In My 31 Years, This Will Be My Best Year Ever. Come and Join Us!

Saturday, February 18, 2017 at 1:51PM by

Saturday, February 18, 2017 at 1:51PM by  Kip Herriage -VRAInsider.com

Kip Herriage -VRAInsider.com In My 31 Years, This Will Be My Best Year Ever. Come and Join Us!

Hi, it’s Kip again. I’ll keep this very brief…2017 will be my best year ever in beating the markets. If you’re serious about making more money with your investing than you’ve ever experienced, take 2 minutes and keep reading.

In just the last 2 months (from December 20th to today), my VRA Core Portfolio (which contains ALL of my recommended stocks) has a net gain of 570%, with an average gain per stock of 71%. All “time stamp” documented.

I am recommending just 8 stocks to my Members (I never recommend more than 10, at any time) and while the actual stock selections are for VRA Members only, here is exactly how each stock has performed…since just December 20th, 2016.

+201%

+122%

+36%

+91%

+183%

-13.6%

+10%

+23%

8 recommended stocks, with a total “net” gain of 570%...for an average gain of 71% per position.

Here’s an email I received just this week from a VRA Subscriber:

“Kip, after losing money in the market with my broker year after year, I have finally found the one guy that not only makes us incredible money but that actually seems to care about OUR success. 500% gains in 2 months. WOW. I read your early morning updates right when you send them out and they are by far my favorite emails of the day. My wife and I sincerely THANK YOU!”

TK and MK, Miami, FL.

I said I would keep this brief. Many of you have followed my work for years…some for decades…now is the time to make sure you are a Member of our community. My VRA Trading & Investing System is unlike anything you’ve seen before. I know, because I created it…no one else has it…it is my propriety work.

* Each morning I email you before the US markets open. I tell you exactly what to own, exactly what price to pay and then exactly when to sell and take profits.

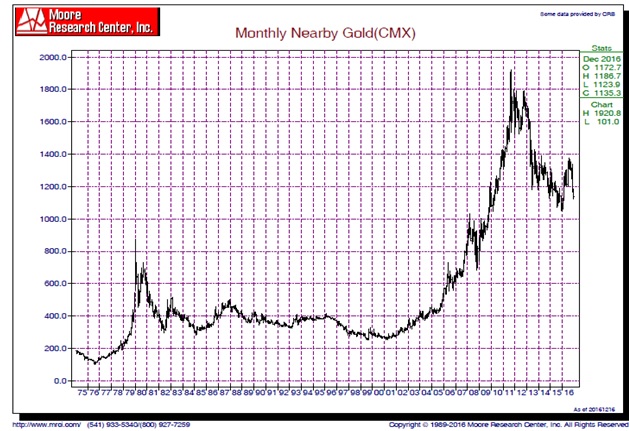

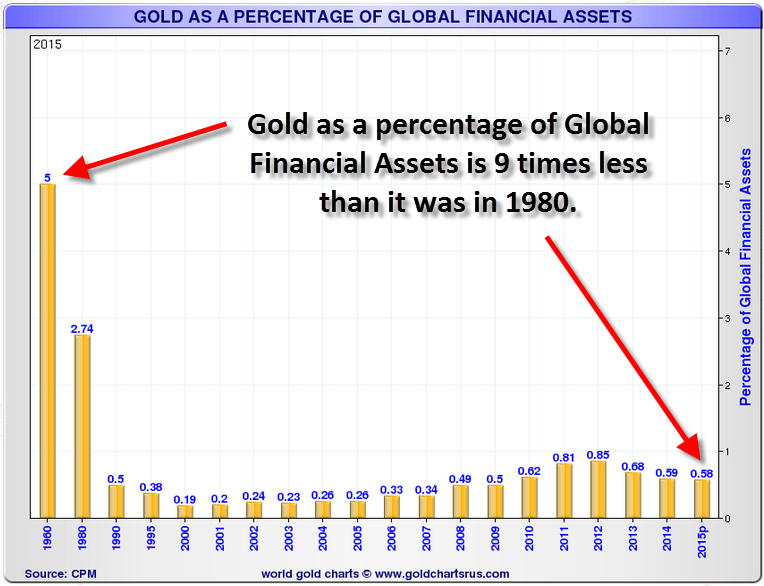

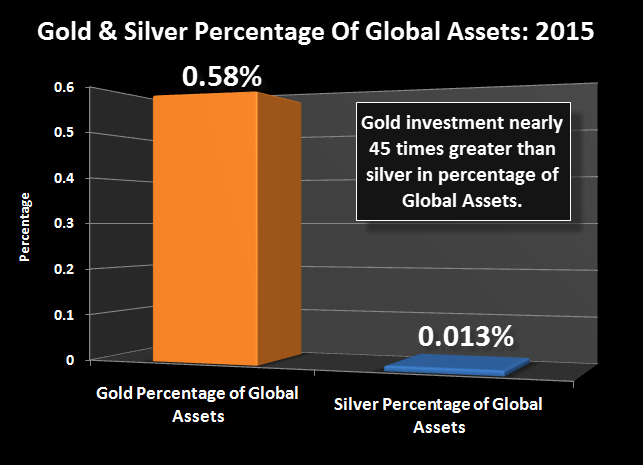

* Your VRA Membership also comes with my two VRA Special Reports (“Making a Fortune in Precious Metals and Mining Stocks” and “Kip’s Stock of the Century”). My Stock of the Century is an unknown energy company with more potential than any stock I have ever discovered. Just this week it soared 142%but that’s nothing compared to what it’s about to do.

* Your VRA Membership also comes with your private Members Site, my VRA Core Portfolio and every VRA Update that I have issued going back to 2005.

It’s my sincere hope that you’ll act on this invitation. For the next 72 hours you can join us for either 6 months or a full year, with a huge discount of 75%.

Simply go to VRALetter.com and click the “Join Us Now” tab.

1) For your 6 Month Membership, use promo code: vra6month

($495, or 75% off from $3995 web site price)

2) For your 1 Year Membership, use promo code: vragold

($998, or 75% off from $3995 web site price)

Offer is good for next 72 Hours….

We look forward to welcoming you to the VRA!

Sincerely,

Kip Herriage

VRA Founder/Publisher (2003)