VRA Weekly Update: Housing and Transports on Fire, But We Are Expecting Volatility. Technical Pause in PMs.

Friday, August 14, 2020 at 10:06AM by

Friday, August 14, 2020 at 10:06AM by  Kip Herriage -VRAInsider.com

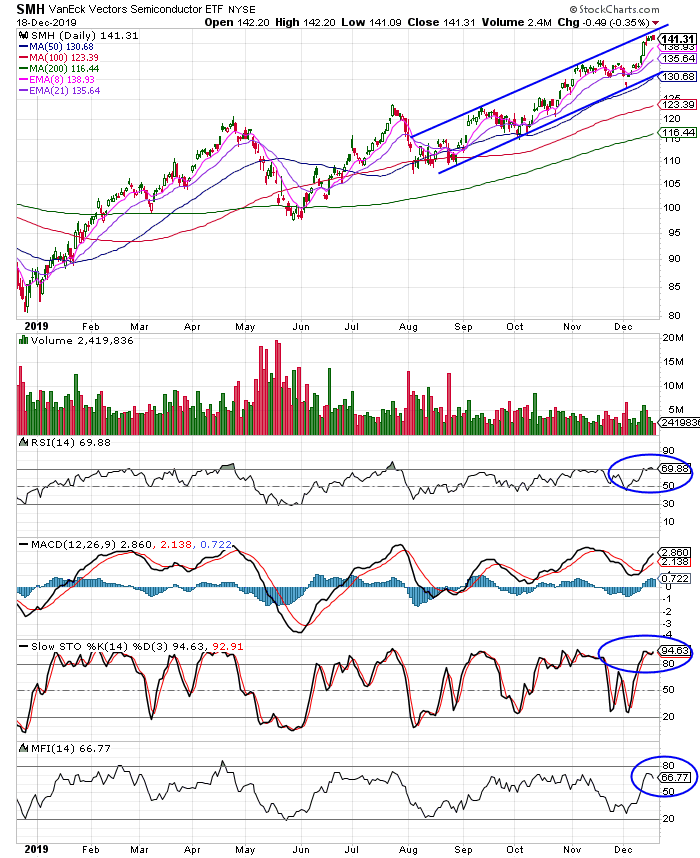

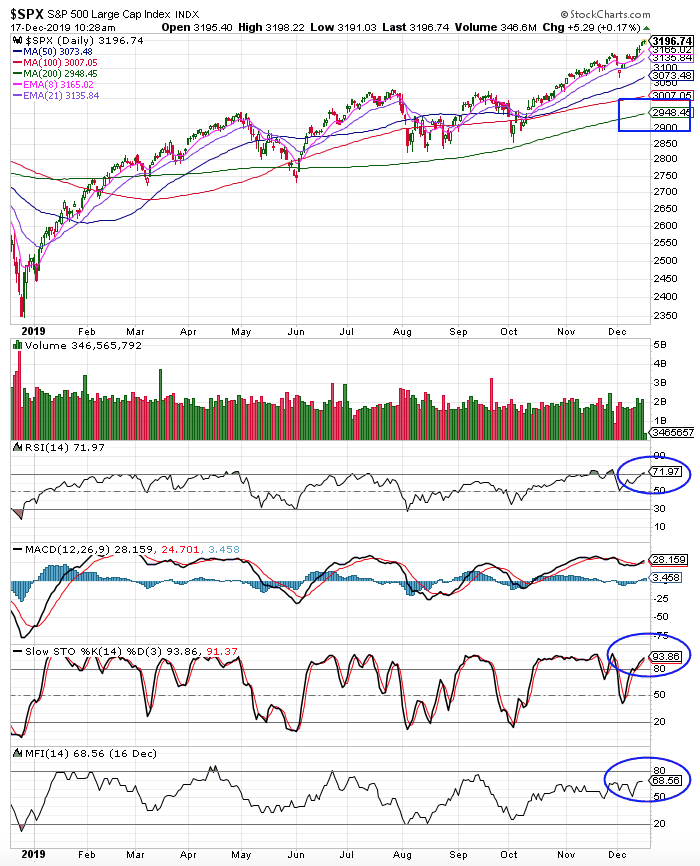

Kip Herriage -VRAInsider.com Good Friday morning all. US and global markets taking a pause after hitting new ATH's this week in consumer discretionary, consumer staples, semis, health care and home builders. New highs tend to beget new highs. With no resistance above in these sectors, the path of least resistance remains higher.

The transports hit their highest levels since January, +70% in 4 months. Housing index at another ATH, +114% in 4 months. Housing and transports are telling us that this V-shaped recovery is real.

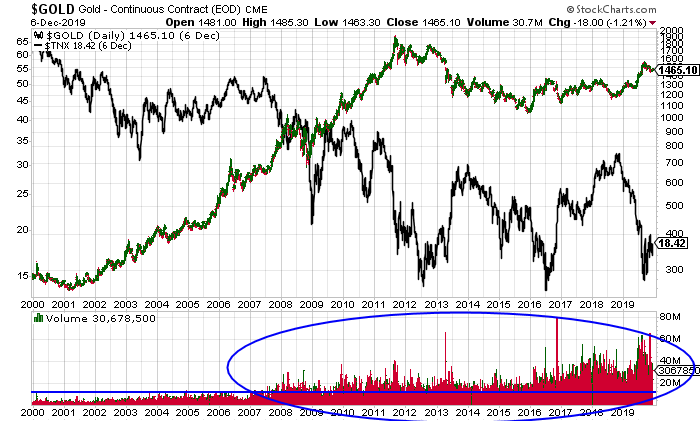

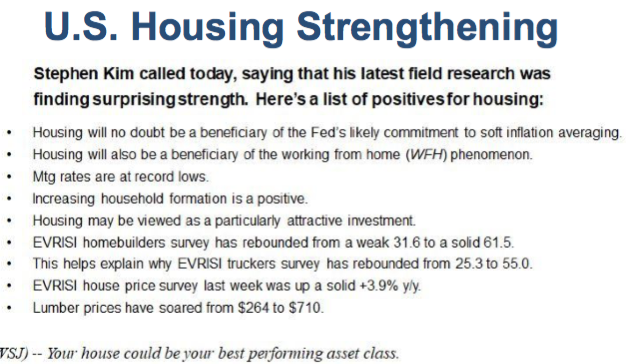

The following is from Evercores Ed Hyman (with thanks to VRA Member Jeffrey S) who sees surprising strength in housing. Lumber prices are up from $264 to $710...stunning. Folks, inflation is very quickly bubbling up. Know that. This is the message that precious metals have been sending...and its why interest rates have reversed sharply higher of late.

We're just a stones throw away from ATH in S&P 500, but there was an interesting point that Tyler made on our podcast Wednesday (sign up for alerts at vrainsider.com/podcast); market internals were not close to what you'd expect to see when the Dow is up close to 300 points and Nasdaq +230.

Not a cause for concern but the VRA System keys off of market internals to detect either a reversal or lift-off...we believe an increase in volatility over the coming days/weeks is likely, our thoughts:

1) The VIX has hit a level of extreme oversold that points to a reversal higher. While this doesn’t mean a sharp drop in US equity markets is directly ahead, we do see short term risks emerging.

2) Interest rates have reversed higher and while the 10 year yield still sits at just .71%, that’s a rather significant 41% spike in 10 year rates in just 10 days. Attention getting.

3) Stimulus talks in DC are dead. Both the House and Senate are on August recess and with both parties conventions directly ahead, little progress is expected over at least the next 2–3 weeks. Without question Trumps executive orders will help…we hear that more could be on the way. What’s becoming very clear is that the left appears unmotivated to get a deal done. It’s a dangerous ploy by Dems…sticking it to the American people in order to “Get Trump.”

It’s looking more and more likely that no further stimulus will come from DC. Only from Trumps EO’s. The wild card is the Fed. They still have another $2 trillion or so they want to get out in the form of QE. Will they take additional action with less than 3 months before the election, or will that make it appear that they are tipping the scales and trying to get Trump re-elected?

4) So yes, ST risks have emerged. The question is, with $11 trillion in global QE/stimulus, and with a V-shaped economic recovery that looks to be very real, will these risks even matter? Or, will they only serve as a wall of worry for a bull market that wants to go higher still?

Again, the internals have not been great of late. Not poor either…but definitely weaker than we’ve seen of late. This is typically the tell for the VRA System. Watching closely.

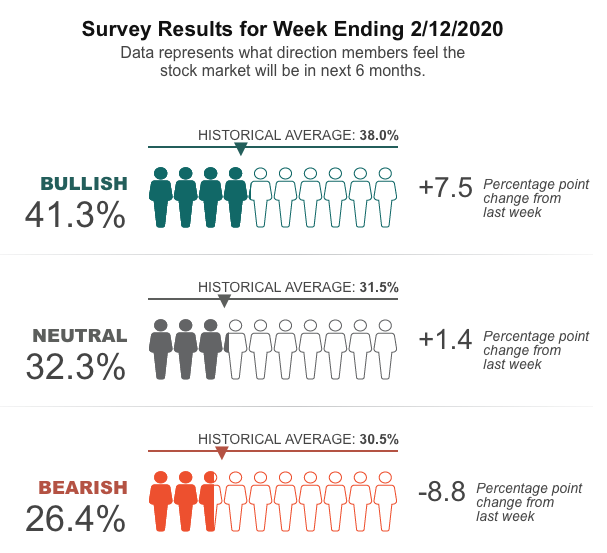

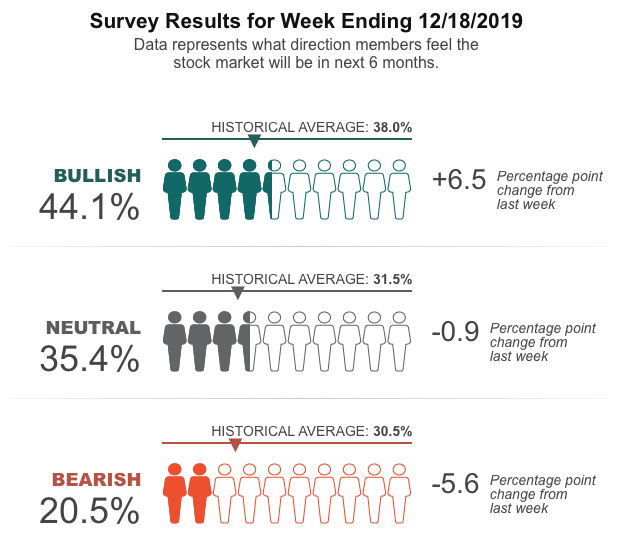

Sentiment Update

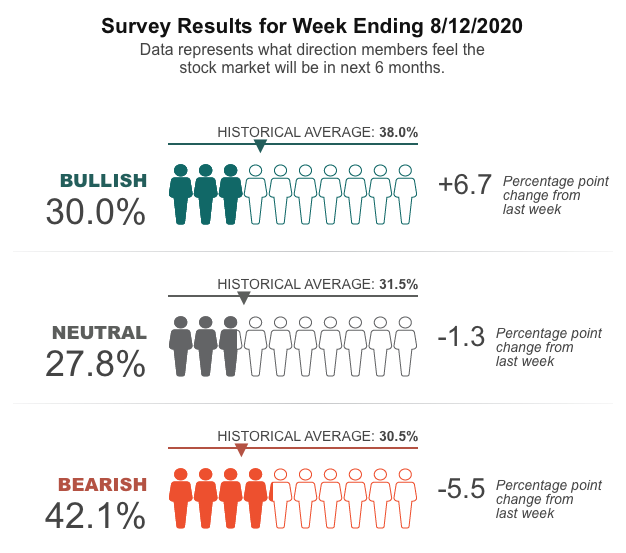

In our weekly sentiment update we see that, finally, the AAII Survey is getting more bullish...if only by a hair. Bulls now at 30% (+6.7%) and bears at 42% (-5.5%).

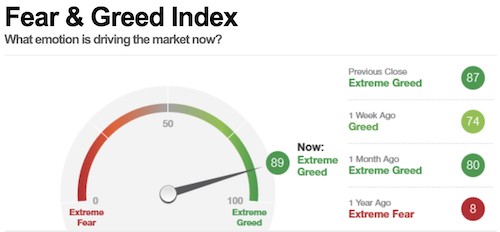

The Fear and Greed Index has hit "extreme greed" reading of 75, the highest reading since the onset of CV insanity. There are elements to this index that have hit rare-air lofty, bullish extremes, namely the put/call ratio and stock price breadth.

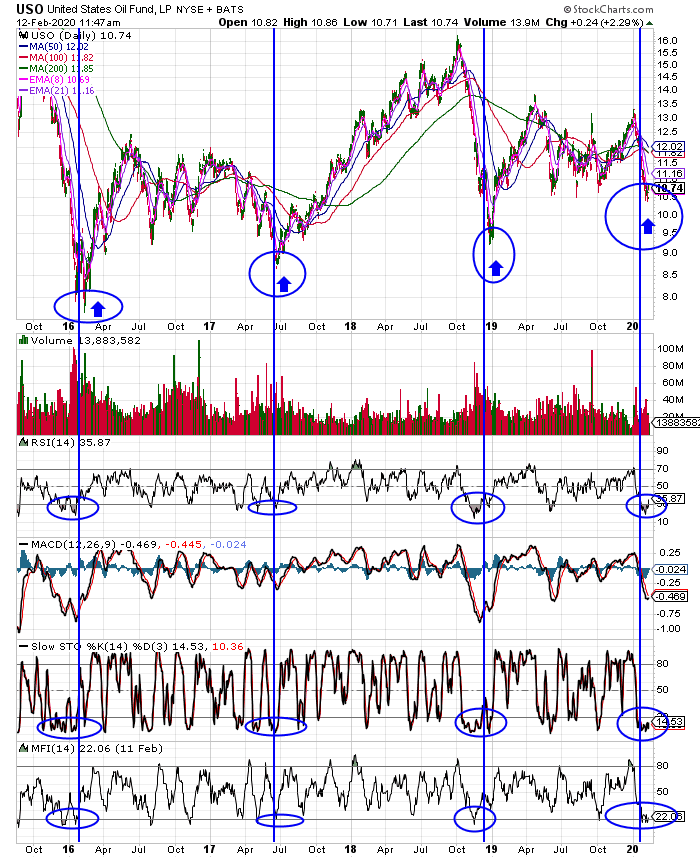

Precious Metals

The shake-out in Precious Metals looks to have been a near perfect technical (extreme OB) correction. 50% Fibonacci retrace across the board in GLD, SLV, GDX and GDXJ. As long as Tuesdays lows hold...which I expect will be the case...we should be off to the races again.

The following article and video is from our friends at GATA, who see the attack this today on PM’s as a “rigged selloff”. Chris Powell and Andrew Maguire know what they speak of. The shake-out is likely behind us.

Dear Friend of GATA and Gold:

Tuesday’s attack on gold and silver futures prices was a “rigged selloff” aimed at speculative longs with “surgical precision,” London metals trader Andrew Maguire said yesterday in an interview with Kinesis Money’s Shane Morand, but it won’t change the trajectory of the monetary metals.

The instigators of the raid violated futures position limits, Maguire adds, and the CME Group, operator of the New York Commodities Exchange, is “pandering” to the big bullion bank shorts that can’t deliver metal.

Maguire adds that the Bank for International Settlements is trading real metal for unallocated — imaginary — metal to help bullion banks meet the delivery claims giving them trouble.

Central banks and bullion banks, Maguire says, are aiming to move gold prices up to $2,500 and silver prices up to $35 soon but had to strike the market on Tuesday because prices were rising too fast for them.

The interview is 24 minutes long and can be viewed at YouTube here:

https://www.youtube.com/watch?v=kZcrB489LSc&feature=youtu.be

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

CPowell@GATA.org

Until next time, thanks again for reading…have a good weekend

Kip

Since 2014 the VRA Portfolio has net profits of more than 2300% and we have beaten the S&P 500 in 15/17 years.

Join us for two free weeks at VRAInsider.com

Sign up to join us for our daily VRA Investing System podcast