VRA Weekly Recap: VRA System/Market Update, Important Mega-Bull Market Rotation. Energy, Biotechs, Retailers, Precious Metals/Miners and Bitcoin

Friday, December 1, 2017 at 12:54PM by

Friday, December 1, 2017 at 12:54PM by  Kip Herriage -VRAInsider.com

Kip Herriage -VRAInsider.com Good Friday morning all. November went out like a lion….big 331 point move higher in the Dow Jones (DJ), with a solid recovery move higher in the nasdaq, which was destroyed on Wednesday. Exactly what we want to see….as stock market bulls.

If you’re watching the news of the Flynn guilty plea, you know that this is why the Dow dropped 300 points. If this was not a Friday (I don’t buy on Fridays typically) I would probably be recommending that we take action….

We’ll wait til Monday and see whats what.

But I see this as an absolute nothingburger. The bigger risk is that this delays or derails the tax deal. I’ll be surprised if this amounts to anything more than a 1/2 day sell-off.

For our newer VRA Readers, know that in January of 2013 the VRA went bullish on the markets (after buying the exact lows in March 2009…turning bearish in mid 2012…then back to fully invested 1/13.

For those that follow me on Twitter, you’ve seen me make this statement many times over the last (nearly) 5 years; “if you’re not long, you’re wrong”. Yesterdays melt-up like move higher is just the beginning…rather than the end of this mega bull market move higher. When/if the VRA flips back to bearish, you’ll be the first to know. We’ll get an advance heads up from the internals…but today, there are just no signs of worry.

Having said that, also know this; in the short term, each US equity index is trading at Extreme Overbought Levels on the VRA System. Does not mean a correction is imminent…but we should not be surprised if we have a few down days….but candidly, this bull market looks like its ready to go parabolic. I will touch on this again at the end of this post.

VRA Market and Portfolio Comments/Charts

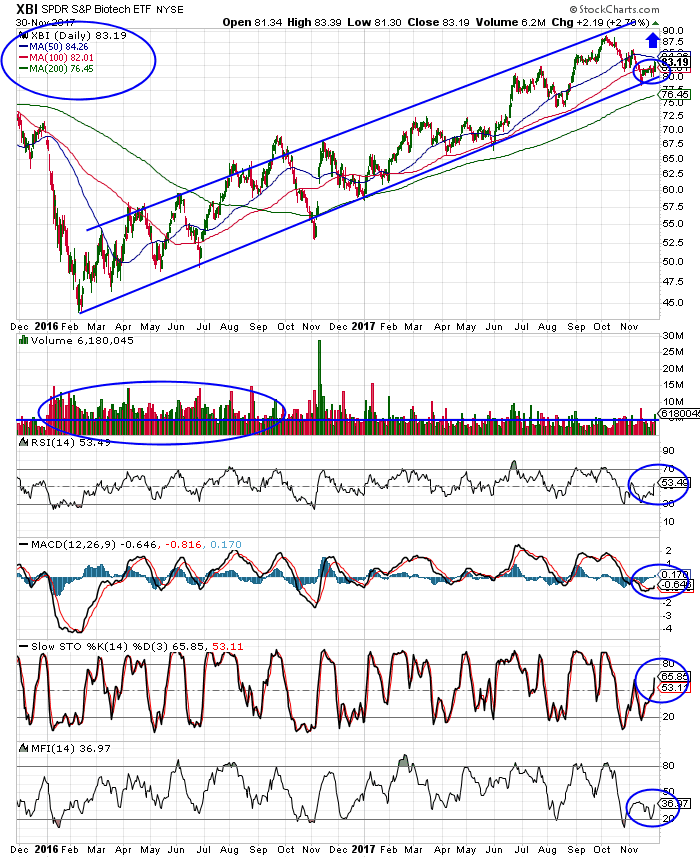

We finally got the breakout I have been looking for in the biotech’s. Check out this BEAUTIFUL chart of XBI.

The VRA System nailed the lows in this group in Q1 2016. Since then, check out this bullish channel! It looks certain to me that the lows are in place. This bullish channel is incredibly well defined…

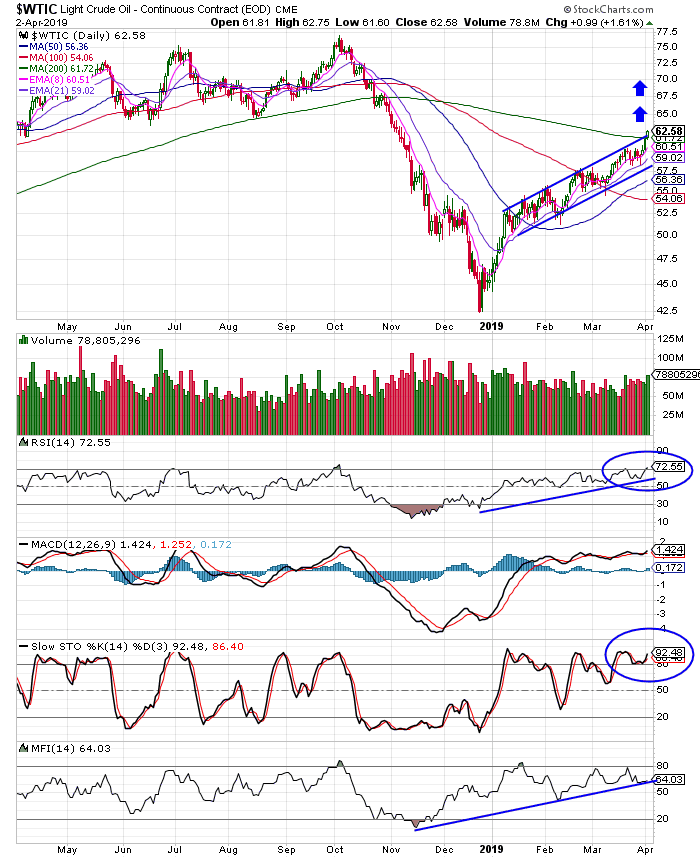

OIL.

The VRA was bearish oil at $100 + and then flipped to bullish at $32/barrel in February 2016. Again, check out this gorgeous chart as well. With the high volume breakout we’re seeing, we could have a monster move for oil in 2018 as well. I expect just that. Next up we want to see a strong move higher through $59….then its $62 pretty quickly.

Even as oil was soft earlier this week, we saw XLE and OIH (energy ETF’s) move higher pretty powerfully. This is exactly the divergence we want to see…it is telling us that oil will likely follow.

It’s time for us to get paid

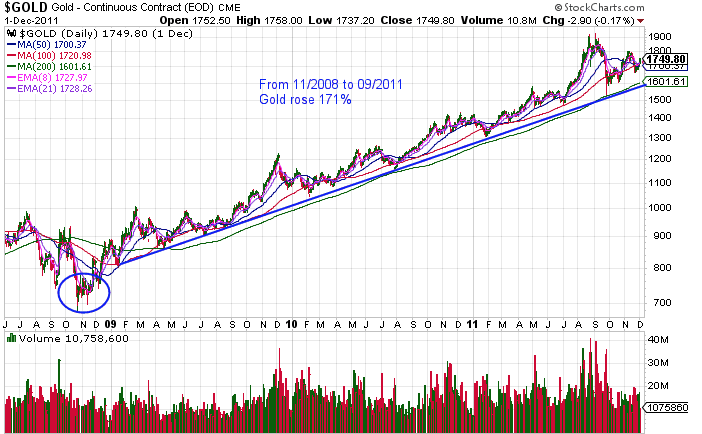

GOLD

Here’s another chart that is telling us higher prices are in our near future. Check out the volume expansion and rising RSI and MFI over the last 6 months or so. Yes, gold has been weak of late….we expected this going into the FED meeting and rate hike in less than 2 weeks.

But, while gold was down .80% yesterday, the miners were down just .20%. Again, this is the positive divergence we want to see. Beginning next week I will walk you through our exact strategy for PM’s and the miners, into year end. Let me repeat; we are going to have a YUGE move higher in PMs and the miners in 2018. My gold target remains $2000/oz. This will produce the biggest mining stock gains in more than a decade. Let me tell you, now is the time to become a VRA Member!

What could change my mind, in the near term? A big move lower in gold….through the 200 dma, on heavy volume. I’ll be shocked if this happens. We will soon be rewarded.

In all modesty, I know of no one who has produced more profits in this space than I have…going back to 2003 when I issued my buy rec on gold/silver/miners in my second ever VRA Update. Now its time for the most explosive bull market in the history of precious metals. Think “bitcoin-like”….for the highly leveraged miners.

Speaking of Bitcoin

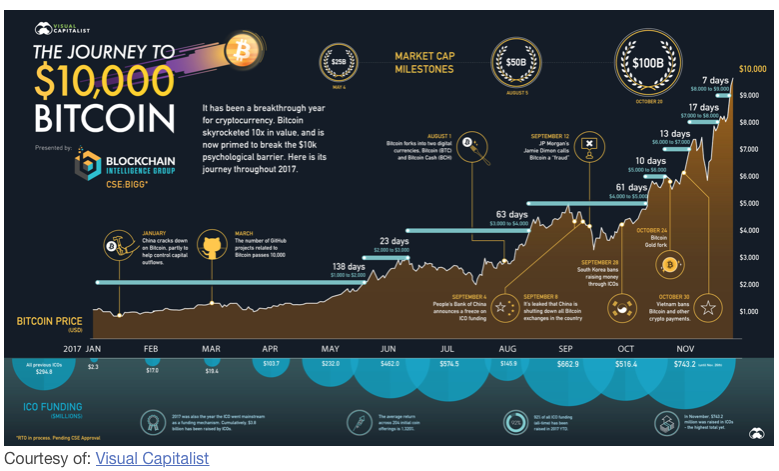

As I write this, Bitcoin is back above it’s $10,000 level. I’ve written about Bitcoin on a handful of occasions and have owned it personally since $600, but trust me, I did not buy enough…you never own enough of something that goes parabolically parabolic.

The chart below is of 2017 Bitcoin trading, featuring important market cap milestones, including the incredible move from $1000 to near $10,000…again, in just this year. Remarkably, since just October, Bitcoin has soared from “just” 4k.

Check out this chart of the ride Bitcoin has taken us on.

My Thoughts on Bitcoin:

1) In my last Bitcoin note I said that it’s likely the entire market cap for all “cryptos” would ultimately reach $1 trillion (again, for all cryptos…Ethereum, Litecoin and the near 1000 others). Today, the total market cap for all cryptos sits at approx. $300 billion. Based on this, I would not be surprised to see Bitcoin hit $30,000 (or 3 x higher than today)

2) Once Bitcoin hit $9000, it was almost certain it would hit $10,000. The same track record exists for stocks that hit $90…or $900…its a high probability trade that it will hit the “10” mark.

3) We have a number of VRA Members that are actively invested in this space. First, congratulations! Your feedback and research has been most helpful and appreciated. Second, just based on feedback and sentiment, I would say that there are very few among us that have “large” exposure to cryptos. As we know with investor sentiment, bubbles do not tend to burst until the public is “all in”…and I do not get that sense at all, from my research.

4) The biggest risk in cryptos today? Its the same as its been for a long while…government/central bank intervention. In my view, until the combined market cap hits $1 trillion for all cryptos, it is likely that they will not be viewed as a “systemic risk” by our global powers that be. In other words, smooth sailing on the intervention front for at least a while longer.

5) Finally, now that futures have been approved for crypto trading, institutional investors now have the ability to get involved…from a legalistic framework. In the short term, this adds new buyers and fresh liquidity. In the longer term, it could also bring about new hedging and shorting strategies. AKA, price suppression/manipulation.

6) Finally, in early 2018 I continue to hear that there will be 2–3 IPO’s that we will take a close look at. Companies like Coinbase (wallets that hold cryptos) rushing to capitalize on the frenzy. I will be watching these closely. This is where the first official VRA Buy Rec in this space will come from. Please continue to send me your research.

2018 Bitcoin-Like Moves

Should Bitcoin hit $30,000 next year, thats another 300% move higher…but again, Bitcoin has gained 1000% in 2017. To duplicate that move in ’18, Bitcoin would have to hit $100,000. Anything is possible…but the odds of back to back 1000% years would be remarkable…also highly unlikely in my view.

Instead of “buying high” we want to “buy low”. The VRA Portfolio has 4 holdings that have the potential to have their own 1000% moves…over the next 12–24 months.

BIG Market Rotation

As we move into December, I see nothing that says our global bull market will slow down. In fact, I see far more signs that it is about to speed up. My favorite sectors, based on both fundamentals and technicals, continue to be energy, precious metals/miners, biotechs, retailers and small cap, special situation growth stocks.

Here’s my tweet on the major market rotation from Wednesday It sent the DJ up another 103 points while sending the tech heavy Nasdaq a big 1.3%.

VRA Members are positioned perfectly for this rotation….and next up, coming out of the FED rate hike in 2 weeks, we’ll see big moves higher in PM’s and miners as well. I’ll get into all of this in more detail in coming updates. I love energy, biotechs, retail here…value stocks are now being rotated into.

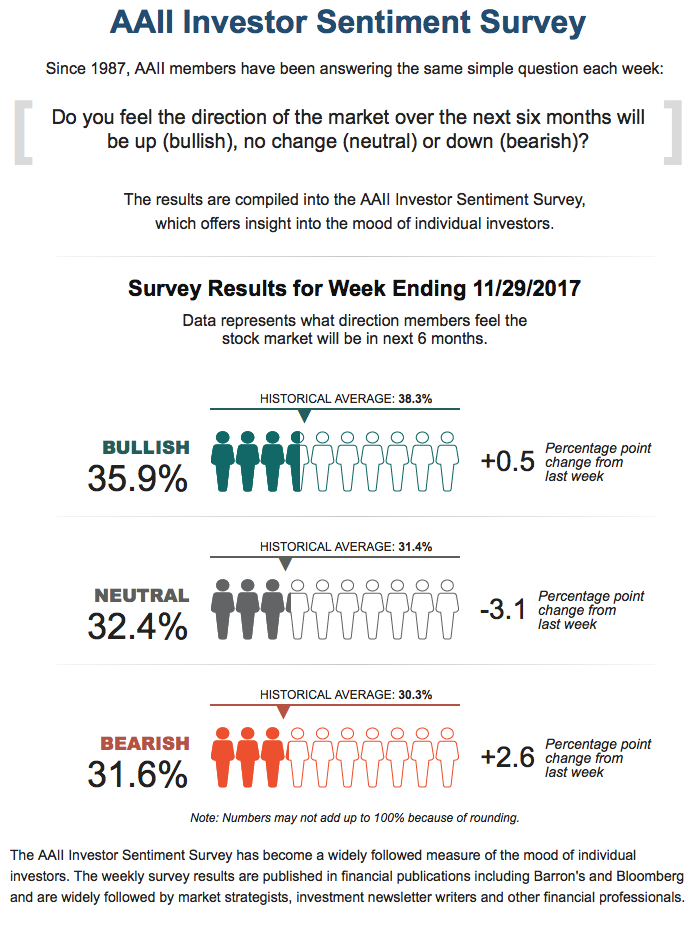

AAII investor Sentiment Survey

Bulls at 35.9%, bears at 31.6%…again, in no way do these readings indicate a market top is close. My targets remains DJ 25,000 by year end and 35,000 by year end 2020. Both could be low….

Until next time, thanks again for reading….have a great weekend.

Kip

To Receive the VRA Daily Updates visit us at VRAinsider.com to receive two free weeks!