VRA Investment Update: Structural Bull Market of Size and Scope. Q4 Earnings. Investor Sentiment Buy Signals. CV Insanity; Wake Up DC, Wake Up America!

Thursday, January 13, 2022 at 10:19AM by

Thursday, January 13, 2022 at 10:19AM by  Kip Herriage -VRAInsider.com

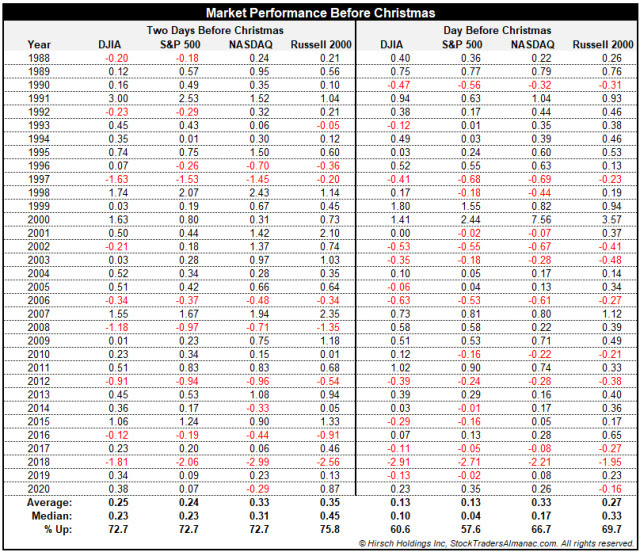

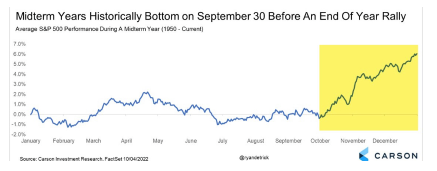

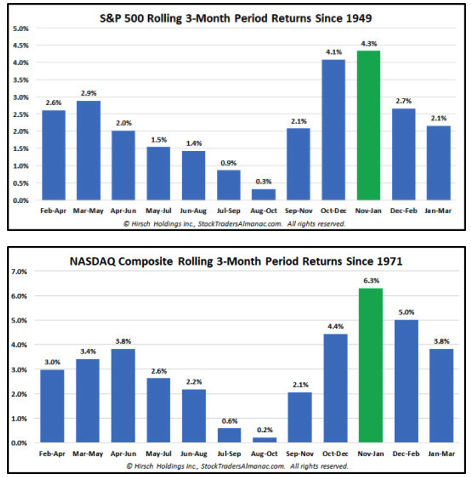

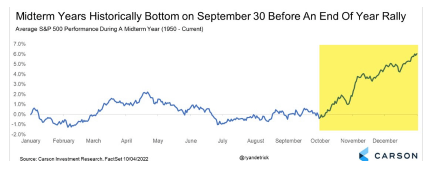

Kip Herriage -VRAInsider.com Good Thursday morning all. After a solid open, following the worst inflation data in the US in almost 40 years, the markets traded listlessly throughout the rest of the day but importantly, the internals do continue to show improvement.It’s not the news that matters most, it’s the markets reaction to that news. Tomorrow kicks off Q4 earnings reports in style as big banks begin reporting (Citi, Wells, JPM, Blackrock). While US markets never reached heavily/extreme oversold levels on the VRA System, even as tech had a quick 10% correction, we may have just seen the lows for the near term. Semis and tech continue to lead, the internals are improving and we expect earnings reports to “significantly “ beat analyst estimates once again. Frankly, that should be the theme throughout the year, even as yes, the midterm election year in the 2nd year of a presidency tends to be weak.

We’ll continue to pick our spots with our ETF’s, while focusing on our top growth stocks that should (significantly) outperform the broad markets. We’re also in the best period of the year for small caps.

Investor Sentiment

Last nights AAII Investor Sentiment Survey, which I’ve voted in for more than 30 years, came back with sharply bearish readings, with bulls falling a big 8% to 25% and bears rising to 38% (+5% on the week).

As contrarians, this is just what we want to see. 25% bulls, just a week or so away from ATH’s in the S&P 500 and Dow Jones can only be called “massively bullish”.

Bit of a mixed bag here, as the Fear & Greed Index never really got hit hard during the last downdraft, with a reading today of 64 (Greed). Frankly, this is in line with how sentiment should be acting.

As a reminder, we would not want to start taking significant profits until the Fear & Greed Index is hitting 85+.

Rona is ending (except in blue states..sorry friends), we’ve just had a 10% shake-out correction in tech, Biden is a lame duck and the midterms get closer with each passing day.

And yes, this still feels (kinda sorta) like Bill Clintons presidency to me, home to the best 8 years for the stock market in US history. Biden can try all he wants to rule by fiat (Executive Orders), but unless our SCOTUS has completely sold out to America hating communists…I don’t believe thats even close to being the case…Biden will soon have no choice but to work with a deeply red and much more MAGA-ish house and senate.

Tyler and I continue to see this as the best set-up for our markets since 1995–2000. And yes, we love the fact that we’re about the only people you’ll find saying it.

This bull market is entirely structural in nature, driven by unprecedented liquidity, surging corporate earnings…which will soon blow away estimates again…and powered by the most important economic and leading indicator elements of housing and transpiration. As long as housing and the trannies are on fire…they very much are today….the US economy will continue to be on rock solid footing.

Even with this mornings inflation reading of a hot 7% CPI (year over year), the structural components of both the economy and markets should continue to power stocks higher. Bull markets do not end until corporate earnings top, which we still see as a 2026-ish event.

As to the bond market and higher rates, you know our thoughts. Rate hikes are bullish for stocks. And no, we will not have 4 rate hikes this year. Today, there are a record number of shorts in the treasury market, meaning that even when we get a hot CPI number, the path of least resistance is lower for yields (as the shorts cover). It’s one of the best times in my career to be a contrarian, when it comes to rates. Most all economists move in lockstep…they are monoliths…driven by what their employers at the Fed command. Lower rates, for longer, remains the smart money play.

CV Insanity Update

While we continue to see highly encouraging signs that CV insanity is ending in the US, we must keep a close eye on these authoritarian tyrants that wish to turn the planet into a dystopian communist monolith.

Have you see the new walls/barricades that late yesterday started being erected around the White House? What exactly is going on here?? All while our nations capital is full-on totalitarianism, requiring that before you leave your home you must have your vax papers and ID. Lets see if we have this right; it’s racist to require ID to vote, but completely fine to require ID’s to leave your home. WHAT? Where are our R elected officials, who should be screaming from mountaintops? Outrageous!!

And folks, it’s becoming equally dystopian here in Texas, as Houston Methodist Hospital has announced they are requiring all employees to have their booster from March 1 or be fired. As we’ve said for close to 2 years, we must stop complying…because they won’t stop pushing. Governor Abbott, please come out of hiding and answer the calls for a special session of congress to make tax mandates illegal. Your EO is doing exactly nothing. Texas needs new leadership. Feels like Beto o’Rourke is Governor today.

Here’s the bottom line. If we keep complying, they will keep taking. And taking. And taking. Are you awake yet?

First it was ‘prevent transmission’.

Next it was ‘prevent symptoms’.

Then it was ‘prevent hospitalization’.

Then it was ‘prevent serious illness and death’.

Now? If you end up vented in the ICU, in Australia (and Canada) it means the vaccines working. Global mass psychosis.

If you think this can’t/won’t come to America, you have not been paying attention.

#DoNotComply

#Nuremberg2

Until next time, thanks again for reading…

Kip

Join us for two free weeks at VRAInsider.com

Sign up to join us for our daily VRA Investing System podcast