VRA Investment Update: Q2; JP Morgan Misses, Taiwan Semi Beats. Team Lockstep. "Quite Frankly" Interview.

Thursday, July 14, 2022 at 12:34PM by

Thursday, July 14, 2022 at 12:34PM by  Kip Herriage -VRAInsider.com

Kip Herriage -VRAInsider.com Good Thursday afternoon all. Yesterday's recovery move higher, on the backs of that horrendous CPI report, was intriguing. Yes, each index finished lower but “well” off of their lows as the semis actually finished up nearly 1% with internals that were only slightly negative.

Yesterday’s June CPI data came in at a very ugly 9.1%, well above estimates of 8.8%, with month over month inflation rising 1.3%, also worse than estimates.

Welcome back to 1980–1981.

Year over year, gas prices up 59% with food prices up 12%…these are the headline readings that matter most.

And another big negative with average hourly earnings down 3.6%, which takes away (entirely) the argument that people are making more money, which blunts the harms of inflation.

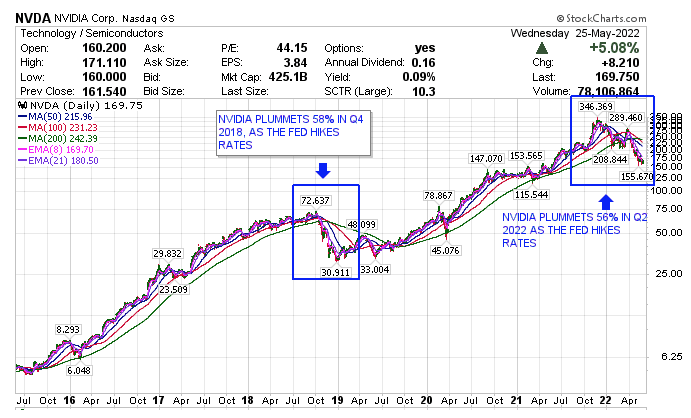

The Fed is already set to hike rates .75% this month. The temptation will be for them to hike by 1%, something we were in favor of back in January/February when it would have actually made a difference. But today, the Fed is hiking into a radically slowing economy. If they want to guarantee a recession, hiking rates aggressively from here will do it.

Any decline in the markets, going forward, will be much less about inflation and much more about recession. That may not be an easy case to make for economists with unemployment at just 3.6%, consumer/corporate balance sheets in good shape and still solid housing and transportation markets, but stagflation is a tough nut to crack.

Also, know this; the employment data is nowhere near as strong as the official data implies. It is, for all intents and purposes, rigged to make this administration look better. Again, if the Fed hikes aggressively from here they are guaranteeing a recession.

In fact, Bank of America is out this week with a forecast of a (mild) recession this year, with estimates for unemployment to jump to 4.6% in early 2022.

This morning's early trading, like yesterday, is back to “ugly” on the heels of JP Morgans earnings miss to go along with their mixed guidance, saying that “consumer spending is still strong” even as they added $428 million to loan loss reserves for a (future) weak economy, resulting in an earnings miss of 28%. JPM opened 5% lower on the news.

Know this; the Fed is hiking into a (radically) slowing economy. This will be the 5th policy error by J Powell and his team of fiat currency printers in just 6 years. #EndTheFed

On the flip-side of JPM are the earnings this AM from Taiwan Semi (TSM). Just as our VRA tech insider forecast earlier this week, TSM registered a solid beat to earnings to go along with solid forward guidance. TSM was up close to 2% yesterday and is tacking on another 2% this AM.

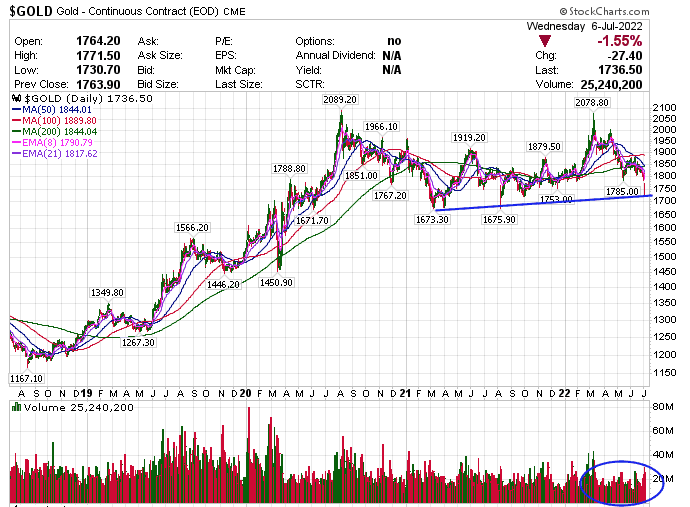

Reminder: the semis (SMH, the semi ETF) have already been destroyed, with losses of 40%….just from last November…to their recent lows of 7/5. There is no more important group to watch than the semis. They were the first major group to go into a bear market and I fully expect….folks I’d put this close to 100%…that they will be the first to lead the way out of this bear market. The semis lead the market in both directions. Watching SMH closely. This morning SMH is only slightly lower and remains some 9% above its 7/5 lows.

Quite Frankly TV

Last night I was on “Quite Frankly” (link below) and we covered the “intentional destruction” of Team Biden and this horrid leadership in place via a rigged election. I’m re-posting what I wrote last month….team lockstep does not have our best interests at heart. The midterms cannot get here soon enough.

Team Lockstep: The Communist Takedown of America

None of this ever made sense. We’ve always known something else was going on here.

- The onset of mass censorship (as Tyler says often on his podcasts, the good guys are NEVER the ones backing censorship).

- The rigged 2020 presidential election

- CV Insanity, all over a flu that 99.9% survive

- Forced lockdowns, business closures

- Forced jabs. Take ’em or lose your damn job…which one’s it gonna be?

- Open borders. America is being invaded.

- Russia-Ukraine war. The wag the dog money grab (to the most corrupt country on the planet) that’s doing its part in ramping global inflation/food shortages.

- Food distribution plants catching fire/blowing up all over the country

- Baby formula shortages, the shutting down of pipelines and limiting oil/gas exploration, 40 year highs in inflation.

All of this is happening while 90% of our elected officials…the Uniparty Ruling Class…marches right along in silence/agreement….in complete lockstep. It’s pure Cloward-Piven.

* None of this is easy for me to write. I am a lifelong optimist that knows America is the best planet on earth and know that our best days are ahead of us. I am certain of it. I see an America that is being overwhelmingly red-pilled with midterm elections that should mark utter devastation for the Democrat Party. The kind of devastation that takes Dems decades to full recover from.

* At the same time, this is no longer up for debate; we are witnessing attempts to intentionally destroy America. The ultimate goal of communists is to crash the American economy/financial system, making Americans desperate and fully dependent on the State. That’s how they plan on winning. We must all be on high alert.

Note: last night I was on “Quite Frankly”, a show that originates out of New York, with one of the more insightful and eclectic hosts on the airwaves (Frank). Just a great guy…true Patriot and lover of America…with a large and diverse global audience. Here’s the link to the clip….I’m on for 30 minutes (starting about 20 minutes in): https://www.quitefrankly.tv

Until next time, thanks again for reading….

Kip

Join us for two free weeks at VRAInsider.com

Sign up to join us for our daily VRA Investing System podcast

Also, Find us on Truth Social and Rumble