VRA Weekly Update: J Powell with the Rare Win. Fed Meeting Bluster & Takeaway; $2.2 Trillion in Additional QE. Buy Buy Buy.

Thursday, June 17, 2021 at 10:08AM by

Thursday, June 17, 2021 at 10:08AM by  Kip Herriage -VRAInsider.com

Kip Herriage -VRAInsider.com Good Thursday morning all. As we have covered in previous updates, as bad as J Powells track record is (once his pressers begin the markets immediately start to tank), JP actually scored a win yesterday. When he began speaking the Dow was -309 and Nasdaq -104, but by the close the Dow was -265 and Nasdaq down just -33. Not much of a W, granted, but a W nonetheless.

Markets are mixed this AM but off the lows. Gold got smoked below $1800/oz (last $1780), now trading below its 200 dma of $1843/oz.

GDX (miner ETF) just broke its 200 dma at $36.54 (last $35.40). The golden cross in GDX has yet to produce the sharp move higher that I expected. I continue to look for that to take place.

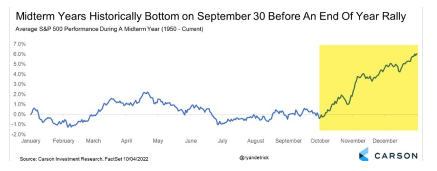

Post Fed-meeting shake-outs are infamous, in both equities and metals, but they have a high probability of being just that…a shake-out only…with the primary trend quickly reasserting itself.

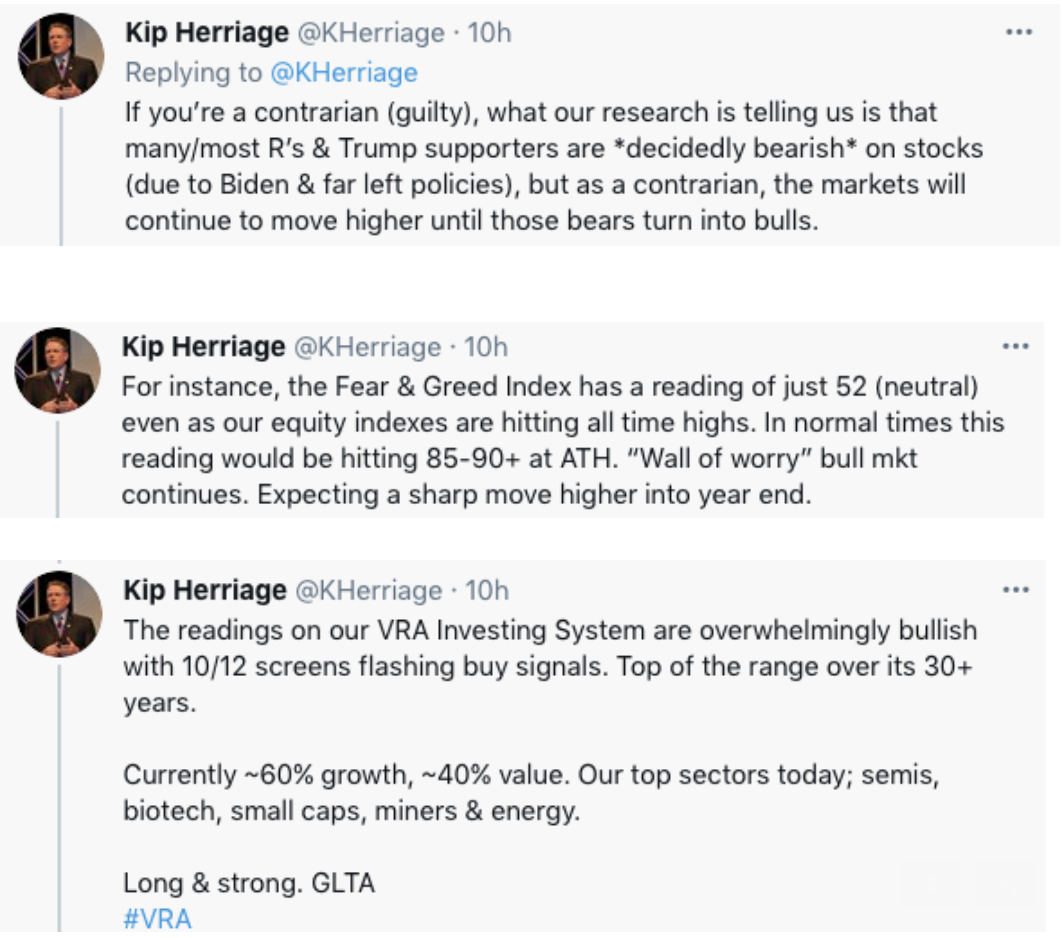

We are buyers of every VRA Portfolio Buy Rec (Check it out with our 14 day free trial at VRAinsider.com).

There’s been quite a bit of bluster from this Fed meeting but only 2 things really caught my eye;

1) the Fed raised their inflation estimates this year to 3.4% from 2.4% (even as actual human beings know that inflation is running “at least” 10%)

2) there may be 2 rate hikes in 2023 instead of only 1

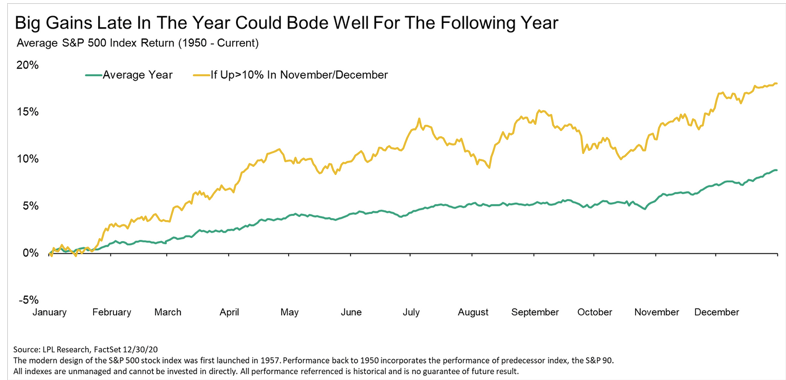

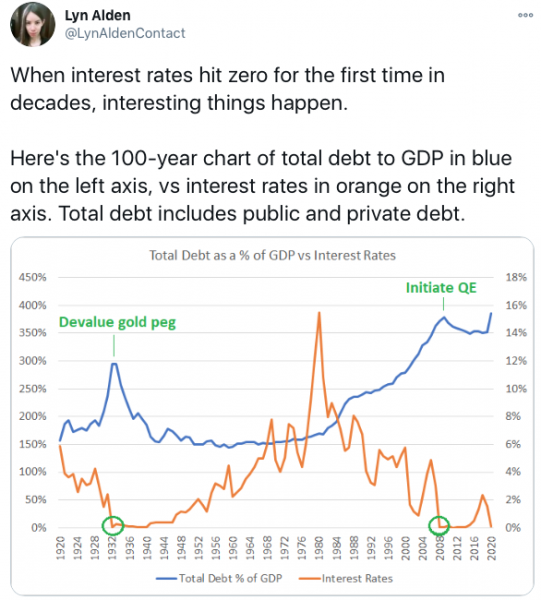

Did you catch that sports fans? We’re still talking about NO RATE HIKES for 2.5 years, and more importantly, there won’t be any tapering of the $120 billion of QE a month until “substantial further progress” has been made toward the Fed’s maximum employment and price stability goals. What does “substantial further progress” mean? Well, we don’t really know.

But what does $120 billion x 18 months mean? We absolutely know that answer. It means $2.2 trillion in additional QE.

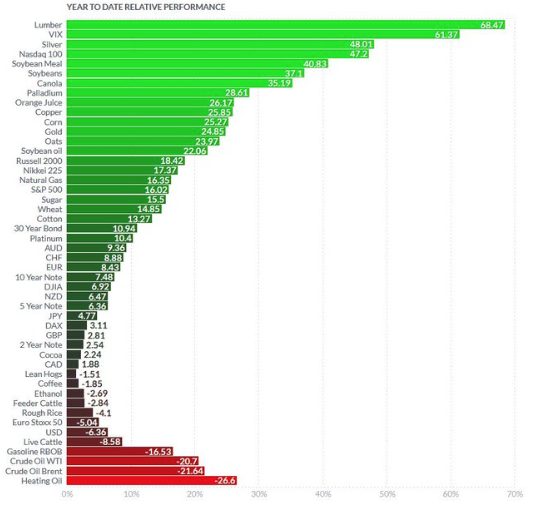

And where will it go? It will go into equities, housing, cryptos and commodities.

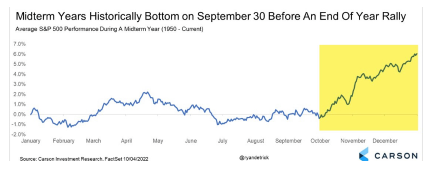

A couple of final points on the Fed and the eventuality of higher rates (sometime in 2023); history tells us that when the Fed starts raising rates, the stock market actually continues to move (sharply) higher through at least the 3rd rate hike. My mentor Ted Parsons (RIP Ted) called it “3 steps and a stumble”. Were Ted with us today, I think I know what he’d be doing; Ted would be backing up the truck to buy his favorite growth stocks.

And this is important…as we’ve been covering here, this melt-up bull market will continue to be led by tech, growth and momentum stocks. It’s not that we don’t love value stocks too (we’re 60% growth, 40% value in VRA Portfolio), it’s just that we know the personality of a melt-up bull market (like the 1995–2000 melt-up that took the Nasdaq 575% higher over just 5 years), and major moves higher like the one we’ve had and will continue to have will be led by tech/growth/momentum.

The Truth About Inflation and “The Actual Big Lie”

The entire debate about inflation being “transitory” is such incredible bullshit. A heaping pile of gas-lighting and lies. This debate is nothing more than a massive red herring, as the CPI has NEVER reported inflation accurately. As actual human beings, we of course know this, as we’ve been forced to pay rapidly rising costs for healthcare, housing/rent, education/college, elder care, rising and hidden taxes….ETC ETC ETC ETC…for year after year after year after year.

So, give us a break when you wanna talk about inflation being “transitory”. This is the “Big Lie”. And why does everything cost more? Why do they lie to us about the truths of inflation? Because they’ll never admit the truth. Inflation has been destroying our way of life since the Fed was created in 1913. Since then, the US dollar has lost 97% of its value. It’s properly called “currency inflation”. THIS is why both couples in a marriage have to work, to bring home the same take-home money that just one salary would provide just 2–3 decades ago. Lets hear JP get into this subject matter in his next press conference!

If you’re looking for a great summer read, pick up a copy of THE book on the Fed and our fiat money; The Creature From Jekkyl Island, written by my friend of 20+ years, G Edward Griffin. Statues should exist for Ed.

Until next time, thanks again for reading…

Kip

Join us for two free weeks at VRAInsider.com

Sign up to join us for our daily VRA Investing System podcast

Also, Find us on Twitter