Precious Metals and Miners: The Move of a Lifetime is Beginning

Friday, January 25, 2019 at 1:20PM by

Friday, January 25, 2019 at 1:20PM by  Kip Herriage -VRAInsider.com

Kip Herriage -VRAInsider.com Good Friday afternoon. If you’ve been with us a while you know our views on gold/silver and the miners. Fundamentally, they MUST be owned. Precious metals are the antidote to fiat currency. The world is awash in debt that can NEVER be repaid. Governments and central banks have done the rest of the damage, printing our currencies into oblivion, as evidenced by the 97% depreciation of the USD since the creation of the FED in 1913…another financial Frankenstein from the worst president in US history, Woodrow Wilson (he also brought us the 16th Amendment/income tax).

If you’ve ever wondered “what the hell happened to our financial way of life”, aka, why is it that both spouses have to work to bring home the same benefits that a single income produced just 30–40 years ago, now you know the answer. Currency debasement. Currency inflation. US dollar destruction.

USD currency destruction lies at the heart of most all our financial issues. Period.

As a side note, this also explains todays manufactured culture wars, aka 99% of the “news” we’re force fed today. The powers that be do not want us talking about currency destruction or the dangers of a runaway, unregulated FED. They do not want us talking about soaring inflation (which sits at 10%+ today). They do not want us talking about The Patriot Act. They do not want us talking about multiple 6 figure college costs. And they don’t want us owning precious metals.

I committed numerous chapters to these subjects in both of my CrashProof Prosperity books. Nows a good time to go back and read them. Inflation is coming…on a global and massive scale. As inflation first returns (and its happening now…those 2% CPI reports are full of deception), it will be a major positive for global equity markets. Again, at first. This view is at the heart of my DJ 35,000+ call by end of 2020. Early inflationary breakouts are HIGHLY bullish for equities, as history has demonstrated often.

To be crystal clear, we should own “physical” gold and silver (not hypothecated gold/silver ETFs). And we should own mining stocks….thats where the real leverage lies. Leverage of 3–5 times historically, meaning that in PM bull markets, the miners actually outperform gold by 3–5 times.

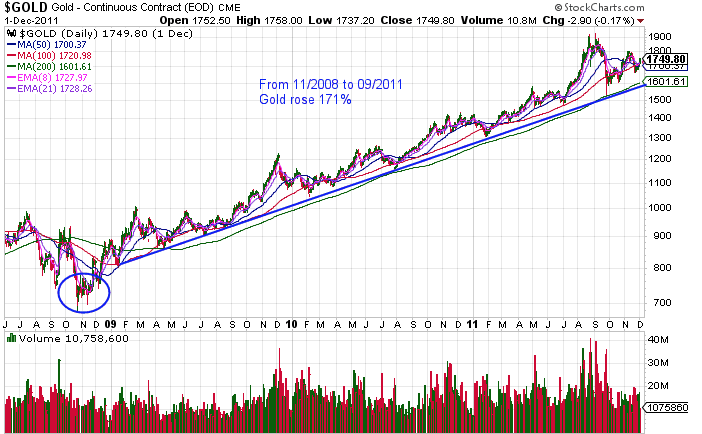

The VRA has been bullish on PM’s (and miners) from 2003, where in my second-ever buy rec I recommended gold and silver. Gold was below $400/oz. Silver was below $5/oz. We’ve also locked in well over 2000% in net gains from our recommended miners.

I know this sector. I know this fundamental story. I love PM’s and miners, particularly in todays climate.

Let me also remind that our VRA 10 x Buy Rec Fortem Resources (FTMR) has a significant stake in “City of Gold”, a massive 465 square mile concession in Myanmar. I’ll have more on this soon, just know that Fortem CEO Marc Bruner and COO Mike Caetano have BIG plans for City of Gold. Just another reason to own Fortem. Here’s the link:

http://www.fortemresources.com/resources/mining/city-of-gold/

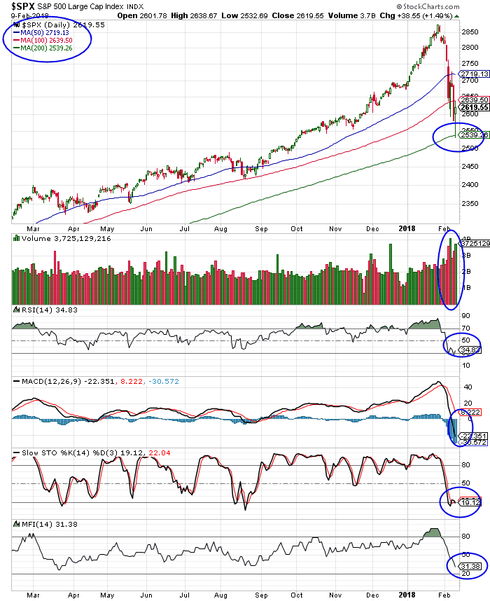

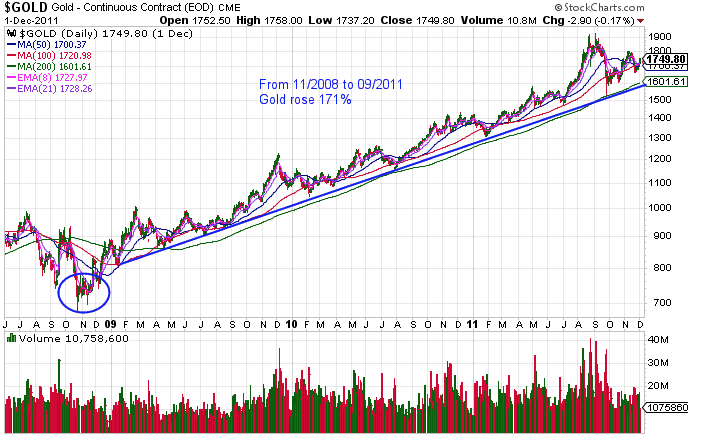

And folks, something big is taking place right now in PM’s. The technicals are flashing all kinds of buy signals. MAJOR buy signals. Lets take a closer look. First up, here’s the chart comparing the miners (GDX, miner ETF) to gold itself. In big bull markets, the underlying equities outperform the commodity.

We see it clearly in this chart, as GDX has “significantly” outperformed gold since early September. This is a most important indicator, one that few are talking about today. But we see it…we love what it’s telling us.

Gold has just broken out as well. Gold is now above its 200 dma with a golden cross occurring this week (50 dma crossing 200 dma). Big technical buy signals here.

We see the same in GDX. Back above its 200 dma with a golden cross nearing. We have yet to see volume confirm the move, but with the breakout that I expect, ramping volume in the miners is near. Once GDX breaks $25, look out above.

Now is the time to have your positions in place. Gold, silver, and the miners. To learn more sign up for our Free 14 day trial at VRAInsider.com and you will receive a copy of our report on investing with Precious Metals & Miners.

The move of a lifetime, for precious metals and miners, is beginning.

Until next time, thanks again for reading…

Kip

Since 2014 the VRA Portfolio has net profits of more than 2300% and we have beaten the S&P 500 in 15/16 years.

Experience the Vertical Research Advisory free for 2 weeks!! For a limited time we are offering a 2 week free trial to the Vertical Research Advisory, visit vrainsider.com for more details.