans assigned to it. As always, we should ignore what these wrong-way PHD economists tell us....because here's the hard core truth; the US was actually in a "Depression" for 4 years. That's right...we actually went through an economic depression.

With GDP barely averaging 1% during this time frame, when you remove the 1.4% in GDP that the income for government workers provides for the US economy, from 2009-2013, the US was actually in a tough depression.

This is why, in early 2013, the VRA went from LT bearish on the stock market to LT bullish...and I've remained LT bullish ever since.

Now, take one final glance back above at the HGX chart. That blue circle tell us where we are today....fresh all-time highs. And here's what matters most; when markets break out to new all-time highs, that breakout actually marks "the beginning" of the move higher...rather than "the end" of the current move. I can find no example of fresh 10 year highs in any market that then signaled reversal, once those new all-time highs have been reached. Not a single example.

Barring a black swan event, a ramping housing market, along with US income tax receipts at record highs and the bullish combination of sentiment and seasonality, we have no choice but to remain fully invested. We also have no choice but to be highly bullish on prospects for the US economy.

It's for these many reasons that I can now predict an end to the long term destruction in US retailers. As my son and research assistant Tyler reminded me this week, "Amazon is not the only company that's learned to use the internet to grow their business. The weak hands have already been driven out of business...today, only the strong have continued to survive".

Now, take a look at this 2 year chart of XRT (Retailer ETF). First, XRT remains 13.5% below its 2016 highs...in this kind of powerful bull market its hard to find any sector that's down this much from its highs. As a contrarian, we love this disparity.

For all of the myriad of reasons I've written about, I expect this highly bullish seasonal period (November-May) to produce the next ramp higher in the broad markets. Last week the bears had their chance to take the markets lower with back to back intraday DJ losses of 150 points. But the bears look to have failed, as the markets came roaring back mid-week (outside of a Friday -100 point day).

For the DJ to reach my 25,000 target by year end we'll need to see a 6.8% move higher to close the year out. Admittedly, that's one heckuva Santa Claus rally, but whether or not we reach 25k by year end, I remain highly confident (based on VRA System readings) that a sharp move higher is directly in front of us.

US markets look near-perfectly poised to have a strong close to this holiday shortened Thanksgiving week and then begin their next spike higher to fresh all-time highs into end of year. Based on the VRA System, we MUST stay fully invested in the market.

Finally, I'm looking for a vey solid close to trading this week, and a continuation of a big move higher into year end. We are positioned well. The best value that I see today resides in energy, precious metals/miners, biotech and the retailers. Until the facts change, this is how we'll continue to stay fully invested.

Until next time, thanks again for reading....have a very Happy Thanksgiving!

Kip

To receive two free weeks of the Daily VRA Updates, sign up at VRAinsider.com

Wednesday, November 22, 2017 at 11:11AM by

Wednesday, November 22, 2017 at 11:11AM by  Kip Herriage -VRAInsider.com

Kip Herriage -VRAInsider.com