VRA Weekly Update 12/29/17: Happy New Year! The January Effect. VRA 2018 Game Plan.

Friday, December 29, 2017 at 1:28PM by

Friday, December 29, 2017 at 1:28PM by  Kip Herriage -VRAInsider.com

Kip Herriage -VRAInsider.com Good Friday Morning All,

In March of this year I predicted DJ 25,000. We’re almost there. Today, I could not be more bullish. Not on the economy, not on the markets and not on the future of our great country. How weird was it that everyone was proudly saying “Merry Christmas” again this year and that we noticed the huge difference from years past?? That’s a sign of things to come that I wrote about in my book, Crashproof Prosperity: Becoming Wealthy in the Age of Trump(download here).

Market Update

US equity futures are trading higher this morning, as we get one final opportunity to crack 25,000 on the Dow Jones. Should the DJ close 163 points higher, 25K will become a reality.

In reality, DJ 25k means little. The VRA System is structured to give us maximum exposure to the groups with the highest probability for big gains, regardless of what the broad market does. Today, these opportunities lie in precious metals and miners, energy, biotech, retail and of course, small cap story stocks…

2018 Snapshot

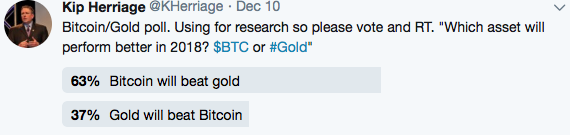

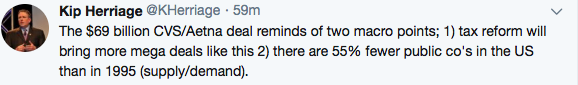

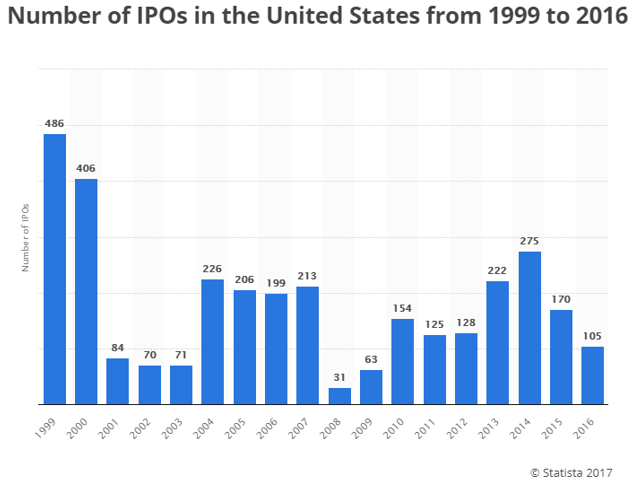

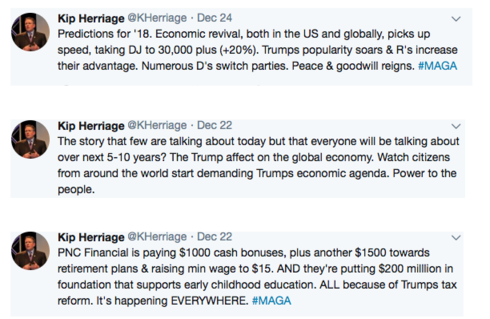

For those that don’t follow me on Twitter, here’s a snapshot of my thoughts about the New Year.

The amount of money thats about to flood into the markets….as all of the year end bonuses and retirement/pension/401k money comes storming in….could send the DJ up 1000 points in just 2–3 weeks.

This is what I expect to see….I’ll be surprised if it does not happen. Just wanted to put this on record.

The January Effect

From my first year in the business (1985) I was taught…by two great mentors (Ted Parsons and Mike Metz, RIP both) about the investing power of the January Effect. Here’s the official definition:

“The January effect is a seasonal increase in stock prices during the month of January. Analysts generally attribute this rally to an increase in buying, which follows the drop in price that typically happens in December when investors, engaging in tax-loss harvesting to offset realized capital gains, prompt a sell-off.

The January Effect produces some of the best short term gains of the year, as stocks that were sold in December for tax purposes come roaring back in the first month of the new year. This applies even more so to small cap stocks that sell-off in December…when liquidity is low…sending the shares of small cap stocks lower, only to snap back quickly in January. In 2018, I look for the January Effect to be powerful

IWM (Russell 2000 ETF)

IWM is displaying one of the most bullish chart patterns you’ll see. A rising bullish wedge, that is compressing into a coiled spring. It’s also flashing buy signals on every important technical and at least 1 week away from reaching Extreme Overbought Levels on the VRA System. IWM is comprised of small cap stocks…with some mid caps as well…but this is the group that will benefit most from the January Effect. This is of course the sweet spot for the VRA Portfolio.

GOLD BACK ABOVE $1300

As I write, gold is trading at $1302/oz with silver back to $17/oz. This places both gold and silver back above every important moving average (50, 100, 200). Highly bullish (while ST overbought).

Here’s my tweet on gold’s recent trading pattern from yesterday.

This trading pattern is highly bullish. It most often occurs before major spikes higher. Our biggest concern? The return of the price suppression manipulators, the global central banks that have kept the price of gold cheap for many, many years. Will 2018 be the year that the price suppression schemes finally fail? I am most hopeful. It’s a major component of my $2000/oz price target for gold.

In this scenario, the miners will explode higher. Especially the VRA Portfolio miners. As always, I’ll be watching closely. However, there is one item that concerns me that I mentioned on Twitter this morning.

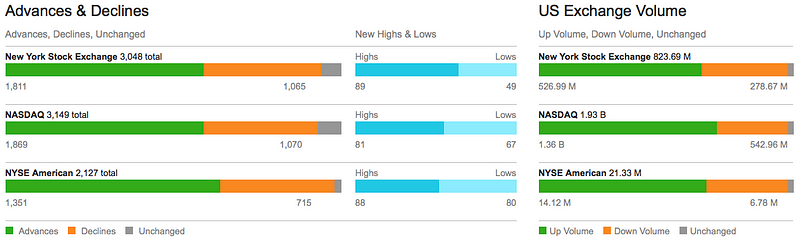

Volume Proceeds Price Movement

OIL

I was bearish on oil at $100/barrel and remained bearish until oil bottomed at $26 (I called the bottom at $32). Take a look at this 3 year chart of oil. Notice the volume surge? This told me that smart money was coming in…likely in a major way. My target for 2018 is now $70 (minimum) but I would not be surprised to see $75–80. The global economy is back…of this there can be no doubt. Great for oil and energy stocks.

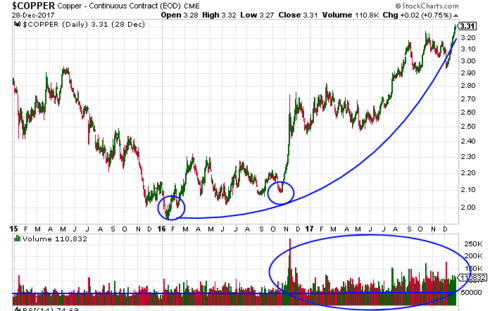

COPPER

Or Dr Copper as its commonly referred to, one of the best all-time indicators for economic growth. In this 3 year chart we see a major increase in volume. I called the global reflation trade here, in these pages, at the beginning of 2017. Copper is now on its best run in close to 3 decades.

Volume precedes price movement. A most important lesson from my mentors….some 30 years ago.

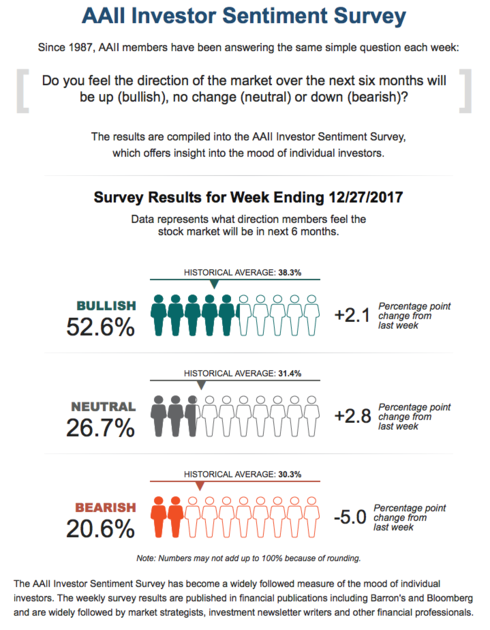

AAII Investor Sentiment Survey

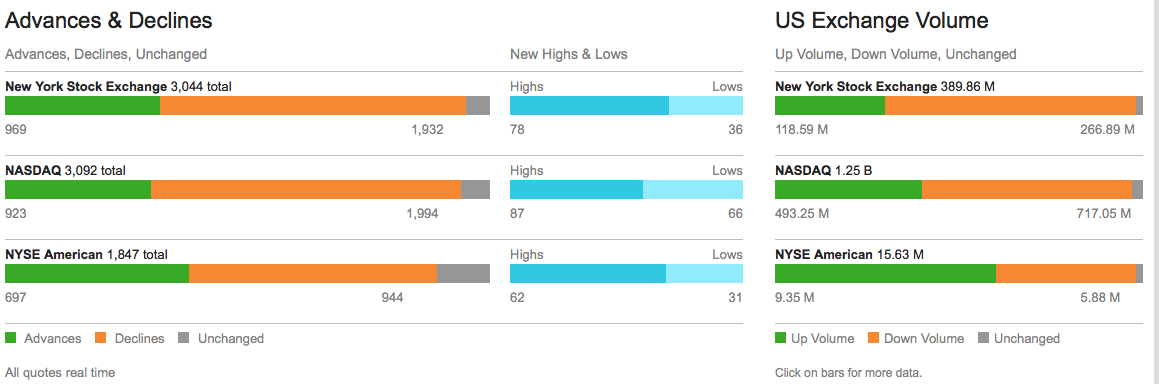

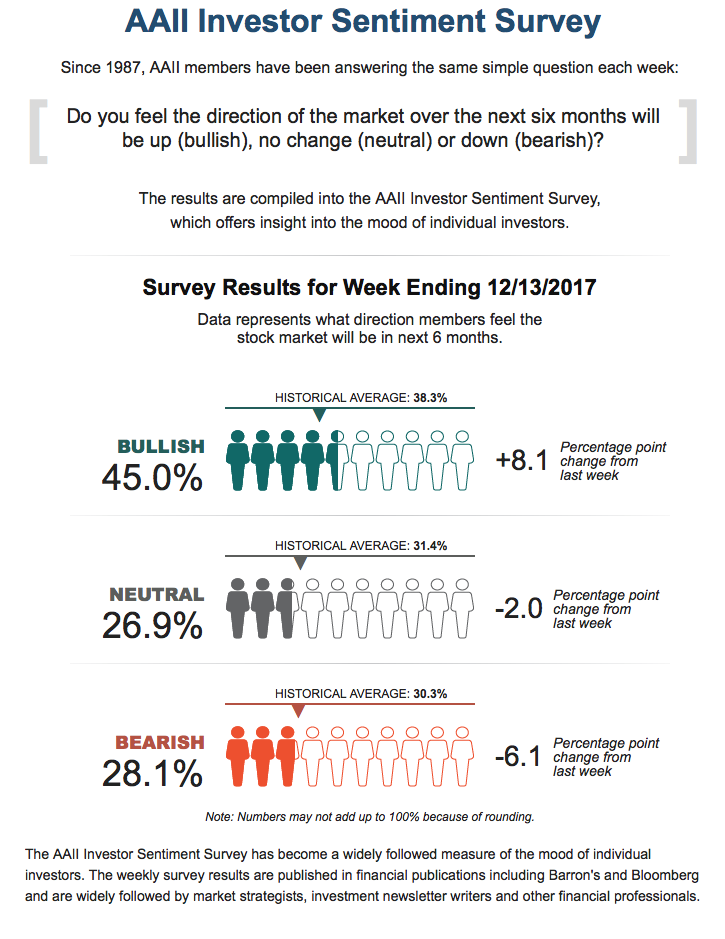

Here’s the latest from AAII from Wednesday. Well folks, its finally happening. Investors are getting bullish. This reading shows bulls at 52.6% and bears at 20.6%. I see no real reason for caution here….but once we start approaching 60% readings we will be forced to be more cautious on the broad market. But…its happening just as we expected…just as we cover here weekly.

I’ll close this holiday trading week VRA Update with a final macro thought; in my estimation, few are prepared for the move that is about to take place in the markets. An absolute flood of fresh money is about to come into the market…from early January retirement plan/401k/pension contributions…to investors that are deciding its finally time to get back into stocks.

I look for a 1000+ point move higher in the Dow Jones…in January…and it may even happen inside of a single week. Yes…I remain highly bullish. My system says we have no choice.

Until NEXT YEAR….thanks again for reading…have a very Happy New Year! See you again in 2018 (and on Twitter, much sooner).

Kip

Sign up to receive two free weeks of Daily updates from the VRA at vrainsider.com